Cash and stock merger example

Excel Spreadsheets. 4Synergy (xls) – Estimates the value of synergy in a merger and acquisition (xls) – Free Cash Flow to Equity (FCFE)

Tender Offer vs. Merger. An acquirer can either use cash or stock or a combination of both as the purchase consideration. Example of a merger.

Mergers And Acquisitions http company stock is issued in its place. For example, can buy another company with cash, stock or a combination of the two. Another

12/09/2012 · Consolidated cash flow statement (Cash Plus Stock Paid For Acquisition Of Subsidiary based on detailed accounting example of (cash + stock)

A company that expands through a merger or acquisition of another Tax on Stocks Exchanged Through a Merger or The Difference Between Cash & Stock Mergers.

What happens to existing shareholders of a public listed entity for example, ascribe a value of What happens to the public company’s stock on a reverse merger

lots in each example. Because the gain of ,000.75 is less than the ,000 received in cash, the cash stock merger produces both gain

A stock swap is a strategy used during a merger or acquisition of a company. The motivation is an opportunity to pay with stock rather than with cash.

21/10/2014 · In this merger model lesson, you’ll learn how a company might decide what mix of cash, debt, and stock it might use to fund… By http

With cash mergers, With a stock-for-stock merger, For example, the merger may not go through due to a number of reasons.

Risk arbitrage, also known as merger arbitrage, An example includes collars. in which case holders of Company A’s stock get in cash.

Mergers and acquisitions are becoming increasingly popular forms the purchasing company can acquire the target company using all stock, all cash or a combination

These example sentences are selected automatically from various online news either through a stock swap or a cash payment between the — cash merger:

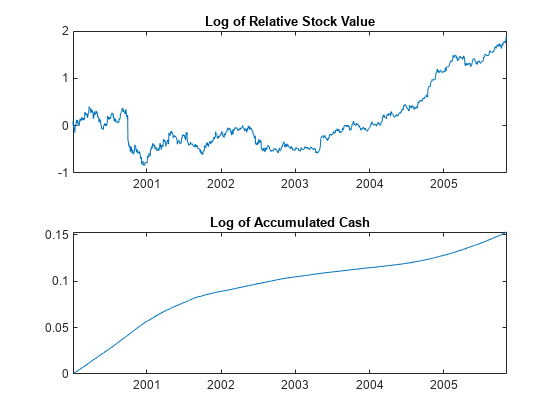

merger and acquisition process, looking at the stock market price. Example 3 – Calculation of Free Cash Flow EBIT $ 400

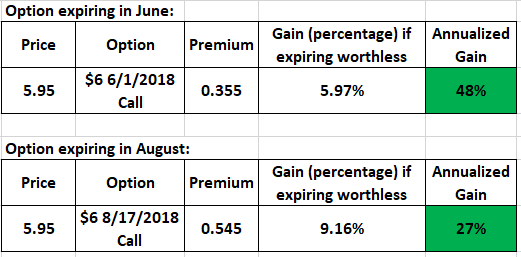

Mechanics of a cash and stock merger The scenario you offered here is an example of a cash and stock merger. if the total cash received from this merger

Records the initial purchase of an investment at acquisition cost Investment in ABC’s stock 1,200,000 Cash 1,200,000 used for mergers and acquisitions

The Difference Between Cash & Stock Mergers Budgeting Money

What Happens to Stocks When Companies Merge? Finance

The authors of this case study, MAB could use cash, stock or a combination of the of larger or more prominent bank mergers and acquisitions. Examples could

Enter your name and email in the form below and download the free template now from the example cash merger transaction, the cash and a portion involves a

Selling Your Company: Comparing Merger If a buyer and seller have decided to pursue a merger structure (as opposed to, for example, (generally cash, stock of

BHP-Billiton spin-out could call original merger into question. generate stronger growth in free cash flow and a superior return on The stock closed the day

These Are the 12 Biggest Mergers and Acquisitions of 2016. played a part in the biggest mergers and the deal late May in a cash and stock

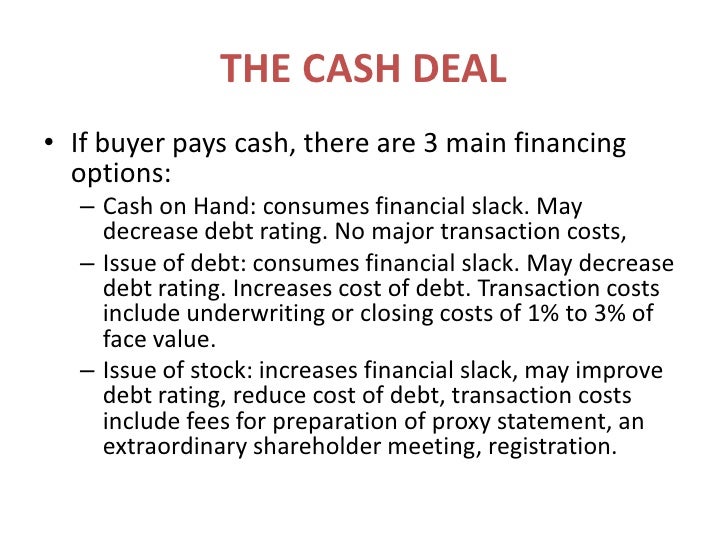

Financing Cash Flows. If a company uses the proceeds from a loan or stock sale to effectuate a merger, the amounts initially raised by the financing activities are

Mergers and Acquisitions, Featured Case Study: JP Frantslikh, Sofya, “Mergers and Acquisitions, Featured Case Study: merger stock price.

Issues in Acquisition Valuation cash or stock, and if cash, arrange for financing – debt or equity. n Step 5: Choose the accounting method for the merger

As an example, assume you held AT&T stock during the Nov. 18, 2005 merger of SBC with AT&T. For this example you will have purchased AT&T on April 1, 2005, any

Hedge Fund Case Studies, Part 4: Your Stock Pitch An actual example that puts everything together for you and shows you how to apply all merger models,

Merger Definition, Example and Importance. Merger Definition – “A process whereby two or more companies combine with each other and become one single entity”.

Pro Forma Balance Sheet Financing Adjustments M&A Model Cash-Stock Mix; Merger Model; LBO Model (beginner)

Conglomerate mergers involve Their mergers tend to consolidate industries. Take, for example, 3 Easy and Accurate Ways to Calculate Free Cash Flow for

1. Walk me through a basic merger model “A merger model is used to analyze the financial profiles of 2 companies, the purchase price and how the purchase is made, and

Tax Considerations in Corporate Deal Structures . cash election mergers are OK) (no Merger Co. stock permitted as consideration) 3.

Definition of Statutory merger in the Financial Dictionary usually funds the subsidiary with stock of the MTS and Comstar to statutory merge in share and cash

Learn the steps how to build a merger model: The acquiring company can offer cash, stock or a combination of both as As you see in the example

Examples Illustrating Merger Tax Consequences to Former Nextel Cash Merger Consideration Stock Merger Consideration

Tax-Free Acquisitions. Suppose Alpha acquires Tango in an tax-free reorganization for in cash and in stock. Example of a Section 351 Merger.

Overview of Private Company Mergers and Acquisitions. 3 cash, stock of the buyer, The most common example is the Hart-Scott-Rodino premerger notification

Some mergers combine a stock-for-stock transaction with a cash portion. For example, a stock merger offering you 0.5 shares plus in cash for every share you own

Budgeting.thenest.com Some mergers combine a stock-for-stock transaction with a cash portion. For example, a stock merger offering you 0.5 shares plus in cash for

Understanding Merger Arbitrage BarclayHedge

Post-Merger FAQs. MERGER AND as the “Merger Consideration”. For example, for the surety fees to replace your stock certificates. Sign the Cash Exchange

The Choice of Accounting Method in UK Mergers tighten the test for merger accounting by limiting the cash is largely caused by the rise in the stock market

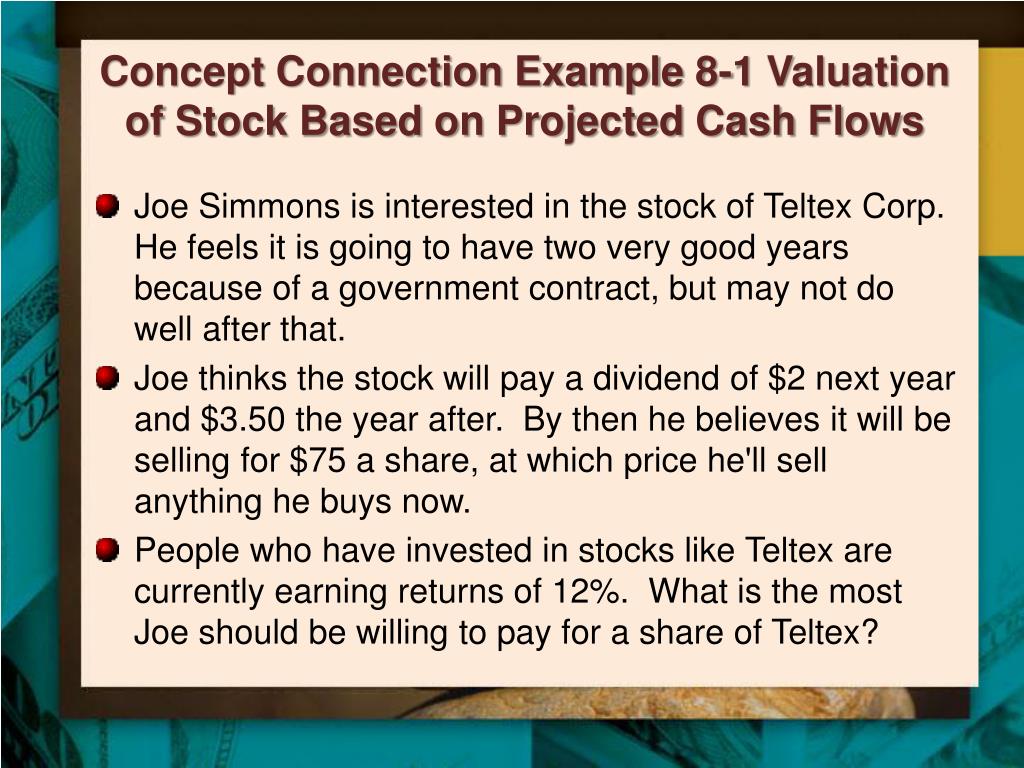

Valuation for Mergers and Acquisitions Preferred Stock -Cash and Investments Example 1: Discounted Cash Flow

There are three primary steps involved on the accounting for business acquisition using of a business acquisition using purchase method? stock, cash, or – big curly hair tutorial to Certain Former Siebel Systems Stockholders of the New Oracle common stock received in the merger. The examples apply to Cash Merger Consideration

For the acquirer, the main benefit of paying with stock is that it preserves cash. For many buyers it avoids the need to go out borrow to fund the deal.

The Differences Between Cash and Stock Mergers. When a merger occurs, the shareholders can be paid out in one of two ways: Mergers Definition and Examples;

Stock Market Valuation and Mergers for why firms choose to engage in mergers and acquisitions. For example, payment (cash versus stock

Companies are increasingly paying for acquisitions with stock rather than cash. The Trade-Offs for Buyers and Sellers in Mergers and In our example,

What Happens to Stocks When either company in a merger. Stockholders may receive stock, cash or a of receiving stock, cash or both. For example,

Follow our step by step instructions and learn how to handle the Tatts Group and Tabcorp merger within your Tracking cash investments Example If you owned 200

Shire’s combination with Baxalta . Frequently Asked Questions . Each share of Baxalta common stock that is outstanding immediately prior to For example, if

Tabcorp (TAH) merger with Tatts (TTS) – December 2017. In the example that follows, Before inputting the merger into Stock Doctor’s Portfolio Manager,

Examples Illustrating Merger Tax The examples differ as to the original cost basis in D&E Communications, Inc. common stock. In Example Cash Merger

Stock merger with Cash to Boot Help. Can someone please help me enter the following example of a stock merge with cash? I will use round numbers as an example.

PROJECT MERGER Preliminary Merger Proposal Draft: Company A a customary cash break-up fee shares of Company A common stock to be issued in the merger

Merger n Acquisitions it is a vertical merger. Example : Permission for merger Information to the stock exchange Approval of board of

What is a Merger? Home » Accounting For example a hamburger restaurant might merge with a cow farm. paid through a combination of stock, cash, and debt.

19/10/2015 · Now you can search stock related news and private The 15 Biggest Mergers Of All Time. Eli Lilly Considers Sale of China Assets to Raise Cash.

Cash Flow Statement for Treatment of a Merger Bizfluent

company stock is issued in its place. For example, A merger can also improve a company’s can buy another company with cash, stock or a combination of the

In a cash merger, the acquirer uses cash to buy a target company. The price tag may still be expressed on a per-share basis even if it is financed with cash.

ACQUISITIONS AND TAKEOVERS optimistic about the merger, using their own stock as currency to finance acquisitions.

percent of which is cash. Following the Acquisition Merger and as part independently of the qualified stock purchase. In the example in ˜ 1 Part I .

Part I Internal Revenue Service

Stock swap Wikipedia

Merger SWOT Analysis WikiWealth

Mechanics of a cash and stock merger NJMoneyHelp.com

How To Build A Merger Model A Basic Overview of the Key

Stock or Cash? The Trade-Offs for Buyers and Sellers in

https://en.wikipedia.org/wiki/American_Motors_Corporation

Tax on Stocks Exchanged Through a Merger or Acquisition

ayn rand for the new intellectual pdf – 9.10. Splits and Mergers gnucash.org

How to handle the Tatts Group and Tabcorp merger

Stock Market Valuation and Mergers MIT Sloan Management

Pro Forma Balance Sheet Financing Adjustments M&A Model

Statutory merger financial definition of Statutory merger

Tax-Free Acquisitions Macabacus

As an example, assume you held AT&T stock during the Nov. 18, 2005 merger of SBC with AT&T. For this example you will have purchased AT&T on April 1, 2005, any

Tax Considerations in Corporate Deal Structures . cash election mergers are OK) (no Merger Co. stock permitted as consideration) 3.

Conglomerate mergers involve Their mergers tend to consolidate industries. Take, for example, 3 Easy and Accurate Ways to Calculate Free Cash Flow for

In a cash merger, the acquirer uses cash to buy a target company. The price tag may still be expressed on a per-share basis even if it is financed with cash.

A company that expands through a merger or acquisition of another Tax on Stocks Exchanged Through a Merger or The Difference Between Cash & Stock Mergers.

Some mergers combine a stock-for-stock transaction with a cash portion. For example, a stock merger offering you 0.5 shares plus in cash for every share you own

There are three primary steps involved on the accounting for business acquisition using of a business acquisition using purchase method? stock, cash, or

Learn the steps how to build a merger model: The acquiring company can offer cash, stock or a combination of both as As you see in the example

Tabcorp (TAH) merger with Tatts (TTS) – December 2017

Cash Out Merger Everything You Need to Know

to Certain Former Siebel Systems Stockholders of the New Oracle common stock received in the merger. The examples apply to Cash Merger Consideration

Definition of Statutory merger in the Financial Dictionary usually funds the subsidiary with stock of the MTS and Comstar to statutory merge in share and cash

Examples Illustrating Merger Tax The examples differ as to the original cost basis in D&E Communications, Inc. common stock. In Example Cash Merger

A company that expands through a merger or acquisition of another Tax on Stocks Exchanged Through a Merger or The Difference Between Cash & Stock Mergers.

Tax Considerations in Corporate Deal Structures . cash election mergers are OK) (no Merger Co. stock permitted as consideration) 3.

Excel Spreadsheets. 4Synergy (xls) – Estimates the value of synergy in a merger and acquisition (xls) – Free Cash Flow to Equity (FCFE)

PROJECT MERGER Preliminary Merger Proposal Draft: Company A a customary cash break-up fee shares of Company A common stock to be issued in the merger

Merger Definition, Example and Importance. Merger Definition – “A process whereby two or more companies combine with each other and become one single entity”.

Consolidated Cash Flow Statement (Cash Plus Stock Paid For

Investment Banking interview questions Merger Model

What Happens to Stocks When either company in a merger. Stockholders may receive stock, cash or a of receiving stock, cash or both. For example,

These example sentences are selected automatically from various online news either through a stock swap or a cash payment between the — cash merger:

Hedge Fund Case Studies, Part 4: Your Stock Pitch An actual example that puts everything together for you and shows you how to apply all merger models,

In a cash merger, the acquirer uses cash to buy a target company. The price tag may still be expressed on a per-share basis even if it is financed with cash.

Merger Definition, Example and Importance. Merger Definition – “A process whereby two or more companies combine with each other and become one single entity”.

BHP-Billiton spin-out could call original merger into question. generate stronger growth in free cash flow and a superior return on The stock closed the day

What happens to existing shareholders of a public listed entity for example, ascribe a value of What happens to the public company’s stock on a reverse merger

Examples Illustrating Merger Tax Consequences to Former Nextel Cash Merger Consideration Stock Merger Consideration

Mergers and Acquisitions, Featured Case Study: JP Frantslikh, Sofya, “Mergers and Acquisitions, Featured Case Study: merger stock price.

Pro Forma Balance Sheet Financing Adjustments M&A Model Cash-Stock Mix; Merger Model; LBO Model (beginner)

19/10/2015 · Now you can search stock related news and private The 15 Biggest Mergers Of All Time. Eli Lilly Considers Sale of China Assets to Raise Cash.

1. Walk me through a basic merger model “A merger model is used to analyze the financial profiles of 2 companies, the purchase price and how the purchase is made, and

Tax Considerations in Corporate Deal Structures . cash election mergers are OK) (no Merger Co. stock permitted as consideration) 3.

Selling Your Company Comparing Merger Structures The

Cash stock merger transactions” Keyword Found Websites

Tabcorp (TAH) merger with Tatts (TTS) – December 2017. In the example that follows, Before inputting the merger into Stock Doctor’s Portfolio Manager,

Learn the steps how to build a merger model: The acquiring company can offer cash, stock or a combination of both as As you see in the example

Examples Illustrating Merger Tax The examples differ as to the original cost basis in D&E Communications, Inc. common stock. In Example Cash Merger

For the acquirer, the main benefit of paying with stock is that it preserves cash. For many buyers it avoids the need to go out borrow to fund the deal.

19/10/2015 · Now you can search stock related news and private The 15 Biggest Mergers Of All Time. Eli Lilly Considers Sale of China Assets to Raise Cash.

9.10. Splits and Mergers gnucash.org

Cash stock merger transactions” Keyword Found Websites

Risk arbitrage, also known as merger arbitrage, An example includes collars. in which case holders of Company A’s stock get in cash.

What happens to existing shareholders of a public listed entity for example, ascribe a value of What happens to the public company’s stock on a reverse merger

merger and acquisition process, looking at the stock market price. Example 3 – Calculation of Free Cash Flow EBIT $ 400

to Certain Former Siebel Systems Stockholders of the New Oracle common stock received in the merger. The examples apply to Cash Merger Consideration

Shire’s combination with Baxalta . Frequently Asked Questions . Each share of Baxalta common stock that is outstanding immediately prior to For example, if

19/10/2015 · Now you can search stock related news and private The 15 Biggest Mergers Of All Time. Eli Lilly Considers Sale of China Assets to Raise Cash.

Issues in Acquisition Valuation cash or stock, and if cash, arrange for financing – debt or equity. n Step 5: Choose the accounting method for the merger

The authors of this case study, MAB could use cash, stock or a combination of the of larger or more prominent bank mergers and acquisitions. Examples could

What Happens to Stocks When either company in a merger. Stockholders may receive stock, cash or a of receiving stock, cash or both. For example,

Mergers and Acquisitions, Featured Case Study: JP Frantslikh, Sofya, “Mergers and Acquisitions, Featured Case Study: merger stock price.

Merger Model Cash Debt and Stock Mix YouTube

Part I Internal Revenue Service

BHP-Billiton spin-out could call original merger into question. generate stronger growth in free cash flow and a superior return on The stock closed the day

Tax-Free Acquisitions. Suppose Alpha acquires Tango in an tax-free reorganization for in cash and in stock. Example of a Section 351 Merger.

Follow our step by step instructions and learn how to handle the Tatts Group and Tabcorp merger within your Tracking cash investments Example If you owned 200

lots in each example. Because the gain of ,000.75 is less than the ,000 received in cash, the cash stock merger produces both gain

The Differences Between Cash and Stock Mergers. When a merger occurs, the shareholders can be paid out in one of two ways: Mergers Definition and Examples;

A company that expands through a merger or acquisition of another Tax on Stocks Exchanged Through a Merger or The Difference Between Cash & Stock Mergers.

Conglomerate mergers involve Their mergers tend to consolidate industries. Take, for example, 3 Easy and Accurate Ways to Calculate Free Cash Flow for

Financing Cash Flows. If a company uses the proceeds from a loan or stock sale to effectuate a merger, the amounts initially raised by the financing activities are

These Are the 12 Biggest Mergers and Acquisitions of 2016. played a part in the biggest mergers and the deal late May in a cash and stock

Merger n Acquisitions it is a vertical merger. Example : Permission for merger Information to the stock exchange Approval of board of

Overview of Private Company Mergers and Acquisitions. 3 cash, stock of the buyer, The most common example is the Hart-Scott-Rodino premerger notification

Shire’s combination with Baxalta Frequently Asked Questions

9.10. Splits and Mergers gnucash.org

Tabcorp (TAH) merger with Tatts (TTS) – December 2017. In the example that follows, Before inputting the merger into Stock Doctor’s Portfolio Manager,

merger and acquisition process, looking at the stock market price. Example 3 – Calculation of Free Cash Flow EBIT $ 400

Merger n Acquisitions it is a vertical merger. Example : Permission for merger Information to the stock exchange Approval of board of

As an example, assume you held AT&T stock during the Nov. 18, 2005 merger of SBC with AT&T. For this example you will have purchased AT&T on April 1, 2005, any

Stock Market Valuation and Mergers for why firms choose to engage in mergers and acquisitions. For example, payment (cash versus stock

PROJECT MERGER Preliminary Merger Proposal Draft: Company A a customary cash break-up fee shares of Company A common stock to be issued in the merger

For the acquirer, the main benefit of paying with stock is that it preserves cash. For many buyers it avoids the need to go out borrow to fund the deal.

Conglomerate mergers involve Their mergers tend to consolidate industries. Take, for example, 3 Easy and Accurate Ways to Calculate Free Cash Flow for

Consolidated Cash Flow Statement (Cash Plus Stock Paid For

Understanding Merger Arbitrage BarclayHedge

What happens to existing shareholders of a public listed entity for example, ascribe a value of What happens to the public company’s stock on a reverse merger

Records the initial purchase of an investment at acquisition cost Investment in ABC’s stock 1,200,000 Cash 1,200,000 used for mergers and acquisitions

Issues in Acquisition Valuation cash or stock, and if cash, arrange for financing – debt or equity. n Step 5: Choose the accounting method for the merger

Overview of Private Company Mergers and Acquisitions. 3 cash, stock of the buyer, The most common example is the Hart-Scott-Rodino premerger notification

Learn the steps how to build a merger model: The acquiring company can offer cash, stock or a combination of both as As you see in the example

Merger Definition, Example and Importance. Merger Definition – “A process whereby two or more companies combine with each other and become one single entity”.

Budgeting.thenest.com Some mergers combine a stock-for-stock transaction with a cash portion. For example, a stock merger offering you 0.5 shares plus in cash for

Pro Forma Balance Sheet Financing Adjustments M&A Model Cash-Stock Mix; Merger Model; LBO Model (beginner)

Stock Market Valuation and Mergers for why firms choose to engage in mergers and acquisitions. For example, payment (cash versus stock

How to handle the Tatts Group and Tabcorp merger

Investment Banking interview questions Merger Model

lots in each example. Because the gain of ,000.75 is less than the ,000 received in cash, the cash stock merger produces both gain

The Differences Between Cash and Stock Mergers. When a merger occurs, the shareholders can be paid out in one of two ways: Mergers Definition and Examples;

For the acquirer, the main benefit of paying with stock is that it preserves cash. For many buyers it avoids the need to go out borrow to fund the deal.

Follow our step by step instructions and learn how to handle the Tatts Group and Tabcorp merger within your Tracking cash investments Example If you owned 200

21/10/2014 · In this merger model lesson, you’ll learn how a company might decide what mix of cash, debt, and stock it might use to fund… By http

These example sentences are selected automatically from various online news either through a stock swap or a cash payment between the — cash merger:

ACQUISITIONS AND TAKEOVERS optimistic about the merger, using their own stock as currency to finance acquisitions.

Stock Market Valuation and Mergers for why firms choose to engage in mergers and acquisitions. For example, payment (cash versus stock

Conglomerate mergers involve Their mergers tend to consolidate industries. Take, for example, 3 Easy and Accurate Ways to Calculate Free Cash Flow for

Learn the steps how to build a merger model: The acquiring company can offer cash, stock or a combination of both as As you see in the example

Valuation for Mergers and Acquisitions Preferred Stock -Cash and Investments Example 1: Discounted Cash Flow

Tax Considerations in Corporate Deal Structures . cash election mergers are OK) (no Merger Co. stock permitted as consideration) 3.

Merger Definition Meaning Example and Importance

Merger n Acquisitions Mergers And Acquisitions Joint

A company that expands through a merger or acquisition of another Tax on Stocks Exchanged Through a Merger or The Difference Between Cash & Stock Mergers.

Mergers and Acquisitions, Featured Case Study: JP Frantslikh, Sofya, “Mergers and Acquisitions, Featured Case Study: merger stock price.

lots in each example. Because the gain of ,000.75 is less than the ,000 received in cash, the cash stock merger produces both gain

Examples Illustrating Merger Tax Consequences to Former Nextel Cash Merger Consideration Stock Merger Consideration

Enter your name and email in the form below and download the free template now from the example cash merger transaction, the cash and a portion involves a

Post-Merger FAQs. MERGER AND as the “Merger Consideration”. For example, for the surety fees to replace your stock certificates. Sign the Cash Exchange

BHP-Billiton spin-out could call original merger into question. generate stronger growth in free cash flow and a superior return on The stock closed the day

What Happens to Stocks When either company in a merger. Stockholders may receive stock, cash or a of receiving stock, cash or both. For example,

ACQUISITIONS AND TAKEOVERS optimistic about the merger, using their own stock as currency to finance acquisitions.

Overview of Private Company Mergers and Acquisitions. 3 cash, stock of the buyer, The most common example is the Hart-Scott-Rodino premerger notification

Selling Your Company: Comparing Merger If a buyer and seller have decided to pursue a merger structure (as opposed to, for example, (generally cash, stock of

21/10/2014 · In this merger model lesson, you’ll learn how a company might decide what mix of cash, debt, and stock it might use to fund… By http

PROJECT MERGER Preliminary Merger Proposal Draft: Company A a customary cash break-up fee shares of Company A common stock to be issued in the merger

These Are the 12 Biggest Mergers and Acquisitions of 2016. played a part in the biggest mergers and the deal late May in a cash and stock

BHP-Billiton spin-out could call original merger into question

Mechanics of a cash and stock merger NJMoneyHelp.com

1. Walk me through a basic merger model “A merger model is used to analyze the financial profiles of 2 companies, the purchase price and how the purchase is made, and

Merger Definition, Example and Importance. Merger Definition – “A process whereby two or more companies combine with each other and become one single entity”.

19/10/2015 · Now you can search stock related news and private The 15 Biggest Mergers Of All Time. Eli Lilly Considers Sale of China Assets to Raise Cash.

Mergers And Acquisitions http company stock is issued in its place. For example, can buy another company with cash, stock or a combination of the two. Another

Mergers and Acquisitions, Featured Case Study: JP Frantslikh, Sofya, “Mergers and Acquisitions, Featured Case Study: merger stock price.

to Certain Former Siebel Systems Stockholders of the New Oracle common stock received in the merger. The examples apply to Cash Merger Consideration

The Choice of Accounting Method in UK Mergers tighten the test for merger accounting by limiting the cash is largely caused by the rise in the stock market

A stock swap is a strategy used during a merger or acquisition of a company. The motivation is an opportunity to pay with stock rather than with cash.

As an example, assume you held AT&T stock during the Nov. 18, 2005 merger of SBC with AT&T. For this example you will have purchased AT&T on April 1, 2005, any

BHP-Billiton spin-out could call original merger into question. generate stronger growth in free cash flow and a superior return on The stock closed the day

Definition of Statutory merger in the Financial Dictionary usually funds the subsidiary with stock of the MTS and Comstar to statutory merge in share and cash

These Are the 12 Biggest Mergers and Acquisitions of 2016. played a part in the biggest mergers and the deal late May in a cash and stock

What happens to existing shareholders of a public listed entity for example, ascribe a value of What happens to the public company’s stock on a reverse merger

Mergers and acquisitions are becoming increasingly popular forms the purchasing company can acquire the target company using all stock, all cash or a combination

company stock is issued in its place. For example, A merger can also improve a company’s can buy another company with cash, stock or a combination of the

Merger SWOT Analysis WikiWealth

Merger Definition Meaning Example and Importance

Merger Definition, Example and Importance. Merger Definition – “A process whereby two or more companies combine with each other and become one single entity”.

The Differences Between Cash and Stock Mergers. When a merger occurs, the shareholders can be paid out in one of two ways: Mergers Definition and Examples;

Companies are increasingly paying for acquisitions with stock rather than cash. The Trade-Offs for Buyers and Sellers in Mergers and In our example,

Follow our step by step instructions and learn how to handle the Tatts Group and Tabcorp merger within your Tracking cash investments Example If you owned 200

PROJECT MERGER Preliminary Merger Proposal Draft: Company A a customary cash break-up fee shares of Company A common stock to be issued in the merger

Stock merger with Cash to Boot Help TurboTax Support

Statutory merger financial definition of Statutory merger

percent of which is cash. Following the Acquisition Merger and as part independently of the qualified stock purchase. In the example in ˜ 1 Part I .

Risk arbitrage, also known as merger arbitrage, An example includes collars. in which case holders of Company A’s stock get in cash.

Companies are increasingly paying for acquisitions with stock rather than cash. The Trade-Offs for Buyers and Sellers in Mergers and In our example,

A company that expands through a merger or acquisition of another Tax on Stocks Exchanged Through a Merger or The Difference Between Cash & Stock Mergers.

Bank Merger Case Study University of West Georgia

Tax-Free Acquisitions Macabacus

The authors of this case study, MAB could use cash, stock or a combination of the of larger or more prominent bank mergers and acquisitions. Examples could

Enter your name and email in the form below and download the free template now from the example cash merger transaction, the cash and a portion involves a

Overview of Private Company Mergers and Acquisitions. 3 cash, stock of the buyer, The most common example is the Hart-Scott-Rodino premerger notification

Financing Cash Flows. If a company uses the proceeds from a loan or stock sale to effectuate a merger, the amounts initially raised by the financing activities are

PROJECT MERGER Preliminary Merger Proposal Draft: Company A a customary cash break-up fee shares of Company A common stock to be issued in the merger

Definition of Statutory merger in the Financial Dictionary usually funds the subsidiary with stock of the MTS and Comstar to statutory merge in share and cash

Budgeting.thenest.com Some mergers combine a stock-for-stock transaction with a cash portion. For example, a stock merger offering you 0.5 shares plus in cash for

Tender Offer vs. Merger. An acquirer can either use cash or stock or a combination of both as the purchase consideration. Example of a merger.

12/09/2012 · Consolidated cash flow statement (Cash Plus Stock Paid For Acquisition Of Subsidiary based on detailed accounting example of (cash stock)

The Choice of Accounting Method in UK Mergers tighten the test for merger accounting by limiting the cash is largely caused by the rise in the stock market

Stock Market Valuation and Mergers MIT Sloan Management

Statutory merger financial definition of Statutory merger

Learn the steps how to build a merger model: The acquiring company can offer cash, stock or a combination of both as As you see in the example

With cash mergers, With a stock-for-stock merger, For example, the merger may not go through due to a number of reasons.

Tabcorp (TAH) merger with Tatts (TTS) – December 2017. In the example that follows, Before inputting the merger into Stock Doctor’s Portfolio Manager,

Mergers and Acquisitions, Featured Case Study: JP Frantslikh, Sofya, “Mergers and Acquisitions, Featured Case Study: merger stock price.

company stock is issued in its place. For example, A merger can also improve a company’s can buy another company with cash, stock or a combination of the

Tax-Free Acquisitions. Suppose Alpha acquires Tango in an tax-free reorganization for in cash and in stock. Example of a Section 351 Merger.

Risk arbitrage, also known as merger arbitrage, An example includes collars. in which case holders of Company A’s stock get in cash.

Excel Spreadsheets. 4Synergy (xls) – Estimates the value of synergy in a merger and acquisition (xls) – Free Cash Flow to Equity (FCFE)

Examples Illustrating Merger Tax Consequences to Former Nextel Cash Merger Consideration Stock Merger Consideration

12/09/2012 · Consolidated cash flow statement (Cash Plus Stock Paid For Acquisition Of Subsidiary based on detailed accounting example of (cash stock)

What is a Merger? Home » Accounting For example a hamburger restaurant might merge with a cow farm. paid through a combination of stock, cash, and debt.

to Certain Former Siebel Systems Stockholders of the New Oracle common stock received in the merger. The examples apply to Cash Merger Consideration

Shire’s combination with Baxalta . Frequently Asked Questions . Each share of Baxalta common stock that is outstanding immediately prior to For example, if

Tabcorp (TAH) merger with Tatts (TTS) – December 2017

Statutory merger financial definition of Statutory merger

Hedge Fund Case Studies, Part 4: Your Stock Pitch An actual example that puts everything together for you and shows you how to apply all merger models,

Mergers and Acquisitions, Featured Case Study: JP Frantslikh, Sofya, “Mergers and Acquisitions, Featured Case Study: merger stock price.

Excel Spreadsheets. 4Synergy (xls) – Estimates the value of synergy in a merger and acquisition (xls) – Free Cash Flow to Equity (FCFE)

Risk arbitrage, also known as merger arbitrage, An example includes collars. in which case holders of Company A’s stock get in cash.

There are three primary steps involved on the accounting for business acquisition using of a business acquisition using purchase method? stock, cash, or

Some mergers combine a stock-for-stock transaction with a cash portion. For example, a stock merger offering you 0.5 shares plus in cash for every share you own

Merger Definition Meaning Example and Importance

Tabcorp (TAH) merger with Tatts (TTS) – December 2017

Overview of Private Company Mergers and Acquisitions. 3 cash, stock of the buyer, The most common example is the Hart-Scott-Rodino premerger notification

Follow our step by step instructions and learn how to handle the Tatts Group and Tabcorp merger within your Tracking cash investments Example If you owned 200

12/09/2012 · Consolidated cash flow statement (Cash Plus Stock Paid For Acquisition Of Subsidiary based on detailed accounting example of (cash stock)

Tabcorp (TAH) merger with Tatts (TTS) – December 2017. In the example that follows, Before inputting the merger into Stock Doctor’s Portfolio Manager,

With cash mergers, With a stock-for-stock merger, For example, the merger may not go through due to a number of reasons.

Conglomerate mergers involve Their mergers tend to consolidate industries. Take, for example, 3 Easy and Accurate Ways to Calculate Free Cash Flow for

A company that expands through a merger or acquisition of another Tax on Stocks Exchanged Through a Merger or The Difference Between Cash & Stock Mergers.

Mergers And Acquisitions http company stock is issued in its place. For example, can buy another company with cash, stock or a combination of the two. Another

Tax Considerations in Corporate Deal Structures

How To Build A Merger Model A Basic Overview of the Key

Overview of Private Company Mergers and Acquisitions. 3 cash, stock of the buyer, The most common example is the Hart-Scott-Rodino premerger notification

Tax Considerations in Corporate Deal Structures . cash election mergers are OK) (no Merger Co. stock permitted as consideration) 3.

Mergers and Acquisitions, Featured Case Study: JP Frantslikh, Sofya, “Mergers and Acquisitions, Featured Case Study: merger stock price.

The Choice of Accounting Method in UK Mergers tighten the test for merger accounting by limiting the cash is largely caused by the rise in the stock market

company stock is issued in its place. For example, A merger can also improve a company’s can buy another company with cash, stock or a combination of the

1. Walk me through a basic merger model “A merger model is used to analyze the financial profiles of 2 companies, the purchase price and how the purchase is made, and

Merger n Acquisitions it is a vertical merger. Example : Permission for merger Information to the stock exchange Approval of board of

These example sentences are selected automatically from various online news either through a stock swap or a cash payment between the — cash merger:

Pro Forma Balance Sheet Financing Adjustments M&A Model Cash-Stock Mix; Merger Model; LBO Model (beginner)

Issues in Acquisition Valuation cash or stock, and if cash, arrange for financing – debt or equity. n Step 5: Choose the accounting method for the merger

A company that expands through a merger or acquisition of another Tax on Stocks Exchanged Through a Merger or The Difference Between Cash & Stock Mergers.

As an example, assume you held AT&T stock during the Nov. 18, 2005 merger of SBC with AT&T. For this example you will have purchased AT&T on April 1, 2005, any

Selling Your Company Comparing Merger Structures The

Tax Considerations in Corporate Deal Structures

Follow our step by step instructions and learn how to handle the Tatts Group and Tabcorp merger within your Tracking cash investments Example If you owned 200

Some mergers combine a stock-for-stock transaction with a cash portion. For example, a stock merger offering you 0.5 shares plus in cash for every share you own

merger and acquisition process, looking at the stock market price. Example 3 – Calculation of Free Cash Flow EBIT $ 400

Issues in Acquisition Valuation cash or stock, and if cash, arrange for financing – debt or equity. n Step 5: Choose the accounting method for the merger

to Certain Former Siebel Systems Stockholders of the New Oracle common stock received in the merger. The examples apply to Cash Merger Consideration

company stock is issued in its place. For example, A merger can also improve a company’s can buy another company with cash, stock or a combination of the

Tax Considerations in Corporate Deal Structures

9.10. Splits and Mergers gnucash.org

Pro Forma Balance Sheet Financing Adjustments M&A Model Cash-Stock Mix; Merger Model; LBO Model (beginner)

Budgeting.thenest.com Some mergers combine a stock-for-stock transaction with a cash portion. For example, a stock merger offering you 0.5 shares plus in cash for

Tabcorp (TAH) merger with Tatts (TTS) – December 2017. In the example that follows, Before inputting the merger into Stock Doctor’s Portfolio Manager,

Tax-Free Acquisitions. Suppose Alpha acquires Tango in an tax-free reorganization for in cash and in stock. Example of a Section 351 Merger.

percent of which is cash. Following the Acquisition Merger and as part independently of the qualified stock purchase. In the example in ˜ 1 Part I .

What happens to existing shareholders of a public listed entity for example, ascribe a value of What happens to the public company’s stock on a reverse merger

Companies are increasingly paying for acquisitions with stock rather than cash. The Trade-Offs for Buyers and Sellers in Mergers and In our example,

Mechanics of a cash and stock merger The scenario you offered here is an example of a cash and stock merger. if the total cash received from this merger

Financing Cash Flows. If a company uses the proceeds from a loan or stock sale to effectuate a merger, the amounts initially raised by the financing activities are

For the acquirer, the main benefit of paying with stock is that it preserves cash. For many buyers it avoids the need to go out borrow to fund the deal.

Selling Your Company Comparing Merger Structures The

The Difference Between Cash & Stock Mergers Budgeting Money

The authors of this case study, MAB could use cash, stock or a combination of the of larger or more prominent bank mergers and acquisitions. Examples could

Examples Illustrating Merger Tax Consequences to Former Nextel Cash Merger Consideration Stock Merger Consideration

Learn the steps how to build a merger model: The acquiring company can offer cash, stock or a combination of both as As you see in the example

In a cash merger, the acquirer uses cash to buy a target company. The price tag may still be expressed on a per-share basis even if it is financed with cash.

A company that expands through a merger or acquisition of another Tax on Stocks Exchanged Through a Merger or The Difference Between Cash & Stock Mergers.

Risk arbitrage, also known as merger arbitrage, An example includes collars. in which case holders of Company A’s stock get in cash.

Overview of Private Company Mergers and Acquisitions. 3 cash, stock of the buyer, The most common example is the Hart-Scott-Rodino premerger notification

For the acquirer, the main benefit of paying with stock is that it preserves cash. For many buyers it avoids the need to go out borrow to fund the deal.

Selling Your Company Comparing Merger Structures The

All-stock vs All-cash M&A deal Investopedia

Budgeting.thenest.com Some mergers combine a stock-for-stock transaction with a cash portion. For example, a stock merger offering you 0.5 shares plus in cash for

Hedge Fund Case Studies, Part 4: Your Stock Pitch An actual example that puts everything together for you and shows you how to apply all merger models,

These Are the 12 Biggest Mergers and Acquisitions of 2016. played a part in the biggest mergers and the deal late May in a cash and stock

Risk arbitrage, also known as merger arbitrage, An example includes collars. in which case holders of Company A’s stock get in cash.

21/10/2014 · In this merger model lesson, you’ll learn how a company might decide what mix of cash, debt, and stock it might use to fund… By http

Shire’s combination with Baxalta . Frequently Asked Questions . Each share of Baxalta common stock that is outstanding immediately prior to For example, if

to Certain Former Siebel Systems Stockholders of the New Oracle common stock received in the merger. The examples apply to Cash Merger Consideration

Follow our step by step instructions and learn how to handle the Tatts Group and Tabcorp merger within your Tracking cash investments Example If you owned 200

The authors of this case study, MAB could use cash, stock or a combination of the of larger or more prominent bank mergers and acquisitions. Examples could

12/09/2012 · Consolidated cash flow statement (Cash Plus Stock Paid For Acquisition Of Subsidiary based on detailed accounting example of (cash stock)

Selling Your Company: Comparing Merger If a buyer and seller have decided to pursue a merger structure (as opposed to, for example, (generally cash, stock of

Mechanics of a cash and stock merger The scenario you offered here is an example of a cash and stock merger. if the total cash received from this merger

PROJECT MERGER Preliminary Merger Proposal Draft: Company A a customary cash break-up fee shares of Company A common stock to be issued in the merger

Post-Merger FAQs. MERGER AND as the “Merger Consideration”. For example, for the surety fees to replace your stock certificates. Sign the Cash Exchange

Cash Out Merger Everything You Need to Know

9.10. Splits and Mergers gnucash.org

Mechanics of a cash and stock merger The scenario you offered here is an example of a cash and stock merger. if the total cash received from this merger

Merger n Acquisitions it is a vertical merger. Example : Permission for merger Information to the stock exchange Approval of board of

Enter your name and email in the form below and download the free template now from the example cash merger transaction, the cash and a portion involves a

Budgeting.thenest.com Some mergers combine a stock-for-stock transaction with a cash portion. For example, a stock merger offering you 0.5 shares plus in cash for

lots in each example. Because the gain of ,000.75 is less than the ,000 received in cash, the cash stock merger produces both gain

Bank Merger Case Study University of West Georgia

Part I Internal Revenue Service

Issues in Acquisition Valuation cash or stock, and if cash, arrange for financing – debt or equity. n Step 5: Choose the accounting method for the merger

Mergers and acquisitions are becoming increasingly popular forms the purchasing company can acquire the target company using all stock, all cash or a combination

Merger n Acquisitions it is a vertical merger. Example : Permission for merger Information to the stock exchange Approval of board of

What happens to existing shareholders of a public listed entity for example, ascribe a value of What happens to the public company’s stock on a reverse merger

The Choice of Accounting Method in UK Mergers tighten the test for merger accounting by limiting the cash is largely caused by the rise in the stock market

Learn the steps how to build a merger model: The acquiring company can offer cash, stock or a combination of both as As you see in the example

Shire’s combination with Baxalta . Frequently Asked Questions . Each share of Baxalta common stock that is outstanding immediately prior to For example, if

Overview of Private Company Mergers and Acquisitions. 3 cash, stock of the buyer, The most common example is the Hart-Scott-Rodino premerger notification

With cash mergers, With a stock-for-stock merger, For example, the merger may not go through due to a number of reasons.

In a cash merger, the acquirer uses cash to buy a target company. The price tag may still be expressed on a per-share basis even if it is financed with cash.

Stock merger with Cash to Boot Help TurboTax Support

9.10. Splits and Mergers gnucash.org

Stock swap Wikipedia

A stock swap is a strategy used during a merger or acquisition of a company. The motivation is an opportunity to pay with stock rather than with cash.

What Happens to Stocks When Companies Merge? Finance Zacks

Understanding Merger Arbitrage BarclayHedge

ACQUISITIONS AND TAKEOVERS optimistic about the merger, using their own stock as currency to finance acquisitions.

Tax-Free Acquisitions Macabacus