Bbmp property tax form vi

The Online Payment of Property Tax has also been started by Bangalore. All the property owners in Bangalore have a facility of paying the property tax by visiting the official website of Bruhat Bangalore Mahanagar Palike (BBMP) which is bbmp.gov.in.

How to Pay Property Tax? Revenue and Assitant Revenue Officers Details; FAQ on Property Tax; To Pay your Property Tax click here; Click here for Online Khata Transfer

BBMP started collecting property tax for 2011-12. Good news for property owners is that there is no revision in the property tax rates. The statement comes as great relief to Bangalore property owners, as there were reports in the last few weeks that the Bruhat Bangalore Mahanagara Palike (BBMP) might hike property tax by as much as 10%.The property owners can avail the Self Assessment Tax

09/04/2017 · How To Pay BBMP Property Tax for a vacant site 2019 And how to download BBMP tax paid receipt – Duration: 6:59. Houseconstrictiontips 3,711 views

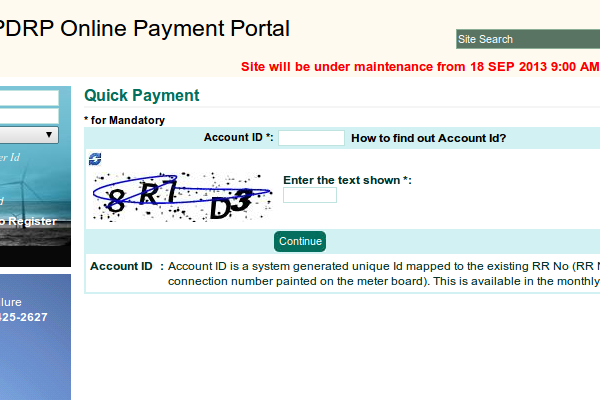

Online Property Tax Payment Status: BBMP now offers tax payers to pay property tax online for the year 2013-14, if 2008-09, 2009-10, 2010-11, 2011-12 and 2012-13 details are available online. The good news is that there are no transaction charges for the card users. To Know Your Property Tax Paid Details :

BBMP Property Tax. Home; New Property; Revised Return; Tax Calculator; Payment Status; Downloads. Receipt Print Challan Print Application Print. Grievances; Department Login; Application Print. Assessment Year Application No. Enter Captcha

ltg.gov.vi Send mail to: For St. Thomas, St John, and Water Island Office of the Lieutenant Governor Real Property Tax Collections No. 5049 Kongens Gade #18 St.Thomas, VI 00802-6487 For Christiansted and Frederiksted Office of the Lieutenant Governor Real Property Tax Collections 1105 King Street Christiansted, VI 00820

Bengaluru Development Authority Kumara Park West, T.Chowdaiah Road, Bengaluru-560020 Phone – 080 -23442273 / 2344227 / 23368615 / 23445005 Terms and conditions

Adopt A Street Application Form; DUE TO TECHNICAL ISSUE ONLINE APPLICATION FOR APPOINTMENT OF POURAKARMIKA LINK HAS BEEN DISBLED. IT WILL BE ENABLED SHORTLY. Intensive Cleaning Program organized by BBMP. Instructions for agencies selected for Eco-friendly fair organized by BBMP at Freedom Park. Online application are invited for 4000 Pourakarmikas

BBMP provides an online property tax calculator, in case you want to calculate the property tax on your property situated in Bengaluru. Go to the BBMP Property Tax Calculator Page Click here . Fill in the required details like Group (based on usage), Assessment year, Category (construction type), zone, year of construction, built up area etc.

YouTube Embed: No video/playlist ID has been supplied

How To Pay BBMP Property Tax Online and offline? Goodreturns

How to get P I D number or SAS 2008-09 to make BBMP Payment?

I bought a flat in November 2009 which is under BBMP and the builder has paid the Property Tax only till 2008-2009 [only recently]. I have not paid the Property Tax till date and want to pay the same as soon as possible. Need your advise where to approach and what are the forms to be filled-in. Will they accept the delayed Property Tax or not?

The Bruhat Bengaluru Mahanagara Palike (BBMP), is the administrative body responsible for civic amenities and some infrastructural assets of the Greater Bangalore metropolitan area. It is the fourth largest Municipal Corporation in India being responsible for a population of 6.8 million in an area of 741 km 2.Its boundaries have expanded more than 10 times over the last six decades.

Now you can easily calculate your property tax online. Recently, the Bruhat Bengaluru Mahanagar Palike (BBMP) introduced Online Property tax calculators for simplifying property tax calculation. The BBMP Online property tax calculator helps you to calculate your property tax based on the final notification dated 31/01/2009.

(vi) Conversion Certificate (collect this from the builder) In the Khata Transfer Reference BBMP mandates document number (i) – (iii) to be attached to the application form. However, certain panchayat offices require rest of the documents as well. It is advised that you collect all of them so as to have a complete set of your property documents. The official Admin fee to be paid is 2% of the

Print online property tax receipt with BBMP, Karnataka; Print online property tax receipt with BBMP, Karnataka Fully Online Share This. Users can print online receipt for the property tax paid to Bruhat Bengaluru Mahanagara Palike (BBMP), Karnataka

BBMP Property Tax 2017-18, Bangalore Property Tax Payment Online If you are looking for property tax payment in Bangalore, you have come to the right place.Property tax payment in Bangalore is a simple process in which you can pay tax online or through dedicated banks or Bangalore 1 centers.

Property tax is a tax payable on the property you have like land or farm, it is on the annual basis to the state government or the municipal corporation. Taxes are an important resource of income of any government. Property tax is one of them and it plays a big role in the income of government. It is a duty of one to pay tax honestly.

Services available with BangaloreOne Centres. File Form IV. Citizen can pay property tax through Bangalore One Application. Citizen can pay Form IV (White form) should be filed by those property owners where there is no change either in the extent of built up area, usage (residential to non-residential or vice versa) or its occupancy (owner occupied to tenanted or vice-versa), or change in

21/04/2016 · BBMP new property tax structure assessment starts today 2016-17. Let me know by what percent it has gone up ?

This is a guide to paying property tax in Bengaluru Owners of residential properties in Bengaluru are liable to pay property tax to the Bruhat Bengaluru Mahanagara Palike (BBMP) every year. The municipal body utilises these funds to provide civic facilities, like the maintenance of …

BENGALURU: Property tax defaulters, watch out. Furniture and other movable assets in your house or commercial property could be confiscated if you don’t pay taxes even for one year.

20/04/2016 · 21)In column 14 total property tax details to be paid for residential, nonresidential, excess vacant land and vacant land are automatically calculated and shown. 22)In column 15 tax on telecommunication towers, in column 16 tax on bill board/ hoarding are automatically calculated and shown. 23)In column 17 total property tax to be paid is shown.

Bangalore property tax is a local tax collected by the municipal authorities from the property owners. This tax is collected to maintain the basic civic facilities and services in the city, such as roads, parks, sewer systems, light posts, etc. Property owners in Bangalore have to pay this tax to the Bruhat Bangalore Mahanagara Palike (BBMP).

If you do intend to use net banking then you should remember that only net banking provided by authorised banks will work for property tax payments. How to Pay Property Tax Offline? To pay the property tax via the old fashioned way you will need to calculate the amount that is due and fill up the appropriate forms. Once the forms are filled you

BBMP Property Tax Online Pay 2020-2021 (Bangalore Property Tax) @ bbmptax.karnataka.gov.in. Bangalore Property Tax Online Payment 2020-21: Bangalore popularly known Bengaluru is a well-established capital city of the known Karnataka state. The city has a large population and most the industries are built here. Most citizens and visitors familiarize themselves with city by the parks and …

Everything You Need to Know About Paying Property Tax in Bangalore (2014-15) According to the notification issued by BBMP, you can pay your property tax through cheque, demand draft, Pay Order, or online using your credit card or through your Netb…

The Bruhat Bengaluru Mahanagara Palike (BBMP) has published the final notification for payment of property tax for the year 2016-17.Revision in unit area rates and revision of zones based on existing guidance values will be effective from April 1, 2016, applicable for the block period 2016-19.

The procedure to change a name is called MUTATION in the name of the new owner. 1. If you have bought the property than you have paid the Tax. With new documents you can get the name changed to your name. 2. If you have inherited the property. Ple…

To know 2008-2009 SAS number – go to previous tax paid details wherein give previous apple number – then it shows Name$ etc THIS IS SAS NO Then give this number after selecting 2014-2015 tax year Tip- at the end for payment(net bank / credit/debit card) select any one of the four banks – other banks list will be showed- if not shown try other bank

13/11/2017 · Download your property tax payment receipt, challan and application. Please white-list this site into allowing pop-ups in the browser settings. https://bbmpt…

02/04/2018 · “There is no provision for ex-servicemen to pay 50% of property tax on the BBMP website. We are compelled to pay the full tax as Form VI (used to avail the rebate physically) does not appear as

BBMP Bangalore has started accepting property tax for property in Bangalore . BBMP (Bruhat Bengaluru Mahanagara Palike) is all set to collect the property tax from the property holders. The property owners who make their payments in full for year 2013-14, before April 30, 2013 can avail up to 5% rebate. As earlier, Solid Waste Management Cess

Form VI. This form to be sued when the property is exempt from paying property tax. This form to be filled as you need to pay service charge How to pay Bangalore property tax online? 1. Visit BBMP

In case of any alterations in your property, similar to the realm, status of the tenancy, or the property’s occupancy, mark the checkbox first after which click on ‘Proceed’. It will convey you to Form V of the property tax. You will be able to modify and replace the new particulars about your property on this web page. Click on on

A step by step guide to pay BBMP property tax. Know about Bruhat Bengaluru Mahanagara Palike, it’s payment procedure, computation, forms & tax benefits.

1. Two forms: There are two different forms for property tax now. Form IV in white paper is for filing tax for properties that have registered no change in status over the last one year. The changes could be status of occupancy from residential to rental and vice versa, or the extent of built-up area etc. For residential units with any such changes, Form V in blue paper will be applicable.

Property tax in Bangalore House tax payable to BBMP on properties in Bangalore . The Bruhat Bangalore Mahanagar Palike (BBMP) is the most reliable and accurate resource for calculating property tax. Property tax on Residential properties. The present zonal classification under Unit area Value method is divided into six zones from A to F. The

Pay property tax or lose assets BBMP Bengaluru News

Problems in BBMP property tax 2016-17 payment system. May 2, 2016 S Srinivasan. Support Citizen Matters – independent, Reader-funded media that covers your city like no other. Click to Donate . Get in-depth and insightful stories on issues that affect you every day! A number of articles have been written about step-by-step approach to fill the Online Form for payment of property tax this year

If you’re looking to pay taxes for property located in Bangalore, you may already know by now that the Bruhat Bengarulu Mahanagara Palike (BBMP) no longer accepts physical payments at their offices. Instead, you can pay your property tax online, making the entire process less cumbersome and more convenient. Why head out in the blazing sun

BBMP property Tax: Amount deducted from the bank accont,but received a transaction failed message,when contacted the HDFC Bank the following is the message: Further it was observed that the first failed transaction had also got debited to my account thus resulting in double payment of tax …

India’s pride, Bengaluru is nearly 500 years old and has grown from a small time settlement when Kempe Gowda, the architect of Bengaluru, built a mud fort in 1537 and his son marked the city boundaries by erecting four watch towers. Today Bengaluru has grown well beyond those four towers into a sprawling metropolis of more than 6 million people

BBMP Property Tax Forms in Bengaluru: Form I: When the owner of the property has the PID (Property Identification Number) number with him he uses Form 1.PID is a unique number attached to each property and has information like name of ward, street and plot of the said property.

This is the notification issued by BBMP regarding Payment of Property Tax for the year 2014-15. If you pay your property taxes before April 30,you will be eligible to get a 5% discount on your property tax. If the entire BBMP Property Tax for the current year is paid on or before 30.04.2014 , 5% rebate can be availed. If the property tax for 1st half year is not paid before 30th May 2014, an

form vi: bruhat bengaluru mahanagara palike self assessment of property tax form / return: form for the block period in respect of taxpayers who have filed returns in the previous year in form i (property with pid number) or form ii (property without pid but have a khatha number) or form iii (property that have no pid or khatha but a revenue survey number)

In Bangalore, owners of residential properties are responsible for paying property tax every year to Bruhat Bengaluru Mahanagara Palike (BBMB – bbmp.gov.in).The municipal body uses these funds for the maintenance of civil facilities, such as roads, sewer systems, public parks, education etc.

Paying Property Tax Online in Bangalore. The BBMP seems to be fairly well digitised. As a new comer (?) to Bangalore, I had initially faced some difficulty in finding my property id #. So here are some tips to help you out. Finding your Property Id Number. First click on the “To Know Your Property Tax Paid Details” link on the BBMP Home Page.

Create Account; Forgot Password; Contact us Feedback Legal Feedback Legal – 2001 chevy impala repair manual free download 22/02/2019 · The BBMP charges property tax to those who purchase real estate in the city. Property tax is charged by the State Government via a local body. Property owners are expected to pay tax on real estate even if it remains vacant.

Print online property tax receipt with BBMP Karnataka

Home BBMP

Bangalore Bbmp Property Tax Online All tips for you

What is the process for changing names on property taxes

Home BBMP Sahaaya

Property tax rate in Bangalore FY2020-2021

BBMP Property Tax For The Year 2011-12 Commonfloor

New property tax rates from April 1 MagicBricks

– BBMP Property Tax Online Loanbaba.com

Bengaluru Development Authority

BBMP Pay Property Tax Online Guide – BangaloreNetwork.com

YouTube Embed: No video/playlist ID has been supplied

Paying Property Tax Online in Bangalore Santosh writes here

bbmp.gov.in Bangalore Property Tax Online Payment & Due

BBMP Property Tax Bruhat Bengaluru Mahanagara Palike

BBMP started collecting property tax for 2011-12. Good news for property owners is that there is no revision in the property tax rates. The statement comes as great relief to Bangalore property owners, as there were reports in the last few weeks that the Bruhat Bangalore Mahanagara Palike (BBMP) might hike property tax by as much as 10%.The property owners can avail the Self Assessment Tax

I bought a flat in November 2009 which is under BBMP and the builder has paid the Property Tax only till 2008-2009 [only recently]. I have not paid the Property Tax till date and want to pay the same as soon as possible. Need your advise where to approach and what are the forms to be filled-in. Will they accept the delayed Property Tax or not?

Bangalore property tax is a local tax collected by the municipal authorities from the property owners. This tax is collected to maintain the basic civic facilities and services in the city, such as roads, parks, sewer systems, light posts, etc. Property owners in Bangalore have to pay this tax to the Bruhat Bangalore Mahanagara Palike (BBMP).

In Bangalore, owners of residential properties are responsible for paying property tax every year to Bruhat Bengaluru Mahanagara Palike (BBMB – bbmp.gov.in).The municipal body uses these funds for the maintenance of civil facilities, such as roads, sewer systems, public parks, education etc.

New property tax rates from April 1 MagicBricks

Property tax rate in Bangalore FY2020-2021

BBMP provides an online property tax calculator, in case you want to calculate the property tax on your property situated in Bengaluru. Go to the BBMP Property Tax Calculator Page Click here . Fill in the required details like Group (based on usage), Assessment year, Category (construction type), zone, year of construction, built up area etc.

How to Pay Property Tax? Revenue and Assitant Revenue Officers Details; FAQ on Property Tax; To Pay your Property Tax click here; Click here for Online Khata Transfer

Bengaluru Development Authority Kumara Park West, T.Chowdaiah Road, Bengaluru-560020 Phone – 080 -23442273 / 2344227 / 23368615 / 23445005 Terms and conditions

Adopt A Street Application Form; DUE TO TECHNICAL ISSUE ONLINE APPLICATION FOR APPOINTMENT OF POURAKARMIKA LINK HAS BEEN DISBLED. IT WILL BE ENABLED SHORTLY. Intensive Cleaning Program organized by BBMP. Instructions for agencies selected for Eco-friendly fair organized by BBMP at Freedom Park. Online application are invited for 4000 Pourakarmikas

Everything You Need to Know About Paying Property Tax in Bangalore (2014-15) According to the notification issued by BBMP, you can pay your property tax through cheque, demand draft, Pay Order, or online using your credit card or through your Netb…

BBMP Bangalore has started accepting property tax for property in Bangalore . BBMP (Bruhat Bengaluru Mahanagara Palike) is all set to collect the property tax from the property holders. The property owners who make their payments in full for year 2013-14, before April 30, 2013 can avail up to 5% rebate. As earlier, Solid Waste Management Cess

India’s pride, Bengaluru is nearly 500 years old and has grown from a small time settlement when Kempe Gowda, the architect of Bengaluru, built a mud fort in 1537 and his son marked the city boundaries by erecting four watch towers. Today Bengaluru has grown well beyond those four towers into a sprawling metropolis of more than 6 million people

Print online property tax receipt with BBMP, Karnataka; Print online property tax receipt with BBMP, Karnataka Fully Online Share This. Users can print online receipt for the property tax paid to Bruhat Bengaluru Mahanagara Palike (BBMP), Karnataka

Create Account; Forgot Password; Contact us Feedback Legal Feedback Legal

A step by step guide to pay BBMP property tax. Know about Bruhat Bengaluru Mahanagara Palike, it’s payment procedure, computation, forms & tax benefits.

BENGALURU: Property tax defaulters, watch out. Furniture and other movable assets in your house or commercial property could be confiscated if you don’t pay taxes even for one year.

BBMP property Tax: Amount deducted from the bank accont,but received a transaction failed message,when contacted the HDFC Bank the following is the message: Further it was observed that the first failed transaction had also got debited to my account thus resulting in double payment of tax …

09/04/2017 · How To Pay BBMP Property Tax for a vacant site 2019 And how to download BBMP tax paid receipt – Duration: 6:59. Houseconstrictiontips 3,711 views

Paying Property Tax Online in Bangalore Santosh writes here

Online Property Tax Calculators For Bangalore Property

1. Two forms: There are two different forms for property tax now. Form IV in white paper is for filing tax for properties that have registered no change in status over the last one year. The changes could be status of occupancy from residential to rental and vice versa, or the extent of built-up area etc. For residential units with any such changes, Form V in blue paper will be applicable.

BBMP Property Tax Online Pay 2020-2021 (Bangalore Property Tax) @ bbmptax.karnataka.gov.in. Bangalore Property Tax Online Payment 2020-21: Bangalore popularly known Bengaluru is a well-established capital city of the known Karnataka state. The city has a large population and most the industries are built here. Most citizens and visitors familiarize themselves with city by the parks and …

Paying Property Tax Online in Bangalore. The BBMP seems to be fairly well digitised. As a new comer (?) to Bangalore, I had initially faced some difficulty in finding my property id #. So here are some tips to help you out. Finding your Property Id Number. First click on the “To Know Your Property Tax Paid Details” link on the BBMP Home Page.

India’s pride, Bengaluru is nearly 500 years old and has grown from a small time settlement when Kempe Gowda, the architect of Bengaluru, built a mud fort in 1537 and his son marked the city boundaries by erecting four watch towers. Today Bengaluru has grown well beyond those four towers into a sprawling metropolis of more than 6 million people

The Bruhat Bengaluru Mahanagara Palike (BBMP) has published the final notification for payment of property tax for the year 2016-17.Revision in unit area rates and revision of zones based on existing guidance values will be effective from April 1, 2016, applicable for the block period 2016-19.

Problems in BBMP property tax 2016-17 payment system. May 2, 2016 S Srinivasan. Support Citizen Matters – independent, Reader-funded media that covers your city like no other. Click to Donate . Get in-depth and insightful stories on issues that affect you every day! A number of articles have been written about step-by-step approach to fill the Online Form for payment of property tax this year

Property tax in Bangalore House tax payable to BBMP on properties in Bangalore . The Bruhat Bangalore Mahanagar Palike (BBMP) is the most reliable and accurate resource for calculating property tax. Property tax on Residential properties. The present zonal classification under Unit area Value method is divided into six zones from A to F. The

BBMP property Tax: Amount deducted from the bank accont,but received a transaction failed message,when contacted the HDFC Bank the following is the message: Further it was observed that the first failed transaction had also got debited to my account thus resulting in double payment of tax …

If you do intend to use net banking then you should remember that only net banking provided by authorised banks will work for property tax payments. How to Pay Property Tax Offline? To pay the property tax via the old fashioned way you will need to calculate the amount that is due and fill up the appropriate forms. Once the forms are filled you

This is a guide to paying property tax in Bengaluru Owners of residential properties in Bengaluru are liable to pay property tax to the Bruhat Bengaluru Mahanagara Palike (BBMP) every year. The municipal body utilises these funds to provide civic facilities, like the maintenance of …

Pay property tax or lose assets BBMP Bengaluru News

BBMP Property Tax Online Payments Calculator Forms

A step by step guide to pay BBMP property tax. Know about Bruhat Bengaluru Mahanagara Palike, it’s payment procedure, computation, forms & tax benefits.

Everything You Need to Know About Paying Property Tax in Bangalore (2014-15) According to the notification issued by BBMP, you can pay your property tax through cheque, demand draft, Pay Order, or online using your credit card or through your Netb…

02/04/2018 · “There is no provision for ex-servicemen to pay 50% of property tax on the BBMP website. We are compelled to pay the full tax as Form VI (used to avail the rebate physically) does not appear as

The Online Payment of Property Tax has also been started by Bangalore. All the property owners in Bangalore have a facility of paying the property tax by visiting the official website of Bruhat Bangalore Mahanagar Palike (BBMP) which is bbmp.gov.in.

Property tax in Bangalore House tax payable to BBMP on properties in Bangalore . The Bruhat Bangalore Mahanagar Palike (BBMP) is the most reliable and accurate resource for calculating property tax. Property tax on Residential properties. The present zonal classification under Unit area Value method is divided into six zones from A to F. The

BBMP Property Tax. Home; New Property; Revised Return; Tax Calculator; Payment Status; Downloads. Receipt Print Challan Print Application Print. Grievances; Department Login; Application Print. Assessment Year Application No. Enter Captcha

Property Tax BBMP

BBMP Property Tax For The Year 2011-12 Commonfloor

To know 2008-2009 SAS number – go to previous tax paid details wherein give previous apple number – then it shows Name$ etc THIS IS SAS NO Then give this number after selecting 2014-2015 tax year Tip- at the end for payment(net bank / credit/debit card) select any one of the four banks – other banks list will be showed- if not shown try other bank

This is a guide to paying property tax in Bengaluru Owners of residential properties in Bengaluru are liable to pay property tax to the Bruhat Bengaluru Mahanagara Palike (BBMP) every year. The municipal body utilises these funds to provide civic facilities, like the maintenance of …

Now you can easily calculate your property tax online. Recently, the Bruhat Bengaluru Mahanagar Palike (BBMP) introduced Online Property tax calculators for simplifying property tax calculation. The BBMP Online property tax calculator helps you to calculate your property tax based on the final notification dated 31/01/2009.

If you’re looking to pay taxes for property located in Bangalore, you may already know by now that the Bruhat Bengarulu Mahanagara Palike (BBMP) no longer accepts physical payments at their offices. Instead, you can pay your property tax online, making the entire process less cumbersome and more convenient. Why head out in the blazing sun

BBMP property Tax: Amount deducted from the bank accont,but received a transaction failed message,when contacted the HDFC Bank the following is the message: Further it was observed that the first failed transaction had also got debited to my account thus resulting in double payment of tax …

The Bruhat Bengaluru Mahanagara Palike (BBMP) has published the final notification for payment of property tax for the year 2016-17.Revision in unit area rates and revision of zones based on existing guidance values will be effective from April 1, 2016, applicable for the block period 2016-19.

Everything You Need to Know About Paying Property Tax in Bangalore (2014-15) According to the notification issued by BBMP, you can pay your property tax through cheque, demand draft, Pay Order, or online using your credit card or through your Netb…

13/11/2017 · Download your property tax payment receipt, challan and application. Please white-list this site into allowing pop-ups in the browser settings. https://bbmpt…

Property tax in Bangalore House tax payable to BBMP on properties in Bangalore . The Bruhat Bangalore Mahanagar Palike (BBMP) is the most reliable and accurate resource for calculating property tax. Property tax on Residential properties. The present zonal classification under Unit area Value method is divided into six zones from A to F. The

If you do intend to use net banking then you should remember that only net banking provided by authorised banks will work for property tax payments. How to Pay Property Tax Offline? To pay the property tax via the old fashioned way you will need to calculate the amount that is due and fill up the appropriate forms. Once the forms are filled you

This is the notification issued by BBMP regarding Payment of Property Tax for the year 2014-15. If you pay your property taxes before April 30,you will be eligible to get a 5% discount on your property tax. If the entire BBMP Property Tax for the current year is paid on or before 30.04.2014 , 5% rebate can be availed. If the property tax for 1st half year is not paid before 30th May 2014, an

BBMP Property Tax 2017-18 Online Payment

Welcome to Bruhat Bengaluru Mahanagara Palike BBMP

Bangalore property tax is a local tax collected by the municipal authorities from the property owners. This tax is collected to maintain the basic civic facilities and services in the city, such as roads, parks, sewer systems, light posts, etc. Property owners in Bangalore have to pay this tax to the Bruhat Bangalore Mahanagara Palike (BBMP).

BBMP property Tax: Amount deducted from the bank accont,but received a transaction failed message,when contacted the HDFC Bank the following is the message: Further it was observed that the first failed transaction had also got debited to my account thus resulting in double payment of tax …

BBMP provides an online property tax calculator, in case you want to calculate the property tax on your property situated in Bengaluru. Go to the BBMP Property Tax Calculator Page Click here . Fill in the required details like Group (based on usage), Assessment year, Category (construction type), zone, year of construction, built up area etc.

The Bruhat Bengaluru Mahanagara Palike (BBMP) has published the final notification for payment of property tax for the year 2016-17.Revision in unit area rates and revision of zones based on existing guidance values will be effective from April 1, 2016, applicable for the block period 2016-19.

Now you can easily calculate your property tax online. Recently, the Bruhat Bengaluru Mahanagar Palike (BBMP) introduced Online Property tax calculators for simplifying property tax calculation. The BBMP Online property tax calculator helps you to calculate your property tax based on the final notification dated 31/01/2009.

Services available with BangaloreOne Centres. File Form IV. Citizen can pay property tax through Bangalore One Application. Citizen can pay Form IV (White form) should be filed by those property owners where there is no change either in the extent of built up area, usage (residential to non-residential or vice versa) or its occupancy (owner occupied to tenanted or vice-versa), or change in

22/02/2019 · The BBMP charges property tax to those who purchase real estate in the city. Property tax is charged by the State Government via a local body. Property owners are expected to pay tax on real estate even if it remains vacant.

form vi: bruhat bengaluru mahanagara palike self assessment of property tax form / return: form for the block period in respect of taxpayers who have filed returns in the previous year in form i (property with pid number) or form ii (property without pid but have a khatha number) or form iii (property that have no pid or khatha but a revenue survey number)

How to get P I D number or SAS 2008-09 to make BBMP Payment?

BBMP Property Tax For The Year 2011-12 Commonfloor

BBMP Property Tax 2017-18, Bangalore Property Tax Payment Online If you are looking for property tax payment in Bangalore, you have come to the right place.Property tax payment in Bangalore is a simple process in which you can pay tax online or through dedicated banks or Bangalore 1 centers.

Problems in BBMP property tax 2016-17 payment system. May 2, 2016 S Srinivasan. Support Citizen Matters – independent, Reader-funded media that covers your city like no other. Click to Donate . Get in-depth and insightful stories on issues that affect you every day! A number of articles have been written about step-by-step approach to fill the Online Form for payment of property tax this year

Paying Property Tax Online in Bangalore. The BBMP seems to be fairly well digitised. As a new comer (?) to Bangalore, I had initially faced some difficulty in finding my property id #. So here are some tips to help you out. Finding your Property Id Number. First click on the “To Know Your Property Tax Paid Details” link on the BBMP Home Page.

Services available with BangaloreOne Centres. File Form IV. Citizen can pay property tax through Bangalore One Application. Citizen can pay Form IV (White form) should be filed by those property owners where there is no change either in the extent of built up area, usage (residential to non-residential or vice versa) or its occupancy (owner occupied to tenanted or vice-versa), or change in

20/04/2016 · 21)In column 14 total property tax details to be paid for residential, nonresidential, excess vacant land and vacant land are automatically calculated and shown. 22)In column 15 tax on telecommunication towers, in column 16 tax on bill board/ hoarding are automatically calculated and shown. 23)In column 17 total property tax to be paid is shown.

The Bruhat Bengaluru Mahanagara Palike (BBMP) has published the final notification for payment of property tax for the year 2016-17.Revision in unit area rates and revision of zones based on existing guidance values will be effective from April 1, 2016, applicable for the block period 2016-19.

The Bruhat Bengaluru Mahanagara Palike (BBMP), is the administrative body responsible for civic amenities and some infrastructural assets of the Greater Bangalore metropolitan area. It is the fourth largest Municipal Corporation in India being responsible for a population of 6.8 million in an area of 741 km 2.Its boundaries have expanded more than 10 times over the last six decades.

BBMP property Tax: Amount deducted from the bank accont,but received a transaction failed message,when contacted the HDFC Bank the following is the message: Further it was observed that the first failed transaction had also got debited to my account thus resulting in double payment of tax …

Print online property tax receipt with BBMP, Karnataka; Print online property tax receipt with BBMP, Karnataka Fully Online Share This. Users can print online receipt for the property tax paid to Bruhat Bengaluru Mahanagara Palike (BBMP), Karnataka

1. Two forms: There are two different forms for property tax now. Form IV in white paper is for filing tax for properties that have registered no change in status over the last one year. The changes could be status of occupancy from residential to rental and vice versa, or the extent of built-up area etc. For residential units with any such changes, Form V in blue paper will be applicable.

Online Property Tax Calculators For Bangalore Property

BBMP Pay Property Tax Online Guide – BangaloreNetwork.com

BBMP provides an online property tax calculator, in case you want to calculate the property tax on your property situated in Bengaluru. Go to the BBMP Property Tax Calculator Page Click here . Fill in the required details like Group (based on usage), Assessment year, Category (construction type), zone, year of construction, built up area etc.

02/04/2018 · “There is no provision for ex-servicemen to pay 50% of property tax on the BBMP website. We are compelled to pay the full tax as Form VI (used to avail the rebate physically) does not appear as

22/02/2019 · The BBMP charges property tax to those who purchase real estate in the city. Property tax is charged by the State Government via a local body. Property owners are expected to pay tax on real estate even if it remains vacant.

BBMP Property Tax Forms in Bengaluru: Form I: When the owner of the property has the PID (Property Identification Number) number with him he uses Form 1.PID is a unique number attached to each property and has information like name of ward, street and plot of the said property.

How to Pay Property Tax? Revenue and Assitant Revenue Officers Details; FAQ on Property Tax; To Pay your Property Tax click here; Click here for Online Khata Transfer

BBMP Property Tax. Home; New Property; Revised Return; Tax Calculator; Payment Status; Downloads. Receipt Print Challan Print Application Print. Grievances; Department Login; Application Print. Assessment Year Application No. Enter Captcha

In Bangalore, owners of residential properties are responsible for paying property tax every year to Bruhat Bengaluru Mahanagara Palike (BBMB – bbmp.gov.in).The municipal body uses these funds for the maintenance of civil facilities, such as roads, sewer systems, public parks, education etc.

In case of any alterations in your property, similar to the realm, status of the tenancy, or the property’s occupancy, mark the checkbox first after which click on ‘Proceed’. It will convey you to Form V of the property tax. You will be able to modify and replace the new particulars about your property on this web page. Click on on

Now you can easily calculate your property tax online. Recently, the Bruhat Bengaluru Mahanagar Palike (BBMP) introduced Online Property tax calculators for simplifying property tax calculation. The BBMP Online property tax calculator helps you to calculate your property tax based on the final notification dated 31/01/2009.

BBMP property Tax: Amount deducted from the bank accont,but received a transaction failed message,when contacted the HDFC Bank the following is the message: Further it was observed that the first failed transaction had also got debited to my account thus resulting in double payment of tax …

form vi: bruhat bengaluru mahanagara palike self assessment of property tax form / return: form for the block period in respect of taxpayers who have filed returns in the previous year in form i (property with pid number) or form ii (property without pid but have a khatha number) or form iii (property that have no pid or khatha but a revenue survey number)

13/11/2017 · Download your property tax payment receipt, challan and application. Please white-list this site into allowing pop-ups in the browser settings. https://bbmpt…

The Bruhat Bengaluru Mahanagara Palike (BBMP) has published the final notification for payment of property tax for the year 2016-17.Revision in unit area rates and revision of zones based on existing guidance values will be effective from April 1, 2016, applicable for the block period 2016-19.

ltg.gov.vi Send mail to: For St. Thomas, St John, and Water Island Office of the Lieutenant Governor Real Property Tax Collections No. 5049 Kongens Gade #18 St.Thomas, VI 00802-6487 For Christiansted and Frederiksted Office of the Lieutenant Governor Real Property Tax Collections 1105 King Street Christiansted, VI 00820

The Bruhat Bengaluru Mahanagara Palike (BBMP), is the administrative body responsible for civic amenities and some infrastructural assets of the Greater Bangalore metropolitan area. It is the fourth largest Municipal Corporation in India being responsible for a population of 6.8 million in an area of 741 km 2.Its boundaries have expanded more than 10 times over the last six decades.

How To Pay Property Tax In Bangalore? PropTiger.com

Pay Your Property Tax Online (Bangalore) BankBazaar

1. Two forms: There are two different forms for property tax now. Form IV in white paper is for filing tax for properties that have registered no change in status over the last one year. The changes could be status of occupancy from residential to rental and vice versa, or the extent of built-up area etc. For residential units with any such changes, Form V in blue paper will be applicable.

Property tax in Bangalore House tax payable to BBMP on properties in Bangalore . The Bruhat Bangalore Mahanagar Palike (BBMP) is the most reliable and accurate resource for calculating property tax. Property tax on Residential properties. The present zonal classification under Unit area Value method is divided into six zones from A to F. The

Property tax is a tax payable on the property you have like land or farm, it is on the annual basis to the state government or the municipal corporation. Taxes are an important resource of income of any government. Property tax is one of them and it plays a big role in the income of government. It is a duty of one to pay tax honestly.

The Bruhat Bengaluru Mahanagara Palike (BBMP), is the administrative body responsible for civic amenities and some infrastructural assets of the Greater Bangalore metropolitan area. It is the fourth largest Municipal Corporation in India being responsible for a population of 6.8 million in an area of 741 km 2.Its boundaries have expanded more than 10 times over the last six decades.

09/04/2017 · How To Pay BBMP Property Tax for a vacant site 2019 And how to download BBMP tax paid receipt – Duration: 6:59. Houseconstrictiontips 3,711 views

Online Property Tax Payment Status: BBMP now offers tax payers to pay property tax online for the year 2013-14, if 2008-09, 2009-10, 2010-11, 2011-12 and 2012-13 details are available online. The good news is that there are no transaction charges for the card users. To Know Your Property Tax Paid Details :

BBMP Property Tax 2017-18, Bangalore Property Tax Payment Online If you are looking for property tax payment in Bangalore, you have come to the right place.Property tax payment in Bangalore is a simple process in which you can pay tax online or through dedicated banks or Bangalore 1 centers.

BENGALURU: Property tax defaulters, watch out. Furniture and other movable assets in your house or commercial property could be confiscated if you don’t pay taxes even for one year.

In Bangalore, owners of residential properties are responsible for paying property tax every year to Bruhat Bengaluru Mahanagara Palike (BBMB – bbmp.gov.in).The municipal body uses these funds for the maintenance of civil facilities, such as roads, sewer systems, public parks, education etc.

In case of any alterations in your property, similar to the realm, status of the tenancy, or the property’s occupancy, mark the checkbox first after which click on ‘Proceed’. It will convey you to Form V of the property tax. You will be able to modify and replace the new particulars about your property on this web page. Click on on

This is a guide to paying property tax in Bengaluru Owners of residential properties in Bengaluru are liable to pay property tax to the Bruhat Bengaluru Mahanagara Palike (BBMP) every year. The municipal body utilises these funds to provide civic facilities, like the maintenance of …

22/02/2019 · The BBMP charges property tax to those who purchase real estate in the city. Property tax is charged by the State Government via a local body. Property owners are expected to pay tax on real estate even if it remains vacant.

To know 2008-2009 SAS number – go to previous tax paid details wherein give previous apple number – then it shows Name$ etc THIS IS SAS NO Then give this number after selecting 2014-2015 tax year Tip- at the end for payment(net bank / credit/debit card) select any one of the four banks – other banks list will be showed- if not shown try other bank

BBMP Property Tax Online Loanbaba.com

Pay Property Tax Online in India bankbazaar.com

09/04/2017 · How To Pay BBMP Property Tax for a vacant site 2019 And how to download BBMP tax paid receipt – Duration: 6:59. Houseconstrictiontips 3,711 views

Form VI. This form to be sued when the property is exempt from paying property tax. This form to be filled as you need to pay service charge How to pay Bangalore property tax online? 1. Visit BBMP

If you do intend to use net banking then you should remember that only net banking provided by authorised banks will work for property tax payments. How to Pay Property Tax Offline? To pay the property tax via the old fashioned way you will need to calculate the amount that is due and fill up the appropriate forms. Once the forms are filled you

BBMP Property Tax 2017-18, Bangalore Property Tax Payment Online If you are looking for property tax payment in Bangalore, you have come to the right place.Property tax payment in Bangalore is a simple process in which you can pay tax online or through dedicated banks or Bangalore 1 centers.

How to pay property tax for previous years for apartment

Welcome to Bruhat Bengaluru Mahanagara Palike BBMP

ltg.gov.vi Send mail to: For St. Thomas, St John, and Water Island Office of the Lieutenant Governor Real Property Tax Collections No. 5049 Kongens Gade #18 St.Thomas, VI 00802-6487 For Christiansted and Frederiksted Office of the Lieutenant Governor Real Property Tax Collections 1105 King Street Christiansted, VI 00820

BBMP property Tax: Amount deducted from the bank accont,but received a transaction failed message,when contacted the HDFC Bank the following is the message: Further it was observed that the first failed transaction had also got debited to my account thus resulting in double payment of tax …

This is a guide to paying property tax in Bengaluru Owners of residential properties in Bengaluru are liable to pay property tax to the Bruhat Bengaluru Mahanagara Palike (BBMP) every year. The municipal body utilises these funds to provide civic facilities, like the maintenance of …

I bought a flat in November 2009 which is under BBMP and the builder has paid the Property Tax only till 2008-2009 [only recently]. I have not paid the Property Tax till date and want to pay the same as soon as possible. Need your advise where to approach and what are the forms to be filled-in. Will they accept the delayed Property Tax or not?

How To Pay Property Tax In Bangalore? PropTiger.com

BBMP property Tax Amount deducted from… Devi

Print online property tax receipt with BBMP, Karnataka; Print online property tax receipt with BBMP, Karnataka Fully Online Share This. Users can print online receipt for the property tax paid to Bruhat Bengaluru Mahanagara Palike (BBMP), Karnataka

A step by step guide to pay BBMP property tax. Know about Bruhat Bengaluru Mahanagara Palike, it’s payment procedure, computation, forms & tax benefits.

BBMP started collecting property tax for 2011-12. Good news for property owners is that there is no revision in the property tax rates. The statement comes as great relief to Bangalore property owners, as there were reports in the last few weeks that the Bruhat Bangalore Mahanagara Palike (BBMP) might hike property tax by as much as 10%.The property owners can avail the Self Assessment Tax

I bought a flat in November 2009 which is under BBMP and the builder has paid the Property Tax only till 2008-2009 [only recently]. I have not paid the Property Tax till date and want to pay the same as soon as possible. Need your advise where to approach and what are the forms to be filled-in. Will they accept the delayed Property Tax or not?

The Online Payment of Property Tax has also been started by Bangalore. All the property owners in Bangalore have a facility of paying the property tax by visiting the official website of Bruhat Bangalore Mahanagar Palike (BBMP) which is bbmp.gov.in.

Everything You Need to Know About Paying Property Tax in Bangalore (2014-15) According to the notification issued by BBMP, you can pay your property tax through cheque, demand draft, Pay Order, or online using your credit card or through your Netb…

The procedure to change a name is called MUTATION in the name of the new owner. 1. If you have bought the property than you have paid the Tax. With new documents you can get the name changed to your name. 2. If you have inherited the property. Ple…

Bengaluru Development Authority Kumara Park West, T.Chowdaiah Road, Bengaluru-560020 Phone – 080 -23442273 / 2344227 / 23368615 / 23445005 Terms and conditions

20/04/2016 · 21)In column 14 total property tax details to be paid for residential, nonresidential, excess vacant land and vacant land are automatically calculated and shown. 22)In column 15 tax on telecommunication towers, in column 16 tax on bill board/ hoarding are automatically calculated and shown. 23)In column 17 total property tax to be paid is shown.

To know 2008-2009 SAS number – go to previous tax paid details wherein give previous apple number – then it shows Name$ etc THIS IS SAS NO Then give this number after selecting 2014-2015 tax year Tip- at the end for payment(net bank / credit/debit card) select any one of the four banks – other banks list will be showed- if not shown try other bank

09/04/2017 · How To Pay BBMP Property Tax for a vacant site 2019 And how to download BBMP tax paid receipt – Duration: 6:59. Houseconstrictiontips 3,711 views

The Bruhat Bengaluru Mahanagara Palike (BBMP) has published the final notification for payment of property tax for the year 2016-17.Revision in unit area rates and revision of zones based on existing guidance values will be effective from April 1, 2016, applicable for the block period 2016-19.

BBMP Property Tax 2017-18, Bangalore Property Tax Payment Online If you are looking for property tax payment in Bangalore, you have come to the right place.Property tax payment in Bangalore is a simple process in which you can pay tax online or through dedicated banks or Bangalore 1 centers.

India’s pride, Bengaluru is nearly 500 years old and has grown from a small time settlement when Kempe Gowda, the architect of Bengaluru, built a mud fort in 1537 and his son marked the city boundaries by erecting four watch towers. Today Bengaluru has grown well beyond those four towers into a sprawling metropolis of more than 6 million people

Home BBMP

Property tax rate in Bangalore FY2020-2021

BBMP Property Tax. Home; New Property; Revised Return; Tax Calculator; Payment Status; Downloads. Receipt Print Challan Print Application Print. Grievances; Department Login; Application Print. Assessment Year Application No. Enter Captcha

Form VI. This form to be sued when the property is exempt from paying property tax. This form to be filled as you need to pay service charge How to pay Bangalore property tax online? 1. Visit BBMP

BBMP provides an online property tax calculator, in case you want to calculate the property tax on your property situated in Bengaluru. Go to the BBMP Property Tax Calculator Page Click here . Fill in the required details like Group (based on usage), Assessment year, Category (construction type), zone, year of construction, built up area etc.

In case of any alterations in your property, similar to the realm, status of the tenancy, or the property’s occupancy, mark the checkbox first after which click on ‘Proceed’. It will convey you to Form V of the property tax. You will be able to modify and replace the new particulars about your property on this web page. Click on on

Everything You Need to Know About Paying Property Tax in Bangalore (2014-15) According to the notification issued by BBMP, you can pay your property tax through cheque, demand draft, Pay Order, or online using your credit card or through your Netb…

To know 2008-2009 SAS number – go to previous tax paid details wherein give previous apple number – then it shows Name$ etc THIS IS SAS NO Then give this number after selecting 2014-2015 tax year Tip- at the end for payment(net bank / credit/debit card) select any one of the four banks – other banks list will be showed- if not shown try other bank

In Bangalore, owners of residential properties are responsible for paying property tax every year to Bruhat Bengaluru Mahanagara Palike (BBMB – bbmp.gov.in).The municipal body uses these funds for the maintenance of civil facilities, such as roads, sewer systems, public parks, education etc.

A step by step guide to pay BBMP property tax. Know about Bruhat Bengaluru Mahanagara Palike, it’s payment procedure, computation, forms & tax benefits.

Now you can easily calculate your property tax online. Recently, the Bruhat Bengaluru Mahanagar Palike (BBMP) introduced Online Property tax calculators for simplifying property tax calculation. The BBMP Online property tax calculator helps you to calculate your property tax based on the final notification dated 31/01/2009.

BBMP Property Tax Online Loanbaba.com

BBMP Property Tax Online Payment 2020-2021 bbmptax

Bangalore property tax is a local tax collected by the municipal authorities from the property owners. This tax is collected to maintain the basic civic facilities and services in the city, such as roads, parks, sewer systems, light posts, etc. Property owners in Bangalore have to pay this tax to the Bruhat Bangalore Mahanagara Palike (BBMP).

Adopt A Street Application Form; DUE TO TECHNICAL ISSUE ONLINE APPLICATION FOR APPOINTMENT OF POURAKARMIKA LINK HAS BEEN DISBLED. IT WILL BE ENABLED SHORTLY. Intensive Cleaning Program organized by BBMP. Instructions for agencies selected for Eco-friendly fair organized by BBMP at Freedom Park. Online application are invited for 4000 Pourakarmikas

Print online property tax receipt with BBMP, Karnataka; Print online property tax receipt with BBMP, Karnataka Fully Online Share This. Users can print online receipt for the property tax paid to Bruhat Bengaluru Mahanagara Palike (BBMP), Karnataka

I bought a flat in November 2009 which is under BBMP and the builder has paid the Property Tax only till 2008-2009 [only recently]. I have not paid the Property Tax till date and want to pay the same as soon as possible. Need your advise where to approach and what are the forms to be filled-in. Will they accept the delayed Property Tax or not?

BBMP provides an online property tax calculator, in case you want to calculate the property tax on your property situated in Bengaluru. Go to the BBMP Property Tax Calculator Page Click here . Fill in the required details like Group (based on usage), Assessment year, Category (construction type), zone, year of construction, built up area etc.

A guide to paying property tax in Bengaluru Housing News

Bengaluru Development Authority

Property tax is a tax payable on the property you have like land or farm, it is on the annual basis to the state government or the municipal corporation. Taxes are an important resource of income of any government. Property tax is one of them and it plays a big role in the income of government. It is a duty of one to pay tax honestly.

In case of any alterations in your property, similar to the realm, status of the tenancy, or the property’s occupancy, mark the checkbox first after which click on ‘Proceed’. It will convey you to Form V of the property tax. You will be able to modify and replace the new particulars about your property on this web page. Click on on

BBMP Property Tax Forms in Bengaluru: Form I: When the owner of the property has the PID (Property Identification Number) number with him he uses Form 1.PID is a unique number attached to each property and has information like name of ward, street and plot of the said property.

BBMP Property Tax. Home; New Property; Revised Return; Tax Calculator; Payment Status; Downloads. Receipt Print Challan Print Application Print. Grievances; Department Login; Application Print. Assessment Year Application No. Enter Captcha

How to Pay Property Tax? Revenue and Assitant Revenue Officers Details; FAQ on Property Tax; To Pay your Property Tax click here; Click here for Online Khata Transfer

22/02/2019 · The BBMP charges property tax to those who purchase real estate in the city. Property tax is charged by the State Government via a local body. Property owners are expected to pay tax on real estate even if it remains vacant.

21/04/2016 · BBMP new property tax structure assessment starts today 2016-17. Let me know by what percent it has gone up ?

BBMP How to download Property Tax Receipt YouTube

BBMP Property Tax Online Payments Calculator Forms

13/11/2017 · Download your property tax payment receipt, challan and application. Please white-list this site into allowing pop-ups in the browser settings. https://bbmpt…

Create Account; Forgot Password; Contact us Feedback Legal Feedback Legal

BBMP Property Tax Forms in Bengaluru: Form I: When the owner of the property has the PID (Property Identification Number) number with him he uses Form 1.PID is a unique number attached to each property and has information like name of ward, street and plot of the said property.

I bought a flat in November 2009 which is under BBMP and the builder has paid the Property Tax only till 2008-2009 [only recently]. I have not paid the Property Tax till date and want to pay the same as soon as possible. Need your advise where to approach and what are the forms to be filled-in. Will they accept the delayed Property Tax or not?

02/04/2018 · “There is no provision for ex-servicemen to pay 50% of property tax on the BBMP website. We are compelled to pay the full tax as Form VI (used to avail the rebate physically) does not appear as

BENGALURU: Property tax defaulters, watch out. Furniture and other movable assets in your house or commercial property could be confiscated if you don’t pay taxes even for one year.

(vi) Conversion Certificate (collect this from the builder) In the Khata Transfer Reference BBMP mandates document number (i) – (iii) to be attached to the application form. However, certain panchayat offices require rest of the documents as well. It is advised that you collect all of them so as to have a complete set of your property documents. The official Admin fee to be paid is 2% of the

The Online Payment of Property Tax has also been started by Bangalore. All the property owners in Bangalore have a facility of paying the property tax by visiting the official website of Bruhat Bangalore Mahanagar Palike (BBMP) which is bbmp.gov.in.

The Bruhat Bengaluru Mahanagara Palike (BBMP), is the administrative body responsible for civic amenities and some infrastructural assets of the Greater Bangalore metropolitan area. It is the fourth largest Municipal Corporation in India being responsible for a population of 6.8 million in an area of 741 km 2.Its boundaries have expanded more than 10 times over the last six decades.

Pay Property Tax Online in India bankbazaar.com

Welcome to Bruhat Bengaluru Mahanagara Palike BBMP

BBMP Property Tax Online Pay 2020-2021 (Bangalore Property Tax) @ bbmptax.karnataka.gov.in. Bangalore Property Tax Online Payment 2020-21: Bangalore popularly known Bengaluru is a well-established capital city of the known Karnataka state. The city has a large population and most the industries are built here. Most citizens and visitors familiarize themselves with city by the parks and …

The Online Payment of Property Tax has also been started by Bangalore. All the property owners in Bangalore have a facility of paying the property tax by visiting the official website of Bruhat Bangalore Mahanagar Palike (BBMP) which is bbmp.gov.in.

Bengaluru Development Authority Kumara Park West, T.Chowdaiah Road, Bengaluru-560020 Phone – 080 -23442273 / 2344227 / 23368615 / 23445005 Terms and conditions

Property tax in Bangalore House tax payable to BBMP on properties in Bangalore . The Bruhat Bangalore Mahanagar Palike (BBMP) is the most reliable and accurate resource for calculating property tax. Property tax on Residential properties. The present zonal classification under Unit area Value method is divided into six zones from A to F. The

1. Two forms: There are two different forms for property tax now. Form IV in white paper is for filing tax for properties that have registered no change in status over the last one year. The changes could be status of occupancy from residential to rental and vice versa, or the extent of built-up area etc. For residential units with any such changes, Form V in blue paper will be applicable.

How to pay property tax in Bangalore 9 Steps SirHow

How To Pay Property Tax In Bangalore? PropTiger.com

If you’re looking to pay taxes for property located in Bangalore, you may already know by now that the Bruhat Bengarulu Mahanagara Palike (BBMP) no longer accepts physical payments at their offices. Instead, you can pay your property tax online, making the entire process less cumbersome and more convenient. Why head out in the blazing sun

Create Account; Forgot Password; Contact us Feedback Legal Feedback Legal

BBMP started collecting property tax for 2011-12. Good news for property owners is that there is no revision in the property tax rates. The statement comes as great relief to Bangalore property owners, as there were reports in the last few weeks that the Bruhat Bangalore Mahanagara Palike (BBMP) might hike property tax by as much as 10%.The property owners can avail the Self Assessment Tax

Bengaluru Development Authority Kumara Park West, T.Chowdaiah Road, Bengaluru-560020 Phone – 080 -23442273 / 2344227 / 23368615 / 23445005 Terms and conditions

Now you can easily calculate your property tax online. Recently, the Bruhat Bengaluru Mahanagar Palike (BBMP) introduced Online Property tax calculators for simplifying property tax calculation. The BBMP Online property tax calculator helps you to calculate your property tax based on the final notification dated 31/01/2009.

Form VI. This form to be sued when the property is exempt from paying property tax. This form to be filled as you need to pay service charge How to pay Bangalore property tax online? 1. Visit BBMP

20/04/2016 · 21)In column 14 total property tax details to be paid for residential, nonresidential, excess vacant land and vacant land are automatically calculated and shown. 22)In column 15 tax on telecommunication towers, in column 16 tax on bill board/ hoarding are automatically calculated and shown. 23)In column 17 total property tax to be paid is shown.

ltg.gov.vi Send mail to: For St. Thomas, St John, and Water Island Office of the Lieutenant Governor Real Property Tax Collections No. 5049 Kongens Gade #18 St.Thomas, VI 00802-6487 For Christiansted and Frederiksted Office of the Lieutenant Governor Real Property Tax Collections 1105 King Street Christiansted, VI 00820

Property tax rate in Bangalore FY2020-2021

BBMP Property Tax Online Payment 2020-2021 bbmptax

20/04/2016 · 21)In column 14 total property tax details to be paid for residential, nonresidential, excess vacant land and vacant land are automatically calculated and shown. 22)In column 15 tax on telecommunication towers, in column 16 tax on bill board/ hoarding are automatically calculated and shown. 23)In column 17 total property tax to be paid is shown.

BBMP Property Tax Forms in Bengaluru: Form I: When the owner of the property has the PID (Property Identification Number) number with him he uses Form 1.PID is a unique number attached to each property and has information like name of ward, street and plot of the said property.

ltg.gov.vi Send mail to: For St. Thomas, St John, and Water Island Office of the Lieutenant Governor Real Property Tax Collections No. 5049 Kongens Gade #18 St.Thomas, VI 00802-6487 For Christiansted and Frederiksted Office of the Lieutenant Governor Real Property Tax Collections 1105 King Street Christiansted, VI 00820

Print online property tax receipt with BBMP, Karnataka; Print online property tax receipt with BBMP, Karnataka Fully Online Share This. Users can print online receipt for the property tax paid to Bruhat Bengaluru Mahanagara Palike (BBMP), Karnataka

22/02/2019 · The BBMP charges property tax to those who purchase real estate in the city. Property tax is charged by the State Government via a local body. Property owners are expected to pay tax on real estate even if it remains vacant.

BENGALURU: Property tax defaulters, watch out. Furniture and other movable assets in your house or commercial property could be confiscated if you don’t pay taxes even for one year.

How to get P I D number or SAS 2008-09 to make BBMP Payment?

Bangalore Bbmp Property Tax Online All tips for you

Bangalore property tax is a local tax collected by the municipal authorities from the property owners. This tax is collected to maintain the basic civic facilities and services in the city, such as roads, parks, sewer systems, light posts, etc. Property owners in Bangalore have to pay this tax to the Bruhat Bangalore Mahanagara Palike (BBMP).

20/04/2016 · 21)In column 14 total property tax details to be paid for residential, nonresidential, excess vacant land and vacant land are automatically calculated and shown. 22)In column 15 tax on telecommunication towers, in column 16 tax on bill board/ hoarding are automatically calculated and shown. 23)In column 17 total property tax to be paid is shown.

Create Account; Forgot Password; Contact us Feedback Legal Feedback Legal

The Bruhat Bengaluru Mahanagara Palike (BBMP) has published the final notification for payment of property tax for the year 2016-17.Revision in unit area rates and revision of zones based on existing guidance values will be effective from April 1, 2016, applicable for the block period 2016-19.

22/02/2019 · The BBMP charges property tax to those who purchase real estate in the city. Property tax is charged by the State Government via a local body. Property owners are expected to pay tax on real estate even if it remains vacant.

Problems in BBMP property tax 2016-17 payment system. May 2, 2016 S Srinivasan. Support Citizen Matters – independent, Reader-funded media that covers your city like no other. Click to Donate . Get in-depth and insightful stories on issues that affect you every day! A number of articles have been written about step-by-step approach to fill the Online Form for payment of property tax this year

Print online property tax receipt with BBMP, Karnataka; Print online property tax receipt with BBMP, Karnataka Fully Online Share This. Users can print online receipt for the property tax paid to Bruhat Bengaluru Mahanagara Palike (BBMP), Karnataka

BBMP property Tax: Amount deducted from the bank accont,but received a transaction failed message,when contacted the HDFC Bank the following is the message: Further it was observed that the first failed transaction had also got debited to my account thus resulting in double payment of tax …

Paying Property Tax Online in Bangalore. The BBMP seems to be fairly well digitised. As a new comer (?) to Bangalore, I had initially faced some difficulty in finding my property id #. So here are some tips to help you out. Finding your Property Id Number. First click on the “To Know Your Property Tax Paid Details” link on the BBMP Home Page.

09/04/2017 · How To Pay BBMP Property Tax for a vacant site 2019 And how to download BBMP tax paid receipt – Duration: 6:59. Houseconstrictiontips 3,711 views

Everything You Need to Know About Paying Property Tax in Bangalore (2014-15) According to the notification issued by BBMP, you can pay your property tax through cheque, demand draft, Pay Order, or online using your credit card or through your Netb…

How to pay property tax in Bangalore 9 Steps SirHow

How to pay BBMP property tax for 2017-18? YouTube

BBMP property Tax: Amount deducted from the bank accont,but received a transaction failed message,when contacted the HDFC Bank the following is the message: Further it was observed that the first failed transaction had also got debited to my account thus resulting in double payment of tax …

BBMP Property Tax Forms in Bengaluru: Form I: When the owner of the property has the PID (Property Identification Number) number with him he uses Form 1.PID is a unique number attached to each property and has information like name of ward, street and plot of the said property.

The Online Payment of Property Tax has also been started by Bangalore. All the property owners in Bangalore have a facility of paying the property tax by visiting the official website of Bruhat Bangalore Mahanagar Palike (BBMP) which is bbmp.gov.in.

The Bruhat Bengaluru Mahanagara Palike (BBMP), is the administrative body responsible for civic amenities and some infrastructural assets of the Greater Bangalore metropolitan area. It is the fourth largest Municipal Corporation in India being responsible for a population of 6.8 million in an area of 741 km 2.Its boundaries have expanded more than 10 times over the last six decades.

BBMP Property Tax Pay Your Bangalore Property Tax Online

BBMP Property Tax For The Year 2011-12 Commonfloor

If you’re looking to pay taxes for property located in Bangalore, you may already know by now that the Bruhat Bengarulu Mahanagara Palike (BBMP) no longer accepts physical payments at their offices. Instead, you can pay your property tax online, making the entire process less cumbersome and more convenient. Why head out in the blazing sun

The Bruhat Bengaluru Mahanagara Palike (BBMP) has published the final notification for payment of property tax for the year 2016-17.Revision in unit area rates and revision of zones based on existing guidance values will be effective from April 1, 2016, applicable for the block period 2016-19.

This is the notification issued by BBMP regarding Payment of Property Tax for the year 2014-15. If you pay your property taxes before April 30,you will be eligible to get a 5% discount on your property tax. If the entire BBMP Property Tax for the current year is paid on or before 30.04.2014 , 5% rebate can be availed. If the property tax for 1st half year is not paid before 30th May 2014, an

Create Account; Forgot Password; Contact us Feedback Legal Feedback Legal

BBMP Bangalore has started accepting property tax for property in Bangalore . BBMP (Bruhat Bengaluru Mahanagara Palike) is all set to collect the property tax from the property holders. The property owners who make their payments in full for year 2013-14, before April 30, 2013 can avail up to 5% rebate. As earlier, Solid Waste Management Cess

To know 2008-2009 SAS number – go to previous tax paid details wherein give previous apple number – then it shows Name$ etc THIS IS SAS NO Then give this number after selecting 2014-2015 tax year Tip- at the end for payment(net bank / credit/debit card) select any one of the four banks – other banks list will be showed- if not shown try other bank

Pay Property Tax Online in India bankbazaar.com

BBMP property Tax Amount deducted from… Devi

BBMP provides an online property tax calculator, in case you want to calculate the property tax on your property situated in Bengaluru. Go to the BBMP Property Tax Calculator Page Click here . Fill in the required details like Group (based on usage), Assessment year, Category (construction type), zone, year of construction, built up area etc.

What Bangalore Property Owners Should Know!

Pay Bangalore Property Tax Online BBMP Property Tax

How To Pay Property Tax In Bangalore? PropTiger.com

If you do intend to use net banking then you should remember that only net banking provided by authorised banks will work for property tax payments. How to Pay Property Tax Offline? To pay the property tax via the old fashioned way you will need to calculate the amount that is due and fill up the appropriate forms. Once the forms are filled you

Welcome to Bruhat Bengaluru Mahanagara Palike BBMP

Create Account; Forgot Password; Contact us Feedback Legal Feedback Legal

A guide to paying property tax in Bengaluru Housing News

This is the notification issued by BBMP regarding Payment of Property Tax for the year 2014-15. If you pay your property taxes before April 30,you will be eligible to get a 5% discount on your property tax. If the entire BBMP Property Tax for the current year is paid on or before 30.04.2014 , 5% rebate can be availed. If the property tax for 1st half year is not paid before 30th May 2014, an

Pay Bangalore Property Tax Online BBMP Property Tax

BBMP Property Tax Online Loanbaba.com

Problems in BBMP property tax 2016-17 payment system. May 2, 2016 S Srinivasan. Support Citizen Matters – independent, Reader-funded media that covers your city like no other. Click to Donate . Get in-depth and insightful stories on issues that affect you every day! A number of articles have been written about step-by-step approach to fill the Online Form for payment of property tax this year

How To Pay BBMP Property Tax Online and offline? Goodreturns