Service tax online registration form st2

Prerequisites for E-filing are very basic. Assessee is required to possess : 15 digit Service Tax Payer Code i.e. Popularly known as Service Tax Registration No. based on PAN allotted by Income Tax Department. In case, if assessee is not having PAN Based 15 digit Registration No., he can use temporary 15 digit no. given by the department.

1. what is service tax new code system. In new system all service tax code/excise (STC) are of 15 characters and based on Pan. first ten character are same as PAN ,11-12 digit is “ST” in all service tax code(In few cases “SD” is also used) ,13-15 is sr no for service tax number alloted against a pan number ,if you have applied for one service tax number against a pan than your service tax

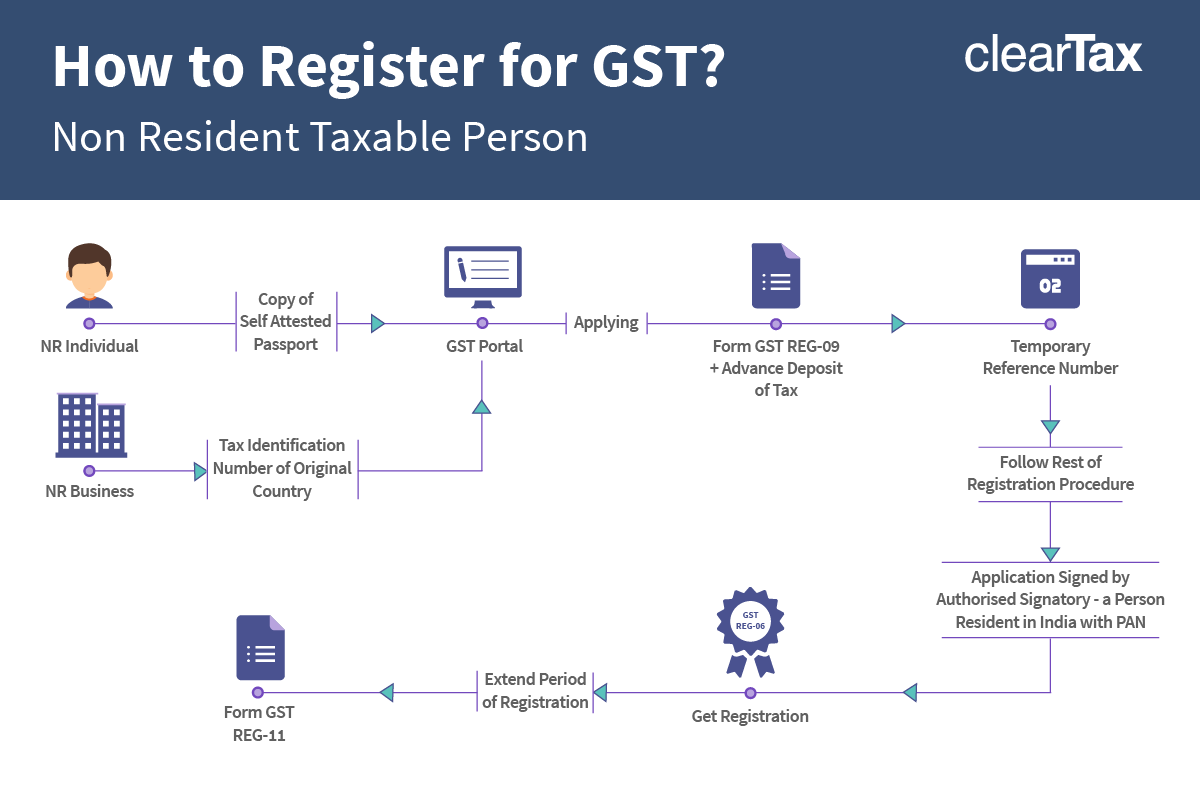

Different Service Tax Forms For Whom Service Tax Registration Compulsory? Procedure to apply for Service Tax Registration: What are ST1 and ST2 Forms? You are here. Registration if more than one service provided Concept of Centralized Registration

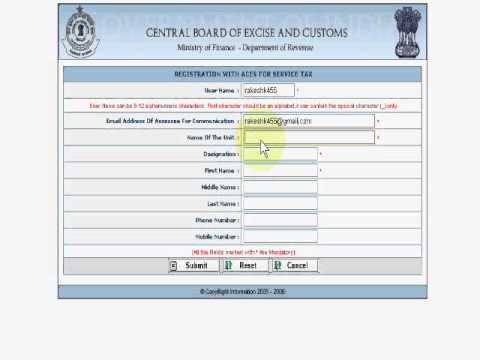

19/12/2013 · Here , we learn how one can do service tax registration online One needs to go to the aces website and then apply We first need to create a account in this s…

form st-2 [Certificate of registration under Section 69 of The Finance Act, 1994 (32 of 1994)] Shri/Ms. ……………………………………………….

FORM ST- 1 [Application form for registration under Section 69 of the Finance Act, 1994 (32 of 1994)] (Please tick appropriate box below) New Registration Amendments to information declared by the existing Registrant. Registration Number in case of existing Registrant seeking Amendment 1. (a) Name of applicant (b) Address of the applicant 2

25/12/2019 · 2. In the Service Tax Rules, 1994, for the Forms ST-1, ST-2 and ST-3, the following Forms shall be substituted, namely:-“Form ST – 1 [Application form for registration under Section 69 of the Finance Act, 1994 (32 of 1994)] (Please tick appropriate box below) New Registration . Amendments to information declared by the existing Registrant.

Service tax registration is a semi online process and should be filed with due care to avoid any repercussions later on. The process of filing service tax registration is being categorized into three steps: #File Online ST 1: The First step in service tax registration application (ST 1) is to create log in under aces portal. After logging into

Service Tax Application is mandatory for anyone involved in the service industry. Service tax applies only to services sold within India Service tax is an indirect tax levied on a wide array of services specified by the Central Government under the Finance Act, 1994 Service tax applies only to services sold within Service Tax registration is

07/07/2011 · Dear Sir can any body give me the full procedure about how to file ST 1 Form for new Service Tax Registration 2 is there any fees 3 how to get Service Tax RC Thanks

ST-1 Sales and Use Tax and E911 Surcharge Return For Reporting Periods January 2019 and After

Form ST-1 is the application form through which service tax registration is applied in India. The form can be filed online through aces.gov.in. The following points should be taken care off while filing the form ST-1: You should keep your personal documents with yourself while filling the form ST-1 to avoid any mismatch of information.

The assessee would then be required to click on the service tax no. which he intends to surrender. The form for surrendering service tax registration i.e. ST-2 would open and the assessee would be required to furnish details in the last 3 columns stating the reason for request for cancellation of service tax registration.

If you currently send paper tax returns. You can register to file your returns online instead of sending paper forms. Agents. If you’re a tax agent or adviser, you can use HMRC online services

This registration is not a statutory registration as envisaged in Central Excise or Service Tax Act but only a registration with the system. To register with the Central Excise or Service Tax department you are required to submit statutory registration form such as A1, A2, A3, ST1 etc online.

YouTube Embed: No video/playlist ID has been supplied

ST-1 Sales and Use Tax and E911 Surcharge Return For

ST-2 Certificate of registration under Section 69 of The

Service Tax form ST-1 in Excel format Application form for registration under Section 69 of the Finance Act, 1994 (32 of 1994) About forms compiled in PDF (Fillable as Excel / Word) format

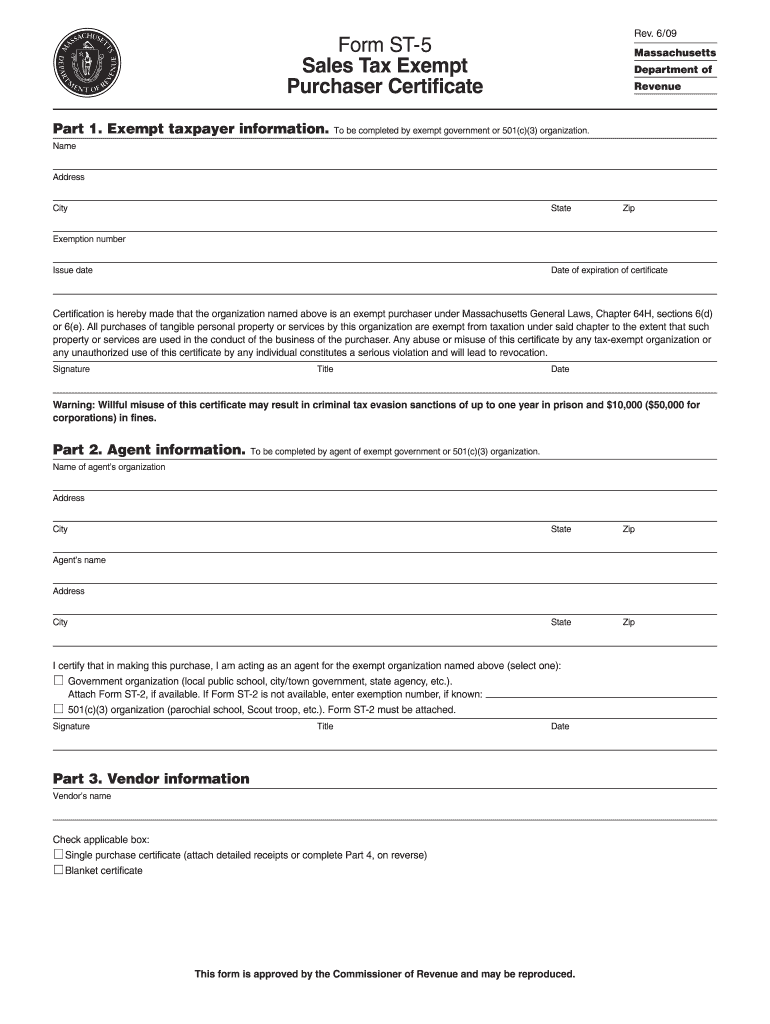

11/12/2019 · Boston College is exempt from Massachusetts State Sales Tax as a non-profit organization. W9 Form: W-9 To access a completed signed W-9 Form for any Grantor, Contractor, Donor or other Payor requesting a W-9 Form to make payments to Boston College.. Tax Exempt Forms. Boston College is exempt from Massachusetts State Sales Tax as a non-profit organization.

26/12/2013 · CCI Online Learning. CAclubindia Online Learning offers a wide variety of online classes and video lectures for various professional courses such as CA, CS, CMA, CISA as well as various certification courses on GST, Transfer Pricing, International Taxation, Excel, Tally, FM, …

SERVICE TAX (1) Details of branches for which S.T. registration has been taken (Please give the details in the table below) Address of Branches STC No. (Please also attach copy of ST-2) Address of jurisdictional C.Ex./Service Tax Authorities (Commissionerate, Divn, Range) Date of Registration Date and Period for which last ST-3 return filed

Posted on July. 27, 2018By: Team STO. Recent Controversial GST notification generates Tremors in the Textile industry!! Last year when textile was brought under the GST net, the textile traders protested PAN India to bring down the tax rates.

G.A.R. Proforma for Service Tax payments (For payments from April, 2007 onwards) ST – 1: Application form for registration under Section 69 of the Finance Act, 1994 ST – 2: Certificate of registration under Section 69 of The Finance Act, 1994 (32 of 1994) ST – 3

Unlike other registration, Service tax registration is more simple and convenient as compared with other registrations. Service tax registration applies to service providers only. Service tax, though looks simple, but it is very complex and a single misinterpretation of law can lead to heavy fines and penalties. Let us discuss the registration process in this part of article. Nature of Registration . Service tax registration …

Introduction. The Central Board of Indirect Taxes and Customs Department (CBIC), Principal Chief Controller of Accounts, CBIC, Controller General of Accounts and the Reserve Bank of India with the participation of 24 Commercial Banks introduced the Electronic Accounting System in Excise and Service Tax (EASIEST) in April 2007 with the GAR-7challan.

18/01/2020 · This registration certificate is not transferable. List of Accounting Codes is enclosed. These may invariably be furnished in the challan at the time of making payment of service tax.

If either of the above 2 options is not exercised within 2 days by the Superintendent, the Service Tax Registration shall be deemed to be granted.The Service Tax Registration i.e. ST-2 Form would be issued in the manner as opted for by the applicant (By Post/Online).

Service Tax form ST-2 in Excel format Certificate of registration under Section 69 of The Finance Act, 1994 (32 of 1994) About forms compiled in PDF (Fillable as Excel / Word) format

2. Taking note of the fact that large number of assesses are inactive and number of applications are pending for surrender/cancellation of service tax Registration, following guidelines are issued detailing the procedure to be followed in this regard. 3. An application for surrender/cancellation of the service tax registration is to be made for

Application for claiming refund of service tax paid on specified services used for authorised operations in SEZ under notification No.12/2013- Service Tax dated 1st July, 2013 : 18 FORM A-1 : Declaration by the SEZ Unit or Developer for availing ab initio exemption under notification No.12/2013- Service Tax dated 1st July, 2013 : 19 Form A-1

CERTIFICATE OF REGISTRATION UNDER SECTION 69 OF THE FINANCE ACT, 1994 (32 OF 1994) 1. Shri/Ms. (Name with complete address of premises) having undertaken to comply with the conditions prescribed in the Service Tax Rules, 1994 and any orders issued thereunder is hereby certified to have been registered with the Central Excise Department for collecting Service Tax on .

This also provides a huge benefit to you. With your Sales Tax Certificate of Registration, you are able to purchase these services tax free. This allows you to save on costs and resell these services. Some examples of services are white labeling services, online services, or in-person services.

Change or Update Details in Service Tax

User Name : Password : Know your location: © Copyright Information 2007

Form No. / Link Description Form GAR 7 : Proforma for Service Tax Payment in Excel Form ST 1 : Application form for registration under Section 69 of the Finance Act, 1994 (32 of 1994) in Excel

Know More: Procedure, Process & FAQs on Service Tax Registration. 3. Non-payment of Service Tax: This is the main reason you should verify a service tax number, as service providers may give you an incorrect service tax number and simply pocket the money. Even Kingfisher Airlines stands accused on non-payment of Rs. 76 crore worth of service

Service Tax: Refund of service tax paid on input service used for providing export of output service: Registration: It is clear that only a person who is liable for paying the service tax is required to apply for registration. Since the appellants in this case have exported their entire output service, they were not required to pay the service – 2017 ohio building code pdf To know your service tax number, you must be registered with service tax department.Service Tax registration is done online and the procedure is simple. You must have registered for service tax within 30 days from the day your service sale exceeds Rs. 9 lakh in a financial year.

My salary is 7 lacks and income from my proprietary firm is around 3-4 lacks. In future my firm income may increase. Please advise me regarding service tax. I did the online procedure for service tax registration, but there was one option, one file I have to upload i.e. excel file, what is that? I submitted the form without uploading that file

You can submit online request for surrendering your Registration Certificate in ACES though: REG-> Surrender RC (In case of CE) REG->Surrender (In case of ST) Once the surrender request is submitted by the Assessee, approval process passes through the Superintendent and then AC/DC.

3. Computation of Service Tax (To be filled by a person liable to pay service tax /Not to be filled by input service distributor) (To be repeated for every category of taxable service on which service tax …

Special offer on GST Package for CAs As per the MOU with ICAI. Subscription Options . ST-2 Certificate of registration under Section 69 of The Finance Act, 1994 – Service Tax

Assessees can file their Central Excise and Service Tax Returns using following offline Excel Utilities/XML Schema by downloading the same from this page. It is advised that the latest Excel Utility may be used every time, for filing Returns, by downloading it from the link given below

22/10/2010 · I have registered for service tax in ACES. I submitted the hard copy of declaration to the concerned service tax office. Now when I log in I can see my service tax registration number in returns section. But still I have not got the registration certificate by e mail nor by post. I have heard we can download it after loggin in. But no such

This facility enables the Assessee view its details (name, address, location code) as present in the Assessee Master provided by CBIC. Details of Assessee codes allotted for Service Tax and Central Excise (i.e. Registration Number or Non-Assessee Code) can be viewed using this facility.

“ACES PORTAL (www.aces.gov.in) FUNCTIONALITIES ARE MIGRATED TO INTEGRATED CBIC-GST PORTAL.PLEASE VISIT www.cbic-gst.gov.in FOR CENTRAL EXCISE & SERVICE TAX ONLINE TRANSACTIONS” FOR ADVISORIES ISSUED ON MIGRATION FROM www.aces.gov.in TO www.cbic-gst.gov.in AND ICEGATE E-PAYMENT PROCEDURE CLICK “WHAT’S NEW” ON THE HOME PAGE OF …

Form ST-2 Vakilno1.com – India Law Online Legal Advice

3(Service tax )How to apply for service tax registration

ST 1 online Filing for Service Tax Registration

Procedure for Surrender of Service Tax Registration

How to get Service Tax Registration Number Online?

Service Tax Online

Indian Service Tax Forms- ST2 Exim guru

https://en.wikipedia.org/wiki/Service_tax

Service Tax Registration Apply Service Tax Online

– Tax Exempt Certificate (ST-2) Boston College

Service Tax Registration Online India ST-2 Application

VERIFY YOUR SERVICE TAX NUMBER EXCISE CODE CHECK

YouTube Embed: No video/playlist ID has been supplied

E-filing Service Tax Online

Know More: Procedure, Process & FAQs on Service Tax Registration. 3. Non-payment of Service Tax: This is the main reason you should verify a service tax number, as service providers may give you an incorrect service tax number and simply pocket the money. Even Kingfisher Airlines stands accused on non-payment of Rs. 76 crore worth of service

ST-2 Certificate of registration under Section 69 of The

Import Export Data Export Import shipment data from Customs

Service Tax: Refund of service tax paid on input service used for providing export of output service: Registration: It is clear that only a person who is liable for paying the service tax is required to apply for registration. Since the appellants in this case have exported their entire output service, they were not required to pay the service

EASIEST

Form ST-1 is the application form through which service tax registration is applied in India. The form can be filed online through aces.gov.in. The following points should be taken care off while filing the form ST-1: You should keep your personal documents with yourself while filling the form ST-1 to avoid any mismatch of information.

How to Verify a Service Tax Number Vakilsearch

Procedure for Surrender and Cancellation of Service Tax

You can submit online request for surrendering your Registration Certificate in ACES though: REG-> Surrender RC (In case of CE) REG->Surrender (In case of ST) Once the surrender request is submitted by the Assessee, approval process passes through the Superintendent and then AC/DC.

Service Tax form ST-2 in Excel format Finotax

If either of the above 2 options is not exercised within 2 days by the Superintendent, the Service Tax Registration shall be deemed to be granted.The Service Tax Registration i.e. ST-2 Form would be issued in the manner as opted for by the applicant (By Post/Online).

Service Tax Registration Online India ST-2 Application

Application for claiming refund of service tax paid on specified services used for authorised operations in SEZ under notification No.12/2013- Service Tax dated 1st July, 2013 : 18 FORM A-1 : Declaration by the SEZ Unit or Developer for availing ab initio exemption under notification No.12/2013- Service Tax dated 1st July, 2013 : 19 Form A-1

FORM ST- 1 servicetax.gov.in

ST-2 Certificate of registration under Section 69 of The