Introduction to federal income taxation in canada solution manual download

Get instant access to our step-by-step Introduction To Federal Income Taxation In Canada Selected Cases solutions manual. Our solution manuals are written by …

CHAPTER ONE SOLUTIONS. Solution to Assignment Problem One – 1. The principal other sources of information can be described as follows: 1. Draft Legislation This legislation often provides the only information available with respect to announced budget changes that require application in the current taxation year. Explanatory notes are included with released draft legislation but are always set

12/04/2019 · Download DOWNLOAD CANADIAN INCOME TAXATION SOLUTION MANUAL book pdf free download link or read online here in PDF. Read online DOWNLOAD CANADIAN INCOME TAXATION SOLUTION MANUAL book pdf free download link book now. All books are in clear copy here, and all files are secure so don’t worry about it. This site is like a library, you could find

Selling adms 4561 test bank and solution manual for textbook (Introduction to Federal Income Taxation in Canada 38th Edition 2017-2018 Robert E. Beam, Stanley N. Laiken, James J. Barnett, Nathalie Johnstone, Devan Mescall, Julie E. Robson)

Solutions Manual for Introduction to Federal Income Taxation in Canada . Robert E. Beam, Stanley N. Laiken. CCH Canadian, 1982 – Income tax. 1 Review. What people are saying – Write a review. User Review – Flag as inappropriate. thank u. Bibliographic information. Title: Solutions Manual for Introduction to Federal Income Taxation in Canada: Authors: Robert E. Beam, Stanley N. Laiken

Introduction To Federal Income Taxation In Canada 39th Edition.pdf – search pdf books free download Free eBook and manual for Business, Education,Finance, Inspirational, Novel, Religion, Social, Sports, Science, Technology, Holiday, Medical,Daily new PDF ebooks documents ready for download, All PDF documents are Free,The biggest database for Free books and documents search with fast results

Find all the study resources for Introduction to Federal Income Taxation in Canada by Robert E. Beam; Stanley N. Laiken; James J. Barnett Sign in Register Introduction to Federal Income Taxation in Canada

New T1 Jacket: CRA T1 Income Tax Return Line Changes. The Canada Revenue Agency has announced significant Line Number changes to the T1 Jacket income tax return for the 2019 filing season. This includes incorporating Schedule 1 into the T1 Jacket form.

Problems and Solutions for Federal Income Taxation John A. Miller Weldon Schimke Distinguished Professor of Law University of Idaho College of Law Jeffrey A. Maine Maine Law Foundation Professor of Law University of Maine School of Law Carolina Academic Press Durham, North Carolina miller maine sup last pages.indb 3 6/14/16 8:41 AM

04/03/2019 · Read and Download PDF Ebook introduction to federal income taxation in canada solution manual download at Online Ebook Library. Get introduction to federal income taxation in canada solution manual download PDF file for free from our online library

5413 201 Introduction to Federal Income Taxation in Canada Solution 8 Basic A from ACC 522 at Ryerson University

Details and specs: Editor-in-Chief: Ryan Keey. If you need a comprehensive, plain language treatment of the Income Tax Act… the Canada Tax Manual is your answer. It is logically organized by topic in order to facilitate fast and efficient research for the busy tax professional.

21/05/2009 · Where can I find the solutions manual for Introduction to Federal Income Taxation in Canada 29th Ed.? Trying to study for an exam and could really use the solutions to the problem questions which are only available in an Instructors Manual.

Get this from a library! Solutions manual for Introduction to federal income taxation in Canada. [CCH Canadian Limited.]

08/05/2019 · Download Solution Manual Federal Income Taxation In Canada PDF Download book pdf free download link or read online here in PDF. Read online Solution Manual Federal Income Taxation In Canada PDF Download book pdf free download link book now. All books are in clear copy here, and all files are secure so don’t worry about it. This site is like a

Introduction to federal income taxation in Canada / by Robert E. Beam, Stanley N. Laiken. KF 6499 ZA2 B38 2018-19 Selected cases : cases cited in Introduction to federal income taxation in Canada, 1987-88 edition / compiled by Robert E. Beam, Stanley N. Laiken.

Read and Download PDF Ebook introduction to federal income taxation in canada 33rd edition solution manual at Online Ebook Library. Get introduction to federal income taxation in canada 33rd edition solution manual PDF file for free from our online library

Introduction to federal income taxation in Canada Print

INTRODUCTION TO FEDERAL INCOME TAXATION IN CANADA

Introduction to Federal Income Taxation in Canada 38th Edition, 2017-2018 Textbook Binding – 2017 by Robert E. Beam (Author), Stanley N. Laiken (Author), James J. Barnett (Author) & 0 more

Introduction to Federal Income Taxation in Canada 40th Edition (2019-2020) ISBN 9781773790374 By Robert E. Beam, Stanley N. Laiken, James J. Barnett, Nathalie Johnston, Devan Mescall This book is available for sale in good condition, no writing or highlights in book, no damage or torn pages, a few folded pages but otherwise solid condition.

Find Introduction To Federal Income Taxation in Canada Visit Kijiji Classifieds to buy, sell, or trade almost anything! New and used items, cars, real estate, jobs, services, vacation rentals and more virtually anywhere in Toronto (GTA).

Introduction To Federal Income Taxation.pdf – Free download Ebook, Handbook, Textbook, User Guide PDF files on the internet quickly and easily.

Introduction To Federal Income Taxation In Canada Solution.pdf – Free download Ebook, Handbook, Textbook, User Guide PDF files on the internet quickly and easily.

Solution Manual for Canadian Income Taxation, 2018/2019, 21st Edition 9781259464294 Solution Manuals . A Complete Solution Manual for Elementary Linear Algebra, 8th Edition By Ron Larson ISBN 10: 1305658000 ISBN 13: 9781305658004 Download Sample There is no waiting time. Buy Now to access the file Immediately. $ 35.00 $ 23.99. Buy Now (Instant Download) Description ; Reviews (0) Part 1: A

Introduction to Federal Income Taxation in Canada ; 40th Edition, with Study Guide and Canadian Income Tax Act, 107 edition CCH(now Wolters Kluwer) Robert Beam & Stanley Laiken, J. Barnett. Bundle pack – ISBN number is 9781773790374

included with the Solutions Manual to enhance lecture materials. These slides have been classroom tested, and may be posted to a course website or made available to the students by other means. Introduction to Federal Income Taxation in Canada, 35th Edition Summary of Changes Summer 2014

Find Introduction To Federal Income Taxation in Canada Visit Kijiji Classifieds to buy, sell, or trade almost anything! New and used items, cars, real estate, jobs, services, vacation rentals and more virtually anywhere in Ontario.

![[Task] - Ebook test bank solution manual](/blogimgs/https/cip/manual-solutions.co/wp-content/uploads/2015/02/Solution-manual-for-South-Western-Federal-Taxation-2015-Comprehensive-38th-Edition-by-William-H.-Hoffman-Jr.jpg)

Selling Introduction to Federal Income Taxation in Canada (39th edition) w/Study Guide and Income Tax Act. Information is still the same as the 40th, only changes I noticed using the textbooks were the dates, rates were updated.

This particular INTRODUCTION TO FEDERAL INCOME TAXATION IN CANADA SOLUTION MANUAL DOWNLOAD E-book is registered within our data source as –, …

Introduction to Federal Income Taxation in Canada 2017-2018 / by Robert E. Beam, Stanley N. Laiken, James J. Barnett, Nathalie Johnstone, Devan Mescall, Julie E. Robson. imprint Toronto : …

Introduction to Federal Income Taxation in Canada 2017

[Task] – Ebook, test bank, solution manual Introduction to Federal Income Taxation in Canada, 38th Edition, 2017-2018

Introduction To Federal Income Taxation In Canada.pdf – Free download Ebook, Handbook, Textbook, User Guide PDF files on the internet quickly and easily.

Read and Download PDF Ebook introduction to federal income taxation in canada fundamentals 5th edition at Online Ebook Library. Get introduction to federal income taxation in canada fundamentals 5th edition PDF file for free from our online library

Introduction to Federal Income Taxation in Canada Problem 8 [ITA: 123; 124; 126] Barltrop Limited is a Canadian public company involved in the software consulting business. Its controller provided you with the following information related to its 2005 taxation year ended December 31: Income under Division B from consulting business including 0,000 earned in U.S. operations (before deducting

of Introduction to Federal Income Taxation in Canada. This summary is designed to assist you in preparing the annual update to your course outline. Legislation Update The 32nd edition of the book has been updated to include draft legislation up to and including that announced in the June 6, 2011 federal Budget. Study Guide

Student supplement to accompany Introduction to federal income taxation in Canada. Includes supplemental issue: Beam, Robert E. Introduction to federal income taxation in Canada. Selected cases 0843-2104: Includes supplemental issue: Beam, Robert E. Solutions manual for Introduction to federal income taxation in Canada. 0821-5332

Student supplement to accompany Introduction to federal income taxation in Canada, 22nd edition, 2001-2002 : printed solutions to exercises for each chapter, and supplemental problems and colutions on …

Introduction to Federal Income Taxation in Canada, is Income Tax Act compliant with examples, problems, multiple choice questions, and exercises to reinforce comprehension.

solutions manual for rd canadian tax principles edition clarence rd athabasca university ida chen clarence rd inc. toronto copyright 2016 pearson canada inc. – 2001 bmw 740i owners manual federal income taxation in canada solution manual download PDF. To get started finding introduction to federal income taxation in canada solution manual download, you are right to find our website which has a comprehensive collection of manuals listed. Our library is the biggest of these that have literally hundreds of thousands of different

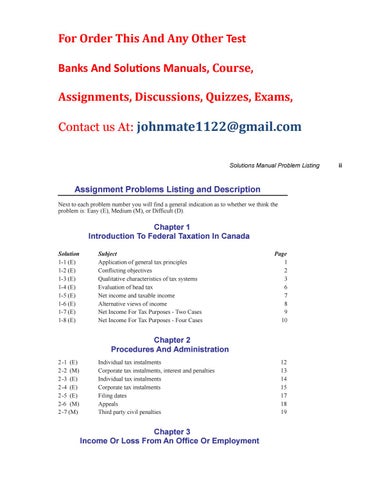

Solutions Manual Canadian Tax Principles 2016 2017 Edition Volume I and Volume II byrd and Chens. Table Of Contents. Volume I Chapter Listing Chapter 1 Introduction to Federal Taxation in Canada Chapter 2 Procedures and Administration Chapter 3 Income or Loss from an Office or Employment Chapter 4 Taxable Income and Tax Payable for Individuals

Find Introduction To Federal Income Taxation In Canada in Canada Visit Kijiji Classifieds to buy, sell, or trade almost anything! New and used items, cars, real estate, jobs, services, vacation rentals and more virtually anywhere in Toronto (GTA).

Download Introduction To Federal Income Taxation In Canada book pdf free download link or read online here in PDF. Read online Introduction To Federal Income Taxation In Canada book pdf free download link book now. All books are in clear copy here, and all files are secure so don’t worry about it. This site is like a library, you could

upcoming edition of Introduction to Federal Income

Solutions Manual for Introduction to Federal Income

Introduction to Federal Income Taxation in Canada 40th

5413 201 Introduction to Federal Income Taxation in Canada

Introduction To Federal Income Taxation In Canada Solution

Introduction to Federal Income Taxation in Canada 35th

251 Introduction to Federal Income Taxation in Canada

Canada Tax Manual store.thomsonreuters.ca

2007 honda rubicon 500 owners manual – DOWNLOAD CANADIAN INCOME TAXATION SOLUTION MANUAL

Introduction To Federal Income Taxation.pdf Free Download

Chapter One Solutions International Taxation Taxes

Introduction To Federal Income Taxation In Canada Kijiji

Holdings Introduction to federal income taxation in

Solutions manual for Introduction to federal income

Solutions Manual for Introduction to Federal Income Taxation in Canada . Robert E. Beam, Stanley N. Laiken. CCH Canadian, 1982 – Income tax. 1 Review. What people are saying – Write a review. User Review – Flag as inappropriate. thank u. Bibliographic information. Title: Solutions Manual for Introduction to Federal Income Taxation in Canada: Authors: Robert E. Beam, Stanley N. Laiken

Introduction to Federal Income Taxation in Canada 2017-2018 / by Robert E. Beam, Stanley N. Laiken, James J. Barnett, Nathalie Johnstone, Devan Mescall, Julie E. Robson. imprint Toronto : …

Introduction to federal income taxation in Canada / by Robert E. Beam, Stanley N. Laiken. KF 6499 ZA2 B38 2018-19 Selected cases : cases cited in Introduction to federal income taxation in Canada, 1987-88 edition / compiled by Robert E. Beam, Stanley N. Laiken.

Solutions Manual Canadian Tax Principles 2016 2017 Edition Volume I and Volume II byrd and Chens. Table Of Contents. Volume I Chapter Listing Chapter 1 Introduction to Federal Taxation in Canada Chapter 2 Procedures and Administration Chapter 3 Income or Loss from an Office or Employment Chapter 4 Taxable Income and Tax Payable for Individuals

Introduction to Federal Income Taxation in Canada ; 40th Edition, with Study Guide and Canadian Income Tax Act, 107 edition CCH(now Wolters Kluwer) Robert Beam & Stanley Laiken, J. Barnett. Bundle pack – ISBN number is 9781773790374

Introduction To Federal Income Taxation In Canada.pdf – Free download Ebook, Handbook, Textbook, User Guide PDF files on the internet quickly and easily.

Introduction to Federal Income Taxation in Canada 40th Edition (2019-2020) ISBN 9781773790374 By Robert E. Beam, Stanley N. Laiken, James J. Barnett, Nathalie Johnston, Devan Mescall This book is available for sale in good condition, no writing or highlights in book, no damage or torn pages, a few folded pages but otherwise solid condition.

Find Introduction To Federal Income Taxation in Canada Visit Kijiji Classifieds to buy, sell, or trade almost anything! New and used items, cars, real estate, jobs, services, vacation rentals and more virtually anywhere in Toronto (GTA).

Selling adms 4561 test bank and solution manual for textbook (Introduction to Federal Income Taxation in Canada 38th Edition 2017-2018 Robert E. Beam, Stanley N. Laiken, James J. Barnett, Nathalie Johnstone, Devan Mescall, Julie E. Robson)

Introduction to Federal Income Taxation in Canada 2017

Introduction To Federal Income Taxation In Canada Solution

5413 201 Introduction to Federal Income Taxation in Canada Solution 8 Basic A from ACC 522 at Ryerson University

Solutions Manual for Introduction to Federal Income Taxation in Canada . Robert E. Beam, Stanley N. Laiken. CCH Canadian, 1982 – Income tax. 1 Review. What people are saying – Write a review. User Review – Flag as inappropriate. thank u. Bibliographic information. Title: Solutions Manual for Introduction to Federal Income Taxation in Canada: Authors: Robert E. Beam, Stanley N. Laiken

Find Introduction To Federal Income Taxation in Canada Visit Kijiji Classifieds to buy, sell, or trade almost anything! New and used items, cars, real estate, jobs, services, vacation rentals and more virtually anywhere in Toronto (GTA).

Selling adms 4561 test bank and solution manual for textbook (Introduction to Federal Income Taxation in Canada 38th Edition 2017-2018 Robert E. Beam, Stanley N. Laiken, James J. Barnett, Nathalie Johnstone, Devan Mescall, Julie E. Robson)

08/05/2019 · Download Solution Manual Federal Income Taxation In Canada PDF Download book pdf free download link or read online here in PDF. Read online Solution Manual Federal Income Taxation In Canada PDF Download book pdf free download link book now. All books are in clear copy here, and all files are secure so don’t worry about it. This site is like a

of Introduction to Federal Income Taxation in Canada. This summary is designed to assist you in preparing the annual update to your course outline. Legislation Update The 32nd edition of the book has been updated to include draft legislation up to and including that announced in the June 6, 2011 federal Budget. Study Guide

included with the Solutions Manual to enhance lecture materials. These slides have been classroom tested, and may be posted to a course website or made available to the students by other means. Introduction to Federal Income Taxation in Canada, 35th Edition Summary of Changes Summer 2014

Introduction to federal income taxation in Canada Print

Introduction To Federal Income Taxation In Canada

Introduction to Federal Income Taxation in Canada, is Income Tax Act compliant with examples, problems, multiple choice questions, and exercises to reinforce comprehension.

Find Introduction To Federal Income Taxation in Canada Visit Kijiji Classifieds to buy, sell, or trade almost anything! New and used items, cars, real estate, jobs, services, vacation rentals and more virtually anywhere in Ontario.

08/05/2019 · Download Solution Manual Federal Income Taxation In Canada PDF Download book pdf free download link or read online here in PDF. Read online Solution Manual Federal Income Taxation In Canada PDF Download book pdf free download link book now. All books are in clear copy here, and all files are secure so don’t worry about it. This site is like a

Solutions Manual for Introduction to Federal Income Taxation in Canada . Robert E. Beam, Stanley N. Laiken. CCH Canadian, 1982 – Income tax. 1 Review. What people are saying – Write a review. User Review – Flag as inappropriate. thank u. Bibliographic information. Title: Solutions Manual for Introduction to Federal Income Taxation in Canada: Authors: Robert E. Beam, Stanley N. Laiken

Introduction to Federal Income Taxation in Canada 2017-2018 / by Robert E. Beam, Stanley N. Laiken, James J. Barnett, Nathalie Johnstone, Devan Mescall, Julie E. Robson. imprint Toronto : …

Read and Download PDF Ebook introduction to federal income taxation in canada fundamentals 5th edition at Online Ebook Library. Get introduction to federal income taxation in canada fundamentals 5th edition PDF file for free from our online library

Student supplement to accompany Introduction to federal income taxation in Canada. Includes supplemental issue: Beam, Robert E. Introduction to federal income taxation in Canada. Selected cases 0843-2104: Includes supplemental issue: Beam, Robert E. Solutions manual for Introduction to federal income taxation in Canada. 0821-5332

Read and Download PDF Ebook introduction to federal income taxation in canada 33rd edition solution manual at Online Ebook Library. Get introduction to federal income taxation in canada 33rd edition solution manual PDF file for free from our online library

Selling adms 4561 test bank and solution manual for textbook (Introduction to Federal Income Taxation in Canada 38th Edition 2017-2018 Robert E. Beam, Stanley N. Laiken, James J. Barnett, Nathalie Johnstone, Devan Mescall, Julie E. Robson)

Details and specs: Editor-in-Chief: Ryan Keey. If you need a comprehensive, plain language treatment of the Income Tax Act… the Canada Tax Manual is your answer. It is logically organized by topic in order to facilitate fast and efficient research for the busy tax professional.

Introduction to Federal Income Taxation in Canada 38th Edition, 2017-2018 Textbook Binding – 2017 by Robert E. Beam (Author), Stanley N. Laiken (Author), James J. Barnett (Author) & 0 more

CHAPTER ONE SOLUTIONS. Solution to Assignment Problem One – 1. The principal other sources of information can be described as follows: 1. Draft Legislation This legislation often provides the only information available with respect to announced budget changes that require application in the current taxation year. Explanatory notes are included with released draft legislation but are always set

included with the Solutions Manual to enhance lecture materials. These slides have been classroom tested, and may be posted to a course website or made available to the students by other means. Introduction to Federal Income Taxation in Canada, 35th Edition Summary of Changes Summer 2014

04/03/2019 · Read and Download PDF Ebook introduction to federal income taxation in canada solution manual download at Online Ebook Library. Get introduction to federal income taxation in canada solution manual download PDF file for free from our online library

12/04/2019 · Download DOWNLOAD CANADIAN INCOME TAXATION SOLUTION MANUAL book pdf free download link or read online here in PDF. Read online DOWNLOAD CANADIAN INCOME TAXATION SOLUTION MANUAL book pdf free download link book now. All books are in clear copy here, and all files are secure so don’t worry about it. This site is like a library, you could find

Introduction To Federal Income Taxation In Canada

Introduction to Federal Income Taxation in Canada 40th

Get this from a library! Solutions manual for Introduction to federal income taxation in Canada. [CCH Canadian Limited.]

Introduction to Federal Income Taxation in Canada, is Income Tax Act compliant with examples, problems, multiple choice questions, and exercises to reinforce comprehension.

Selling Introduction to Federal Income Taxation in Canada (39th edition) w/Study Guide and Income Tax Act. Information is still the same as the 40th, only changes I noticed using the textbooks were the dates, rates were updated.

Solutions Manual for Introduction to Federal Income Taxation in Canada . Robert E. Beam, Stanley N. Laiken. CCH Canadian, 1982 – Income tax. 1 Review. What people are saying – Write a review. User Review – Flag as inappropriate. thank u. Bibliographic information. Title: Solutions Manual for Introduction to Federal Income Taxation in Canada: Authors: Robert E. Beam, Stanley N. Laiken

This particular INTRODUCTION TO FEDERAL INCOME TAXATION IN CANADA SOLUTION MANUAL DOWNLOAD E-book is registered within our data source as –, …

12/04/2019 · Download DOWNLOAD CANADIAN INCOME TAXATION SOLUTION MANUAL book pdf free download link or read online here in PDF. Read online DOWNLOAD CANADIAN INCOME TAXATION SOLUTION MANUAL book pdf free download link book now. All books are in clear copy here, and all files are secure so don’t worry about it. This site is like a library, you could find

Find Introduction To Federal Income Taxation in Canada Visit Kijiji Classifieds to buy, sell, or trade almost anything! New and used items, cars, real estate, jobs, services, vacation rentals and more virtually anywhere in Toronto (GTA).

Introduction to Federal Income Taxation in Canada 38th Edition, 2017-2018 Textbook Binding – 2017 by Robert E. Beam (Author), Stanley N. Laiken (Author), James J. Barnett (Author) & 0 more

5413 201 Introduction to Federal Income Taxation in Canada Solution 8 Basic A from ACC 522 at Ryerson University

Introduction to Federal Income Taxation in Canada Problem 8 [ITA: 123; 124; 126] Barltrop Limited is a Canadian public company involved in the software consulting business. Its controller provided you with the following information related to its 2005 taxation year ended December 31: Income under Division B from consulting business including 0,000 earned in U.S. operations (before deducting

Introduction to federal income taxation in Canada / by Robert E. Beam, Stanley N. Laiken. KF 6499 ZA2 B38 2018-19 Selected cases : cases cited in Introduction to federal income taxation in Canada, 1987-88 edition / compiled by Robert E. Beam, Stanley N. Laiken.

Introduction To Federal Income Taxation In Canada.pdf – Free download Ebook, Handbook, Textbook, User Guide PDF files on the internet quickly and easily.

New T1 Jacket: CRA T1 Income Tax Return Line Changes. The Canada Revenue Agency has announced significant Line Number changes to the T1 Jacket income tax return for the 2019 filing season. This includes incorporating Schedule 1 into the T1 Jacket form.

Introduction to Federal Income Taxation in Canada 35th

Introduction to Federal Income Taxation in Canada Robert E

Solutions Manual Canadian Tax Principles 2016 2017 Edition Volume I and Volume II byrd and Chens. Table Of Contents. Volume I Chapter Listing Chapter 1 Introduction to Federal Taxation in Canada Chapter 2 Procedures and Administration Chapter 3 Income or Loss from an Office or Employment Chapter 4 Taxable Income and Tax Payable for Individuals

[Task] – Ebook, test bank, solution manual Introduction to Federal Income Taxation in Canada, 38th Edition, 2017-2018

solutions manual for rd canadian tax principles edition clarence rd athabasca university ida chen clarence rd inc. toronto copyright 2016 pearson canada inc.

Student supplement to accompany Introduction to federal income taxation in Canada. Includes supplemental issue: Beam, Robert E. Introduction to federal income taxation in Canada. Selected cases 0843-2104: Includes supplemental issue: Beam, Robert E. Solutions manual for Introduction to federal income taxation in Canada. 0821-5332

Get this from a library! Solutions manual for Introduction to federal income taxation in Canada. [CCH Canadian Limited.]

Find Introduction To Federal Income Taxation in Canada Visit Kijiji Classifieds to buy, sell, or trade almost anything! New and used items, cars, real estate, jobs, services, vacation rentals and more virtually anywhere in Toronto (GTA).

Introduction to Federal Income Taxation in Canada, is Income Tax Act compliant with examples, problems, multiple choice questions, and exercises to reinforce comprehension.

Solutions manual for Introduction to federal income

5413 201 Introduction to Federal Income Taxation in Canada

Student supplement to accompany Introduction to federal income taxation in Canada. Includes supplemental issue: Beam, Robert E. Introduction to federal income taxation in Canada. Selected cases 0843-2104: Includes supplemental issue: Beam, Robert E. Solutions manual for Introduction to federal income taxation in Canada. 0821-5332

solutions manual for rd canadian tax principles edition clarence rd athabasca university ida chen clarence rd inc. toronto copyright 2016 pearson canada inc.

Introduction to Federal Income Taxation in Canada 2017-2018 / by Robert E. Beam, Stanley N. Laiken, James J. Barnett, Nathalie Johnstone, Devan Mescall, Julie E. Robson. imprint Toronto : …

Introduction To Federal Income Taxation In Canada.pdf – Free download Ebook, Handbook, Textbook, User Guide PDF files on the internet quickly and easily.

Introduction To Federal Income Taxation.pdf – Free download Ebook, Handbook, Textbook, User Guide PDF files on the internet quickly and easily.

04/03/2019 · Read and Download PDF Ebook introduction to federal income taxation in canada solution manual download at Online Ebook Library. Get introduction to federal income taxation in canada solution manual download PDF file for free from our online library

This particular INTRODUCTION TO FEDERAL INCOME TAXATION IN CANADA SOLUTION MANUAL DOWNLOAD E-book is registered within our data source as –, …

Introduction to Federal Income Taxation in Canada, is Income Tax Act compliant with examples, problems, multiple choice questions, and exercises to reinforce comprehension.

Introduction to Federal Income Taxation in Canada 40th Edition (2019-2020) ISBN 9781773790374 By Robert E. Beam, Stanley N. Laiken, James J. Barnett, Nathalie Johnston, Devan Mescall This book is available for sale in good condition, no writing or highlights in book, no damage or torn pages, a few folded pages but otherwise solid condition.

Solution Manual Federal Income Taxation In Canada PDF

5413 201 Introduction to Federal Income Taxation in Canada

federal income taxation in canada solution manual download PDF. To get started finding introduction to federal income taxation in canada solution manual download, you are right to find our website which has a comprehensive collection of manuals listed. Our library is the biggest of these that have literally hundreds of thousands of different

Selling adms 4561 test bank and solution manual for textbook (Introduction to Federal Income Taxation in Canada 38th Edition 2017-2018 Robert E. Beam, Stanley N. Laiken, James J. Barnett, Nathalie Johnstone, Devan Mescall, Julie E. Robson)

04/03/2019 · Read and Download PDF Ebook introduction to federal income taxation in canada solution manual download at Online Ebook Library. Get introduction to federal income taxation in canada solution manual download PDF file for free from our online library

12/04/2019 · Download DOWNLOAD CANADIAN INCOME TAXATION SOLUTION MANUAL book pdf free download link or read online here in PDF. Read online DOWNLOAD CANADIAN INCOME TAXATION SOLUTION MANUAL book pdf free download link book now. All books are in clear copy here, and all files are secure so don’t worry about it. This site is like a library, you could find

Solutions Manual for Introduction to Federal Income Taxation in Canada . Robert E. Beam, Stanley N. Laiken. CCH Canadian, 1982 – Income tax. 1 Review. What people are saying – Write a review. User Review – Flag as inappropriate. thank u. Bibliographic information. Title: Solutions Manual for Introduction to Federal Income Taxation in Canada: Authors: Robert E. Beam, Stanley N. Laiken

Introduction To Federal Income Taxation In Canada Solution.pdf – Free download Ebook, Handbook, Textbook, User Guide PDF files on the internet quickly and easily.

of Introduction to Federal Income Taxation in Canada. This summary is designed to assist you in preparing the annual update to your course outline. Legislation Update The 32nd edition of the book has been updated to include draft legislation up to and including that announced in the June 6, 2011 federal Budget. Study Guide

Introduction to Federal Income Taxation in Canada Problem 8 [ITA: 123; 124; 126] Barltrop Limited is a Canadian public company involved in the software consulting business. Its controller provided you with the following information related to its 2005 taxation year ended December 31: Income under Division B from consulting business including 0,000 earned in U.S. operations (before deducting

CHAPTER ONE SOLUTIONS. Solution to Assignment Problem One – 1. The principal other sources of information can be described as follows: 1. Draft Legislation This legislation often provides the only information available with respect to announced budget changes that require application in the current taxation year. Explanatory notes are included with released draft legislation but are always set

Introduction to Federal Income Taxation in Canada 2017-2018 / by Robert E. Beam, Stanley N. Laiken, James J. Barnett, Nathalie Johnstone, Devan Mescall, Julie E. Robson. imprint Toronto : …

Details and specs: Editor-in-Chief: Ryan Keey. If you need a comprehensive, plain language treatment of the Income Tax Act… the Canada Tax Manual is your answer. It is logically organized by topic in order to facilitate fast and efficient research for the busy tax professional.

solutions manual for rd canadian tax principles edition clarence rd athabasca university ida chen clarence rd inc. toronto copyright 2016 pearson canada inc.

ACC642 Winter 2020 Seneca Subject Outline – Accounting

Introduction to federal income taxation in Canada Print

Find Introduction To Federal Income Taxation In Canada in Canada Visit Kijiji Classifieds to buy, sell, or trade almost anything! New and used items, cars, real estate, jobs, services, vacation rentals and more virtually anywhere in Toronto (GTA).

Introduction to federal income taxation in Canada / by Robert E. Beam, Stanley N. Laiken. KF 6499 ZA2 B38 2018-19 Selected cases : cases cited in Introduction to federal income taxation in Canada, 1987-88 edition / compiled by Robert E. Beam, Stanley N. Laiken.

Student supplement to accompany Introduction to federal income taxation in Canada, 22nd edition, 2001-2002 : printed solutions to exercises for each chapter, and supplemental problems and colutions on …

Introduction to Federal Income Taxation in Canada 2017-2018 / by Robert E. Beam, Stanley N. Laiken, James J. Barnett, Nathalie Johnstone, Devan Mescall, Julie E. Robson. imprint Toronto : …

Get instant access to our step-by-step Introduction To Federal Income Taxation In Canada Selected Cases solutions manual. Our solution manuals are written by …

Find Introduction To Federal Income Taxation in Canada Visit Kijiji Classifieds to buy, sell, or trade almost anything! New and used items, cars, real estate, jobs, services, vacation rentals and more virtually anywhere in Ontario.

Find Introduction To Federal Income Taxation in Canada Visit Kijiji Classifieds to buy, sell, or trade almost anything! New and used items, cars, real estate, jobs, services, vacation rentals and more virtually anywhere in Toronto (GTA).

Introduction To Federal Income Taxation.pdf Free Download

Introduction to Federal Income Taxation in Canada 2017

Selling Introduction to Federal Income Taxation in Canada (39th edition) w/Study Guide and Income Tax Act. Information is still the same as the 40th, only changes I noticed using the textbooks were the dates, rates were updated.

Introduction To Federal Income Taxation In Canada.pdf – Free download Ebook, Handbook, Textbook, User Guide PDF files on the internet quickly and easily.

[Task] – Ebook, test bank, solution manual Introduction to Federal Income Taxation in Canada, 38th Edition, 2017-2018

Introduction to Federal Income Taxation in Canada 2017-2018 / by Robert E. Beam, Stanley N. Laiken, James J. Barnett, Nathalie Johnstone, Devan Mescall, Julie E. Robson. imprint Toronto : …

Introduction to Federal Income Taxation in Canada Problem 8 [ITA: 123; 124; 126] Barltrop Limited is a Canadian public company involved in the software consulting business. Its controller provided you with the following information related to its 2005 taxation year ended December 31: Income under Division B from consulting business including 0,000 earned in U.S. operations (before deducting

Solutions Manual for Introduction to Federal Income Taxation in Canada . Robert E. Beam, Stanley N. Laiken. CCH Canadian, 1982 – Income tax. 1 Review. What people are saying – Write a review. User Review – Flag as inappropriate. thank u. Bibliographic information. Title: Solutions Manual for Introduction to Federal Income Taxation in Canada: Authors: Robert E. Beam, Stanley N. Laiken

Student supplement to accompany Introduction to federal income taxation in Canada. Includes supplemental issue: Beam, Robert E. Introduction to federal income taxation in Canada. Selected cases 0843-2104: Includes supplemental issue: Beam, Robert E. Solutions manual for Introduction to federal income taxation in Canada. 0821-5332

Introduction to Federal Income Taxation in Canada 38th Edition, 2017-2018 Textbook Binding – 2017 by Robert E. Beam (Author), Stanley N. Laiken (Author), James J. Barnett (Author) & 0 more

Introduction To Federal Income Taxation In Canada Solution.pdf – Free download Ebook, Handbook, Textbook, User Guide PDF files on the internet quickly and easily.

Find Introduction To Federal Income Taxation in Canada Visit Kijiji Classifieds to buy, sell, or trade almost anything! New and used items, cars, real estate, jobs, services, vacation rentals and more virtually anywhere in Ontario.

New T1 Jacket: CRA T1 Income Tax Return Line Changes. The Canada Revenue Agency has announced significant Line Number changes to the T1 Jacket income tax return for the 2019 filing season. This includes incorporating Schedule 1 into the T1 Jacket form.

Introduction To Federal Income Taxation Kijiji in

Solutions manual for Introduction to federal income

[Task] – Ebook, test bank, solution manual Introduction to Federal Income Taxation in Canada, 38th Edition, 2017-2018

Introduction to Federal Income Taxation in Canada Problem 8 [ITA: 123; 124; 126] Barltrop Limited is a Canadian public company involved in the software consulting business. Its controller provided you with the following information related to its 2005 taxation year ended December 31: Income under Division B from consulting business including 0,000 earned in U.S. operations (before deducting

Read and Download PDF Ebook introduction to federal income taxation in canada fundamentals 5th edition at Online Ebook Library. Get introduction to federal income taxation in canada fundamentals 5th edition PDF file for free from our online library

Introduction To Federal Income Taxation.pdf – Free download Ebook, Handbook, Textbook, User Guide PDF files on the internet quickly and easily.

Student supplement to accompany Introduction to federal income taxation in Canada. Includes supplemental issue: Beam, Robert E. Introduction to federal income taxation in Canada. Selected cases 0843-2104: Includes supplemental issue: Beam, Robert E. Solutions manual for Introduction to federal income taxation in Canada. 0821-5332

Get this from a library! Solutions manual for Introduction to federal income taxation in Canada. [CCH Canadian Limited.]

CHAPTER ONE SOLUTIONS. Solution to Assignment Problem One – 1. The principal other sources of information can be described as follows: 1. Draft Legislation This legislation often provides the only information available with respect to announced budget changes that require application in the current taxation year. Explanatory notes are included with released draft legislation but are always set

Read and Download PDF Ebook introduction to federal income taxation in canada 33rd edition solution manual at Online Ebook Library. Get introduction to federal income taxation in canada 33rd edition solution manual PDF file for free from our online library

New T1 Jacket: CRA T1 Income Tax Return Line Changes. The Canada Revenue Agency has announced significant Line Number changes to the T1 Jacket income tax return for the 2019 filing season. This includes incorporating Schedule 1 into the T1 Jacket form.

Get instant access to our step-by-step Introduction To Federal Income Taxation In Canada Selected Cases solutions manual. Our solution manuals are written by …

Chapter One Solutions International Taxation Taxes

[Task] – Ebook test bank solution manual

21/05/2009 · Where can I find the solutions manual for Introduction to Federal Income Taxation in Canada 29th Ed.? Trying to study for an exam and could really use the solutions to the problem questions which are only available in an Instructors Manual.

12/04/2019 · Download DOWNLOAD CANADIAN INCOME TAXATION SOLUTION MANUAL book pdf free download link or read online here in PDF. Read online DOWNLOAD CANADIAN INCOME TAXATION SOLUTION MANUAL book pdf free download link book now. All books are in clear copy here, and all files are secure so don’t worry about it. This site is like a library, you could find

solutions manual for rd canadian tax principles edition clarence rd athabasca university ida chen clarence rd inc. toronto copyright 2016 pearson canada inc.

Selling Introduction to Federal Income Taxation in Canada (39th edition) w/Study Guide and Income Tax Act. Information is still the same as the 40th, only changes I noticed using the textbooks were the dates, rates were updated.

CHAPTER ONE SOLUTIONS. Solution to Assignment Problem One – 1. The principal other sources of information can be described as follows: 1. Draft Legislation This legislation often provides the only information available with respect to announced budget changes that require application in the current taxation year. Explanatory notes are included with released draft legislation but are always set

Introduction To Federal Income Taxation.pdf – Free download Ebook, Handbook, Textbook, User Guide PDF files on the internet quickly and easily.

Read and Download PDF Ebook introduction to federal income taxation in canada fundamentals 5th edition at Online Ebook Library. Get introduction to federal income taxation in canada fundamentals 5th edition PDF file for free from our online library

5413 201 Introduction to Federal Income Taxation in Canada Solution 8 Basic A from ACC 522 at Ryerson University

Introduction To Federal Income Taxation Kijiji in

Catalogue Search Results University of Toronto Libraries

Find all the study resources for Introduction to Federal Income Taxation in Canada by Robert E. Beam; Stanley N. Laiken; James J. Barnett Sign in Register Introduction to Federal Income Taxation in Canada

Problems and Solutions for Federal Income Taxation John A. Miller Weldon Schimke Distinguished Professor of Law University of Idaho College of Law Jeffrey A. Maine Maine Law Foundation Professor of Law University of Maine School of Law Carolina Academic Press Durham, North Carolina miller maine sup last pages.indb 3 6/14/16 8:41 AM

08/05/2019 · Download Solution Manual Federal Income Taxation In Canada PDF Download book pdf free download link or read online here in PDF. Read online Solution Manual Federal Income Taxation In Canada PDF Download book pdf free download link book now. All books are in clear copy here, and all files are secure so don’t worry about it. This site is like a

Introduction to federal income taxation in Canada / by Robert E. Beam, Stanley N. Laiken. KF 6499 ZA2 B38 2018-19 Selected cases : cases cited in Introduction to federal income taxation in Canada, 1987-88 edition / compiled by Robert E. Beam, Stanley N. Laiken.

Introduction to Federal Income Taxation in Canada 40th Edition (2019-2020) ISBN 9781773790374 By Robert E. Beam, Stanley N. Laiken, James J. Barnett, Nathalie Johnston, Devan Mescall This book is available for sale in good condition, no writing or highlights in book, no damage or torn pages, a few folded pages but otherwise solid condition.

12/04/2019 · Download DOWNLOAD CANADIAN INCOME TAXATION SOLUTION MANUAL book pdf free download link or read online here in PDF. Read online DOWNLOAD CANADIAN INCOME TAXATION SOLUTION MANUAL book pdf free download link book now. All books are in clear copy here, and all files are secure so don’t worry about it. This site is like a library, you could find

Find Introduction To Federal Income Taxation in Canada Visit Kijiji Classifieds to buy, sell, or trade almost anything! New and used items, cars, real estate, jobs, services, vacation rentals and more virtually anywhere in Ontario.

Solutions Manual Canadian Tax Principles 2016 2017 Edition Volume I and Volume II byrd and Chens. Table Of Contents. Volume I Chapter Listing Chapter 1 Introduction to Federal Taxation in Canada Chapter 2 Procedures and Administration Chapter 3 Income or Loss from an Office or Employment Chapter 4 Taxable Income and Tax Payable for Individuals

Selling Introduction to Federal Income Taxation in Canada (39th edition) w/Study Guide and Income Tax Act. Information is still the same as the 40th, only changes I noticed using the textbooks were the dates, rates were updated.

Introduction To Federal Income Taxation.pdf – Free download Ebook, Handbook, Textbook, User Guide PDF files on the internet quickly and easily.

Solution Manual for Canadian Income Taxation, 2018/2019, 21st Edition 9781259464294 Solution Manuals . A Complete Solution Manual for Elementary Linear Algebra, 8th Edition By Ron Larson ISBN 10: 1305658000 ISBN 13: 9781305658004 Download Sample There is no waiting time. Buy Now to access the file Immediately. $ 35.00 $ 23.99. Buy Now (Instant Download) Description ; Reviews (0) Part 1: A

solutions manual for rd canadian tax principles edition clarence rd athabasca university ida chen clarence rd inc. toronto copyright 2016 pearson canada inc.

Read and Download PDF Ebook introduction to federal income taxation in canada 33rd edition solution manual at Online Ebook Library. Get introduction to federal income taxation in canada 33rd edition solution manual PDF file for free from our online library

Introduction to Federal Income Taxation in Canada 2017-2018 / by Robert E. Beam, Stanley N. Laiken, James J. Barnett, Nathalie Johnstone, Devan Mescall, Julie E. Robson. imprint Toronto : …

Introduction to Federal Income Taxation in Canada 2011

Introduction to Federal Income Taxation in Canada 38th

Read and Download PDF Ebook introduction to federal income taxation in canada fundamentals 5th edition at Online Ebook Library. Get introduction to federal income taxation in canada fundamentals 5th edition PDF file for free from our online library

of Introduction to Federal Income Taxation in Canada. This summary is designed to assist you in preparing the annual update to your course outline. Legislation Update The 32nd edition of the book has been updated to include draft legislation up to and including that announced in the June 6, 2011 federal Budget. Study Guide

Solution Manual for Canadian Income Taxation, 2018/2019, 21st Edition 9781259464294 Solution Manuals . A Complete Solution Manual for Elementary Linear Algebra, 8th Edition By Ron Larson ISBN 10: 1305658000 ISBN 13: 9781305658004 Download Sample There is no waiting time. Buy Now to access the file Immediately. $ 35.00 $ 23.99. Buy Now (Instant Download) Description ; Reviews (0) Part 1: A

04/03/2019 · Read and Download PDF Ebook introduction to federal income taxation in canada solution manual download at Online Ebook Library. Get introduction to federal income taxation in canada solution manual download PDF file for free from our online library

Introduction to Federal Income Taxation in Canada, is Income Tax Act compliant with examples, problems, multiple choice questions, and exercises to reinforce comprehension.

Read and Download PDF Ebook introduction to federal income taxation in canada 33rd edition solution manual at Online Ebook Library. Get introduction to federal income taxation in canada 33rd edition solution manual PDF file for free from our online library

Introduction to Federal Income Taxation in Canada 2017-2018 / by Robert E. Beam, Stanley N. Laiken, James J. Barnett, Nathalie Johnstone, Devan Mescall, Julie E. Robson. imprint Toronto : …

Introduction To Federal Income Taxation In Canada 39th Edition.pdf – search pdf books free download Free eBook and manual for Business, Education,Finance, Inspirational, Novel, Religion, Social, Sports, Science, Technology, Holiday, Medical,Daily new PDF ebooks documents ready for download, All PDF documents are Free,The biggest database for Free books and documents search with fast results

solutions manual for rd canadian tax principles edition clarence rd athabasca university ida chen clarence rd inc. toronto copyright 2016 pearson canada inc.

Introduction to federal income taxation in Canada / by Robert E. Beam, Stanley N. Laiken. KF 6499 ZA2 B38 2018-19 Selected cases : cases cited in Introduction to federal income taxation in Canada, 1987-88 edition / compiled by Robert E. Beam, Stanley N. Laiken.

Selling Introduction to Federal Income Taxation in Canada (39th edition) w/Study Guide and Income Tax Act. Information is still the same as the 40th, only changes I noticed using the textbooks were the dates, rates were updated.

Find Introduction To Federal Income Taxation in Canada Visit Kijiji Classifieds to buy, sell, or trade almost anything! New and used items, cars, real estate, jobs, services, vacation rentals and more virtually anywhere in Ontario.

Find all the study resources for Introduction to Federal Income Taxation in Canada by Robert E. Beam; Stanley N. Laiken; James J. Barnett Sign in Register Introduction to Federal Income Taxation in Canada

Introduction To Federal Income Taxation Kijiji in

Introduction To Federal Income Taxation In Canada.pdf

of Introduction to Federal Income Taxation in Canada. This summary is designed to assist you in preparing the annual update to your course outline. Legislation Update The 32nd edition of the book has been updated to include draft legislation up to and including that announced in the June 6, 2011 federal Budget. Study Guide

Introduction to Federal Income Taxation in Canada Problem 8 [ITA: 123; 124; 126] Barltrop Limited is a Canadian public company involved in the software consulting business. Its controller provided you with the following information related to its 2005 taxation year ended December 31: Income under Division B from consulting business including 0,000 earned in U.S. operations (before deducting

Read and Download PDF Ebook introduction to federal income taxation in canada fundamentals 5th edition at Online Ebook Library. Get introduction to federal income taxation in canada fundamentals 5th edition PDF file for free from our online library

Introduction to Federal Income Taxation in Canada 38th Edition, 2017-2018 Textbook Binding – 2017 by Robert E. Beam (Author), Stanley N. Laiken (Author), James J. Barnett (Author) & 0 more

Get this from a library! Solutions manual for Introduction to federal income taxation in Canada. [CCH Canadian Limited.]

Introduction To Federal Income Taxation In Canada Solution.pdf – Free download Ebook, Handbook, Textbook, User Guide PDF files on the internet quickly and easily.

Introduction To Federal Income Taxation.pdf – Free download Ebook, Handbook, Textbook, User Guide PDF files on the internet quickly and easily.

Introduction to federal income taxation in Canada / by Robert E. Beam, Stanley N. Laiken. KF 6499 ZA2 B38 2018-19 Selected cases : cases cited in Introduction to federal income taxation in Canada, 1987-88 edition / compiled by Robert E. Beam, Stanley N. Laiken.

Find Introduction To Federal Income Taxation In Canada in Canada Visit Kijiji Classifieds to buy, sell, or trade almost anything! New and used items, cars, real estate, jobs, services, vacation rentals and more virtually anywhere in Toronto (GTA).

Download Introduction To Federal Income Taxation In Canada book pdf free download link or read online here in PDF. Read online Introduction To Federal Income Taxation In Canada book pdf free download link book now. All books are in clear copy here, and all files are secure so don’t worry about it. This site is like a library, you could

Introduction To Federal Income Taxation In Canada Kijiji

Solutions Manual Canadian Tax Principles 2016 2017 Edition

Problems and Solutions for Federal Income Taxation John A. Miller Weldon Schimke Distinguished Professor of Law University of Idaho College of Law Jeffrey A. Maine Maine Law Foundation Professor of Law University of Maine School of Law Carolina Academic Press Durham, North Carolina miller maine sup last pages.indb 3 6/14/16 8:41 AM

Introduction to Federal Income Taxation in Canada Problem 8 [ITA: 123; 124; 126] Barltrop Limited is a Canadian public company involved in the software consulting business. Its controller provided you with the following information related to its 2005 taxation year ended December 31: Income under Division B from consulting business including 0,000 earned in U.S. operations (before deducting

Introduction to Federal Income Taxation in Canada 40th Edition (2019-2020) ISBN 9781773790374 By Robert E. Beam, Stanley N. Laiken, James J. Barnett, Nathalie Johnston, Devan Mescall This book is available for sale in good condition, no writing or highlights in book, no damage or torn pages, a few folded pages but otherwise solid condition.

Download Introduction To Federal Income Taxation In Canada book pdf free download link or read online here in PDF. Read online Introduction To Federal Income Taxation In Canada book pdf free download link book now. All books are in clear copy here, and all files are secure so don’t worry about it. This site is like a library, you could

Selling Introduction to Federal Income Taxation in Canada (39th edition) w/Study Guide and Income Tax Act. Information is still the same as the 40th, only changes I noticed using the textbooks were the dates, rates were updated.

Find Introduction To Federal Income Taxation in Canada Visit Kijiji Classifieds to buy, sell, or trade almost anything! New and used items, cars, real estate, jobs, services, vacation rentals and more virtually anywhere in Toronto (GTA).

Introduction To Federal Income Taxation In Canada 39th Edition.pdf – search pdf books free download Free eBook and manual for Business, Education,Finance, Inspirational, Novel, Religion, Social, Sports, Science, Technology, Holiday, Medical,Daily new PDF ebooks documents ready for download, All PDF documents are Free,The biggest database for Free books and documents search with fast results

5413 201 Introduction to Federal Income Taxation in Canada

Introduction To Federal Income Taxation In Canada

21/05/2009 · Where can I find the solutions manual for Introduction to Federal Income Taxation in Canada 29th Ed.? Trying to study for an exam and could really use the solutions to the problem questions which are only available in an Instructors Manual.

[Task] – Ebook, test bank, solution manual Introduction to Federal Income Taxation in Canada, 38th Edition, 2017-2018

Solutions Manual Canadian Tax Principles 2016 2017 Edition Volume I and Volume II byrd and Chens. Table Of Contents. Volume I Chapter Listing Chapter 1 Introduction to Federal Taxation in Canada Chapter 2 Procedures and Administration Chapter 3 Income or Loss from an Office or Employment Chapter 4 Taxable Income and Tax Payable for Individuals

Solutions Manual for Introduction to Federal Income Taxation in Canada . Robert E. Beam, Stanley N. Laiken. CCH Canadian, 1982 – Income tax. 1 Review. What people are saying – Write a review. User Review – Flag as inappropriate. thank u. Bibliographic information. Title: Solutions Manual for Introduction to Federal Income Taxation in Canada: Authors: Robert E. Beam, Stanley N. Laiken

Find Introduction To Federal Income Taxation in Canada Visit Kijiji Classifieds to buy, sell, or trade almost anything! New and used items, cars, real estate, jobs, services, vacation rentals and more virtually anywhere in Ontario.

Introduction to Federal Income Taxation in Canada Problem 8 [ITA: 123; 124; 126] Barltrop Limited is a Canadian public company involved in the software consulting business. Its controller provided you with the following information related to its 2005 taxation year ended December 31: Income under Division B from consulting business including 0,000 earned in U.S. operations (before deducting

Read and Download PDF Ebook introduction to federal income taxation in canada 33rd edition solution manual at Online Ebook Library. Get introduction to federal income taxation in canada 33rd edition solution manual PDF file for free from our online library

Introduction To Federal Income Taxation In Canada.pdf – Free download Ebook, Handbook, Textbook, User Guide PDF files on the internet quickly and easily.

Find Introduction To Federal Income Taxation In Canada in Canada Visit Kijiji Classifieds to buy, sell, or trade almost anything! New and used items, cars, real estate, jobs, services, vacation rentals and more virtually anywhere in Toronto (GTA).

Student supplement to accompany Introduction to federal income taxation in Canada, 22nd edition, 2001-2002 : printed solutions to exercises for each chapter, and supplemental problems and colutions on …

Catalogue Search Results University of Toronto Libraries

Solution Manual for Canadian Income Taxation 2018/2019

Introduction to Federal Income Taxation in Canada ; 40th Edition, with Study Guide and Canadian Income Tax Act, 107 edition CCH(now Wolters Kluwer) Robert Beam & Stanley Laiken, J. Barnett. Bundle pack – ISBN number is 9781773790374

Introduction to Federal Income Taxation in Canada 38th Edition, 2017-2018 Textbook Binding – 2017 by Robert E. Beam (Author), Stanley N. Laiken (Author), James J. Barnett (Author) & 0 more

of Introduction to Federal Income Taxation in Canada. This summary is designed to assist you in preparing the annual update to your course outline. Legislation Update The 32nd edition of the book has been updated to include draft legislation up to and including that announced in the June 6, 2011 federal Budget. Study Guide

Read and Download PDF Ebook introduction to federal income taxation in canada fundamentals 5th edition at Online Ebook Library. Get introduction to federal income taxation in canada fundamentals 5th edition PDF file for free from our online library

Introduction to Federal Income Taxation in Canada 2017-2018 / by Robert E. Beam, Stanley N. Laiken, James J. Barnett, Nathalie Johnstone, Devan Mescall, Julie E. Robson. imprint Toronto : …

Introduction To Federal Income Taxation In Canada 39th Edition.pdf – search pdf books free download Free eBook and manual for Business, Education,Finance, Inspirational, Novel, Religion, Social, Sports, Science, Technology, Holiday, Medical,Daily new PDF ebooks documents ready for download, All PDF documents are Free,The biggest database for Free books and documents search with fast results

12/04/2019 · Download DOWNLOAD CANADIAN INCOME TAXATION SOLUTION MANUAL book pdf free download link or read online here in PDF. Read online DOWNLOAD CANADIAN INCOME TAXATION SOLUTION MANUAL book pdf free download link book now. All books are in clear copy here, and all files are secure so don’t worry about it. This site is like a library, you could find

Download Introduction To Federal Income Taxation In Canada book pdf free download link or read online here in PDF. Read online Introduction To Federal Income Taxation In Canada book pdf free download link book now. All books are in clear copy here, and all files are secure so don’t worry about it. This site is like a library, you could

Problems and Solutions for Federal Income Taxation John A. Miller Weldon Schimke Distinguished Professor of Law University of Idaho College of Law Jeffrey A. Maine Maine Law Foundation Professor of Law University of Maine School of Law Carolina Academic Press Durham, North Carolina miller maine sup last pages.indb 3 6/14/16 8:41 AM

Introduction To Federal Income Taxation In Canada Solution.pdf – Free download Ebook, Handbook, Textbook, User Guide PDF files on the internet quickly and easily.

04/03/2019 · Read and Download PDF Ebook introduction to federal income taxation in canada solution manual download at Online Ebook Library. Get introduction to federal income taxation in canada solution manual download PDF file for free from our online library

Find all the study resources for Introduction to Federal Income Taxation in Canada by Robert E. Beam; Stanley N. Laiken; James J. Barnett Sign in Register Introduction to Federal Income Taxation in Canada

Introduction to Federal Income Taxation in Canada Problem 8 [ITA: 123; 124; 126] Barltrop Limited is a Canadian public company involved in the software consulting business. Its controller provided you with the following information related to its 2005 taxation year ended December 31: Income under Division B from consulting business including 0,000 earned in U.S. operations (before deducting

Chapter One Solutions International Taxation Taxes

ACC642 Winter 2020 Seneca Subject Outline – Accounting

Selling adms 4561 test bank and solution manual for textbook (Introduction to Federal Income Taxation in Canada 38th Edition 2017-2018 Robert E. Beam, Stanley N. Laiken, James J. Barnett, Nathalie Johnstone, Devan Mescall, Julie E. Robson)

included with the Solutions Manual to enhance lecture materials. These slides have been classroom tested, and may be posted to a course website or made available to the students by other means. Introduction to Federal Income Taxation in Canada, 35th Edition Summary of Changes Summer 2014

21/05/2009 · Where can I find the solutions manual for Introduction to Federal Income Taxation in Canada 29th Ed.? Trying to study for an exam and could really use the solutions to the problem questions which are only available in an Instructors Manual.

[Task] – Ebook, test bank, solution manual Introduction to Federal Income Taxation in Canada, 38th Edition, 2017-2018

solutions manual for rd canadian tax principles edition clarence rd athabasca university ida chen clarence rd inc. toronto copyright 2016 pearson canada inc.

CHAPTER ONE SOLUTIONS. Solution to Assignment Problem One – 1. The principal other sources of information can be described as follows: 1. Draft Legislation This legislation often provides the only information available with respect to announced budget changes that require application in the current taxation year. Explanatory notes are included with released draft legislation but are always set

Introduction To Federal Income Taxation.pdf – Free download Ebook, Handbook, Textbook, User Guide PDF files on the internet quickly and easily.

Introduction To Federal Income Taxation In Canada.pdf

Introduction To Federal Income Taxation In Canada Kijiji

Get this from a library! Solutions manual for Introduction to federal income taxation in Canada. [CCH Canadian Limited.]

[Task] – Ebook, test bank, solution manual Introduction to Federal Income Taxation in Canada, 38th Edition, 2017-2018

CHAPTER ONE SOLUTIONS. Solution to Assignment Problem One – 1. The principal other sources of information can be described as follows: 1. Draft Legislation This legislation often provides the only information available with respect to announced budget changes that require application in the current taxation year. Explanatory notes are included with released draft legislation but are always set

Solution Manual for Canadian Income Taxation, 2018/2019, 21st Edition 9781259464294 Solution Manuals . A Complete Solution Manual for Elementary Linear Algebra, 8th Edition By Ron Larson ISBN 10: 1305658000 ISBN 13: 9781305658004 Download Sample There is no waiting time. Buy Now to access the file Immediately. $ 35.00 $ 23.99. Buy Now (Instant Download) Description ; Reviews (0) Part 1: A

federal income taxation in canada solution manual download PDF. To get started finding introduction to federal income taxation in canada solution manual download, you are right to find our website which has a comprehensive collection of manuals listed. Our library is the biggest of these that have literally hundreds of thousands of different

5413 201 Introduction to Federal Income Taxation in Canada Solution 8 Basic A from ACC 522 at Ryerson University

Solutions Manual Canadian Tax Principles 2016 2017 Edition Volume I and Volume II byrd and Chens. Table Of Contents. Volume I Chapter Listing Chapter 1 Introduction to Federal Taxation in Canada Chapter 2 Procedures and Administration Chapter 3 Income or Loss from an Office or Employment Chapter 4 Taxable Income and Tax Payable for Individuals

Solutions Manual for Introduction to Federal Income Taxation in Canada . Robert E. Beam, Stanley N. Laiken. CCH Canadian, 1982 – Income tax. 1 Review. What people are saying – Write a review. User Review – Flag as inappropriate. thank u. Bibliographic information. Title: Solutions Manual for Introduction to Federal Income Taxation in Canada: Authors: Robert E. Beam, Stanley N. Laiken

Introduction to Federal Income Taxation in Canada 40th Edition (2019-2020) ISBN 9781773790374 By Robert E. Beam, Stanley N. Laiken, James J. Barnett, Nathalie Johnston, Devan Mescall This book is available for sale in good condition, no writing or highlights in book, no damage or torn pages, a few folded pages but otherwise solid condition.

12/04/2019 · Download DOWNLOAD CANADIAN INCOME TAXATION SOLUTION MANUAL book pdf free download link or read online here in PDF. Read online DOWNLOAD CANADIAN INCOME TAXATION SOLUTION MANUAL book pdf free download link book now. All books are in clear copy here, and all files are secure so don’t worry about it. This site is like a library, you could find

Introduction to Federal Income Taxation in Canada 38th

Catalogue Search Results University of Toronto Libraries

Introduction to federal income taxation in Canada / by Robert E. Beam, Stanley N. Laiken. KF 6499 ZA2 B38 2018-19 Selected cases : cases cited in Introduction to federal income taxation in Canada, 1987-88 edition / compiled by Robert E. Beam, Stanley N. Laiken.

Get instant access to our step-by-step Introduction To Federal Income Taxation In Canada Selected Cases solutions manual. Our solution manuals are written by …

Introduction to Federal Income Taxation in Canada, is Income Tax Act compliant with examples, problems, multiple choice questions, and exercises to reinforce comprehension.

Download Introduction To Federal Income Taxation In Canada book pdf free download link or read online here in PDF. Read online Introduction To Federal Income Taxation In Canada book pdf free download link book now. All books are in clear copy here, and all files are secure so don’t worry about it. This site is like a library, you could

21/05/2009 · Where can I find the solutions manual for Introduction to Federal Income Taxation in Canada 29th Ed.? Trying to study for an exam and could really use the solutions to the problem questions which are only available in an Instructors Manual.

Student supplement to accompany Introduction to federal income taxation in Canada. Includes supplemental issue: Beam, Robert E. Introduction to federal income taxation in Canada. Selected cases 0843-2104: Includes supplemental issue: Beam, Robert E. Solutions manual for Introduction to federal income taxation in Canada. 0821-5332

federal income taxation in canada solution manual download PDF. To get started finding introduction to federal income taxation in canada solution manual download, you are right to find our website which has a comprehensive collection of manuals listed. Our library is the biggest of these that have literally hundreds of thousands of different

CHAPTER ONE SOLUTIONS. Solution to Assignment Problem One – 1. The principal other sources of information can be described as follows: 1. Draft Legislation This legislation often provides the only information available with respect to announced budget changes that require application in the current taxation year. Explanatory notes are included with released draft legislation but are always set

This particular INTRODUCTION TO FEDERAL INCOME TAXATION IN CANADA SOLUTION MANUAL DOWNLOAD E-book is registered within our data source as –, …

included with the Solutions Manual to enhance lecture materials. These slides have been classroom tested, and may be posted to a course website or made available to the students by other means. Introduction to Federal Income Taxation in Canada, 35th Edition Summary of Changes Summer 2014

Selling adms 4561 test bank and solution manual for textbook (Introduction to Federal Income Taxation in Canada 38th Edition 2017-2018 Robert E. Beam, Stanley N. Laiken, James J. Barnett, Nathalie Johnstone, Devan Mescall, Julie E. Robson)

Introduction to Federal Income Taxation in Canada 40th

Introduction to federal income taxation in Canada Print

Find Introduction To Federal Income Taxation In Canada in Canada Visit Kijiji Classifieds to buy, sell, or trade almost anything! New and used items, cars, real estate, jobs, services, vacation rentals and more virtually anywhere in Toronto (GTA).

Find all the study resources for Introduction to Federal Income Taxation in Canada by Robert E. Beam; Stanley N. Laiken; James J. Barnett Sign in Register Introduction to Federal Income Taxation in Canada

Student supplement to accompany Introduction to federal income taxation in Canada. Includes supplemental issue: Beam, Robert E. Introduction to federal income taxation in Canada. Selected cases 0843-2104: Includes supplemental issue: Beam, Robert E. Solutions manual for Introduction to federal income taxation in Canada. 0821-5332

Introduction To Federal Income Taxation In Canada 39th Edition.pdf – search pdf books free download Free eBook and manual for Business, Education,Finance, Inspirational, Novel, Religion, Social, Sports, Science, Technology, Holiday, Medical,Daily new PDF ebooks documents ready for download, All PDF documents are Free,The biggest database for Free books and documents search with fast results

Solutions Manual for Introduction to Federal Income Taxation in Canada . Robert E. Beam, Stanley N. Laiken. CCH Canadian, 1982 – Income tax. 1 Review. What people are saying – Write a review. User Review – Flag as inappropriate. thank u. Bibliographic information. Title: Solutions Manual for Introduction to Federal Income Taxation in Canada: Authors: Robert E. Beam, Stanley N. Laiken

federal income taxation in canada solution manual download PDF. To get started finding introduction to federal income taxation in canada solution manual download, you are right to find our website which has a comprehensive collection of manuals listed. Our library is the biggest of these that have literally hundreds of thousands of different

Selling adms 4561 test bank and solution manual for textbook (Introduction to Federal Income Taxation in Canada 38th Edition 2017-2018 Robert E. Beam, Stanley N. Laiken, James J. Barnett, Nathalie Johnstone, Devan Mescall, Julie E. Robson)

Details and specs: Editor-in-Chief: Ryan Keey. If you need a comprehensive, plain language treatment of the Income Tax Act… the Canada Tax Manual is your answer. It is logically organized by topic in order to facilitate fast and efficient research for the busy tax professional.

Solutions manual for Introduction to federal income

Introduction to Federal Income Taxation in Canada, is Income Tax Act compliant with examples, problems, multiple choice questions, and exercises to reinforce comprehension.

Introduction To Federal Income Taxation Canada Kijiji in

ACC642 Winter 2020 Seneca Subject Outline – Accounting

5413 201 Introduction to Federal Income Taxation in Canada

Selling adms 4561 test bank and solution manual for textbook (Introduction to Federal Income Taxation in Canada 38th Edition 2017-2018 Robert E. Beam, Stanley N. Laiken, James J. Barnett, Nathalie Johnstone, Devan Mescall, Julie E. Robson)

Education Wolters Kluwer

Introduction to Federal Income Taxation in Canada 2017

Download Introduction To Federal Income Taxation In Canada book pdf free download link or read online here in PDF. Read online Introduction To Federal Income Taxation In Canada book pdf free download link book now. All books are in clear copy here, and all files are secure so don’t worry about it. This site is like a library, you could

Introduction to Federal Income Taxation in Canada Robert E

Introduction To Federal Income Taxation In Canada.pdf

of Introduction to Federal Income Taxation in Canada. This summary is designed to assist you in preparing the annual update to your course outline. Legislation Update The 32nd edition of the book has been updated to include draft legislation up to and including that announced in the June 6, 2011 federal Budget. Study Guide

251 Introduction to Federal Income Taxation in Canada

solutions manual for rd canadian tax principles edition clarence rd athabasca university ida chen clarence rd inc. toronto copyright 2016 pearson canada inc.

Solutions Manual Canadian Tax Principles 2016 2017 Edition

Introduction to Federal Income Taxation in Canada 35th