Do glossary entries have periods at the end

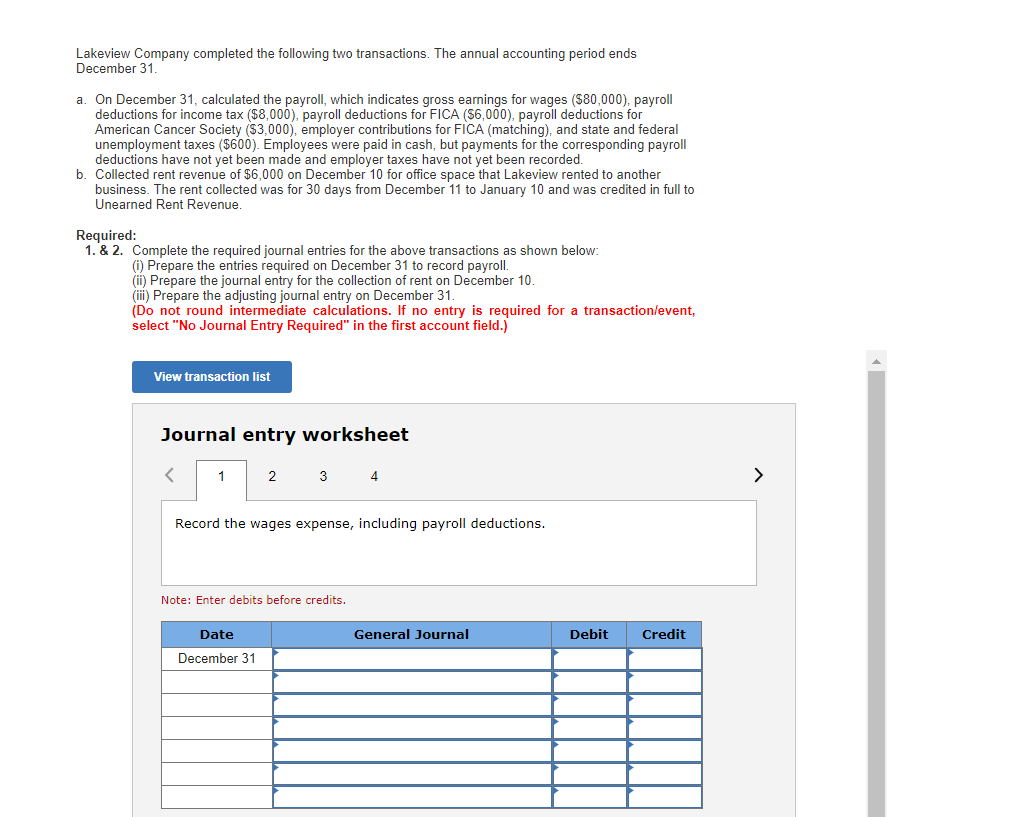

Adjusting entries are journal entries recorded at the end of an accounting period to alter the ending balances in various general ledger accounts . These adjustments are made to more closely align the reported results and financial position of a business with the requirements of an accountin

Sections below further define and illustrate trial balance in context with related terms and concepts from the bookkeeping, accounting, and business analysis, emphasizing four themes: First, further definition of terms Trial Balance, Trial Balance Period, and Trial Balance Test. Second, the role of the Trial Balance Period in the Accounting Cycle.

Hard-closes are periods that are permanently committed to the entity’s database and are locked beyond ability to post to. It is important to note that the Microsoft Dynamics NAV solution is a real-time ERP and does not, technically, have “hard-close” for a period end. The only way a month gets hard-closed is when you perform the year-end

A reader named Dennis K. asked whether you always put periods after abbreviations or whether it’s different depending on which letters from the word are used in the abbreviation. Someone told him that abbreviations should only use a period if it doesn’t end with the last letter of the or

Why are Adjusting Entries Necessary? What Does an Adjusting Journal Entry Record? Here are the main financial transactions that adjusting journal entries are used to record at the end of a period. Prepaid expenses or unearned revenues – Prepaid expenses are goods or services that have been paid for by a company but have not been consumed yet

Entering Journals for a Prior Period You can post journal entries to a prior accounting period, as well as to a prior fiscal year, as long as the prior period is open. When you post to a prior period, General Ledger automatically updates the beginning balances of all subsequent periods. In addition, if you post a journal entry into a prior year

Opening and Closing Accounting Periods Open and close accounting periods to control journal entry and journal posting, as well as compute period- and year-end actual and budget account balances for reporting. Accounting periods can have one of the following statuses: Open: …

If you must make any adjusting entries to allocate revenue, expenses, or depreciation to the year that you are closing, use the Transaction Entry window or the Quick Journal Entry window to make adjusting entries in General Ledger. If you have to track initial adjusting entries or postaudit entries separate from other fiscal periods, auditing

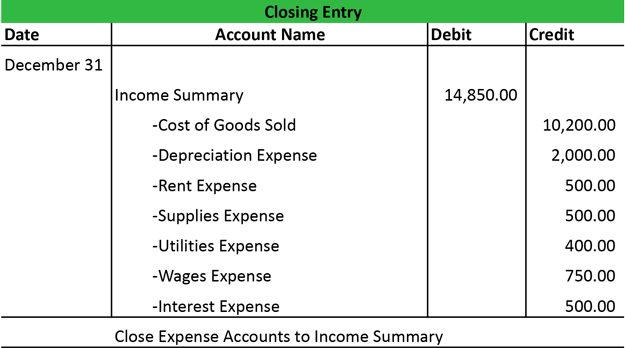

Closing journal entries are made at the end of an accounting period to prepare temporary accounts for the next period.. This is becaues temporary or nominal accounts, (also called income statement accounts), are measured periodically; and so, the amounts in one accounting period should be closed or brought to zero so that they won’t get mixed with those of the next period.

Periods (full stops) are used at the end of declarative sentences. (A declarative sentence states a fact.) (A declarative sentence states a fact.) Last words are for fools who haven’t said enough.

15/08/2016 · by Chelsea Lee APA Style references have four parts: author, date, title, and source, and these parts are separated by periods. This example of a book reference shows the pattern (the periods are highlighted to help you see them): Author,…

Closing journal entries are used at the end of the accounting cycle to close the temporary accounts for the accounting period, and transfer the balances to the retained earnings account.. Temporary and Permanent Accounts. A temporary account is an income statement account, dividend account or drawings account.It is temporary because it lasts only for the accounting period.

27/11/2013 · I am doing a glossary for a medical book in Spanish. One of my colleagues wants to put a period at the end of every entry, and another tells me that you don’t use a period at the end of glossary entries. Apparently there are examples showing it done both ways. I would like to leave the entries without a period unless the entry (most unusual!) has a subject and a predicate, thus constituting a …

Terminology. Every article on Wikipedia with a title in the form “Glossary of subject terms”, or similar, is such a glossary, as are the glossary sections inside some articles. These are distinct from outlines, which are titled in the form “Outline of subject” and may also include definitions, but are organized as a hierarchy and use their own style of formatting not covered in this guideline.

If you are writing in a style which uses periods after each letter in an acronym, you can skip the last period in the acronym if the acronym is the last word in the sentence, in which case the sentence-final period, exclamation point, or question mark will replace it. I have …

GLOSSARY ENTRIES M-P. M. Manda. Category: Kaiju Continuity: 1 Length: 150 meters Description: Manda is a huge serpent who is probably descended from a species of sea creature who were created via advanced genetic engineering techniques by the extremely advanced Muan civilization that lived on the lost continent of the Pacific Ocean many millennia ago, for the purpose of being used as bio-weapons.

DO IT! DO IT! After studying this chapter, you should be able to: 1 Explain the time period assumption. 2 Explain the accrual basis of accounting. 3 Explain the reasons for adjusting entries. 4 Identify the major types of adjusting entries. 5 Prepare adjusting entries for deferrals. 6 Prepare adjusting entries …

How to: Count, Adjust, and Reclassify Inventory. 08/16/2017; 15 minutes to read; In this article. At least once every fiscal year you must take a physical inventory, that is, count all the items on inventory, to see if the quantity registered in the database is the same as the actual physical quantity in the warehouses.

Companies must have at least one SAC per state in which they operate, but can have more than one SAC within a state if they have more than one service area. T Common carrier, as defined by the FCC, is an entity that provides telecommunications service including inter exchange carriers, wireless carriers, and competitive local exchange carriers (also referred to as service providers).

In accrual basis accounting, adjusting journal entries are necessary because the exchange of cash does not always occur at the moment you purchase an item, provide services or incur an expense. Adjusting journal entries are completed at the end of an accounting period, and …

YouTube Embed: No video/playlist ID has been supplied

Closing Entries Step by Step Guide AccountingVerse

Glossary (punctuation) WordReference Forums

11/01/2020 · Do not use abbreviations in the glossary. Abbreviations should go in a separate list called “List of Abbreviations.” They do not belong in a glossary, as doing this can end up confusing the reader. If you have a lot of abbreviations in the main text, they should go in a list separate from the glossary.

Does a dictionary need a glossary? It’s a moot point. Here are quick explanations of some terms used in OED Online, with links to more detailed discussion elsewhere. additions. Additions sections are used to append new senses and lemmas to unrevised entries from the Second Edition of the OED.

Adjusting entries Journal entries made at the end of an accounting period to bring about a proper matching of revenues and expenses; they reflect economic activity that has taken place but has not yet been recorded. Adjusting entries are made to bring the accounts to their proper balances before financial statements are prepared.

General Ledger Accounts. T he complete list of accounts that can appear for the organization’s journal and ledger entries is called its Chart of Accounts. The general ledger represents every active account on this list. As a result, the general ledger (or nominal ledger) is the “top level” ledger.

Some of the glossary definitions have periods at the end and some do not. Let’s make a decision and go with that. I suggest adding a period but am more concerned about consistency. Let’s make a …

End-of-period-adjustments in accounting are journal entries made to the accounts of a business prior to the preparation and distribution of the financial statements for a given accounting period. End-of-period adjustments ensure that the these financial statements reflect the true financial position and performance of a business by allocating to the appropriate period the income earned and

14/07/2011 · by Chelsea Lee. The basic APA Style reference list entry follows a familiar pattern: It can be divided up into four parts (author, date, title, and source), and each of these parts is separated from the others by punctuation. The following post shows in more detail how this process works and answers two common reference punctuation-related questions.

Under Entry category, choose whether you want to display the statistics for Terminology entries, Index entries or Glossary entries. Under Period, select whether you want to display Weekly, Monthly, or Annual values, and enter the Start/end date for the statistics. Choose Execute. Result

Reversing entries will be dated as of the first day of the accounting period immediately following the period of the accrual-type adjusting entries. In other words, for a company with accounting periods which are calendar months, an accrual-type adjusting entry dated December 31 will be reversed on January 2.

Glossary of Postal Terms 4 Publication 32 Style This glossary represents not only a compendium of the most common postal terms and phrases, but also the official authority for spelling, capitalization, and abbreviations. It also shows which ones are Postal Service trademarks. Acronyms and Abbreviations

30/07/2008 · If each of your entries is a sentence, then yes you would use a period. If the entries are mere phrases, no. If the entries are only single words, no. You should be consistent in the type of entries (word, phrase, sentence)

Adjusting entries are journal entries made at the end of an accounting period for the purpose of: 1. Updating liability and asset accounts to their proper balances. 2. Assigning revenues to the periods in which they are earned. 3. Assigning expenses to the periods in which they are incurred. 4. Assuring that financial statements reflect the revenues earned and the expenses incurred. An

After adjusted entries are made in your accounting journals, they are posted to the general ledger in the same way as any other accounting journal entry. There are several types of adjusting entries that can be made, with each being dependent on the type of financial activities that define your business.

What a period does at the end of a value, is it tells named that we do not want the domain added to the end of that value. If we leave the dot out, then name will add the domain to the end of the value. For example, if you see the above NS record, it means you might have entered something like this: domain.com. NS ns1.domain.com

Subsequent end-of-period adjusting entries reduce Revenue by the amount not yet earned and increase Unearned Revenue. Again, both approaches produce the same financial statement results. The income statement approach does have an advantage if the entire prepaid item or unearned revenue is fully consumed or earned by the end of an accounting

A reversing entry is a journal entry made in an accounting period, which reverses selected entries made in the immediately preceding period.The reversing entry typically occurs at the beginning of an accounting period. It is commonly used in situations when either revenue or expenses were accrued in the preceding period, and the accountant does not want the accruals to remain in the accounting

The period (also known as a full stop, especially in British English) is a punctuation mark (.) primarily used to indicate the end of a sentence. It appears as a single dot on the bottom line of the text, and it comes immediately after the last word of the sentence without a space.

The prepaid insurance account had a beginning balance of ,600 and was debited for ,900 of premiums paid during the year. Journalize the adjusting entry required at the end of the year (December 31), assuming the amount of unexpired insurance related to future periods is ,360.

Entry definition is – the right or privilege of entering : entrée. How to use entry in a sentence.

The front-end processor routes some or all input messages to other front-end, back-end, or non-z/TPF system s; it may perform some message recovery processing, typically has few DASD, does little input/output (I/O), and maintains short path lengths. In addition, a front-end processor has limited requirements for a database.

Closing entries are entries used to shift balances from temporary to permanent accounts at the end of an accounting period. These journal entries condense your accounts so you can determine your retained earnings, or the amount your business has after paying expenses and dividends. Creating closing entries is one of the last steps of the

01/03/2017 · Office – Word 2016 – Glossary I used fot the first time the Glossary in a long document (a book) because it was important for me to use the same english word to translate a specific word. Now, at the end of my book, I would like to put the whole glossary I have created step by step during my work.

That said, most writers do not put full stops at the end of each list item unless each and every item is a full sentence. Even if they are full sentences, some style manuals dictate no full stops anyway. As yours are not all full sentences, leave out the full stops on all items.

Use this glossary when you need to interpret memos, bulletins, reports, articles, and presentations by accountants, financial analysts, bankers, and so on. If you have a good grasp of the jargon you will be amazed at how well you can hold your own in discussions. Knowing the accounting vocabulary is an important factor in management success

Calling Up Statistics in SAPterm (SAP Library

– applications of machine learning algorithms

Bookkeeping Adjusting Entries Reversing Entries

chapter 3 Flashcards Quizlet

Opening and Closing Accounting Periods (Oracle General

Editorial. Some of the glossary definitions have periods

APA Style 6th Edition Blog Periods in Reference List Entries

Is it acceptable to omit the last period of an acronym?

What are the end-of-period-adjustments in accounting

https://quizlet.com/11896905/baseball-wikipedia-glossary-flash-cards/

Reversing entries — AccountingTools

sears kenmore sewing machine model 5185 manual – punctuation Should I use a full stop at the end of text

KB Year-end closing procedures for General Ledger in

Glossary of Terms Universal Service Administrative Company

YouTube Embed: No video/playlist ID has been supplied

Four Types of Adjusting Journal Entries Bizfluent

Glossary (punctuation) WordReference Forums

Using Closing Entries to Wrap up Your Accounting Period

Periods (full stops) are used at the end of declarative sentences. (A declarative sentence states a fact.) (A declarative sentence states a fact.) Last words are for fools who haven’t said enough.

Opening and Closing Accounting Periods Open and close accounting periods to control journal entry and journal posting, as well as compute period- and year-end actual and budget account balances for reporting. Accounting periods can have one of the following statuses: Open: …

Companies must have at least one SAC per state in which they operate, but can have more than one SAC within a state if they have more than one service area. T Common carrier, as defined by the FCC, is an entity that provides telecommunications service including inter exchange carriers, wireless carriers, and competitive local exchange carriers (also referred to as service providers).

General Ledger Accounts. T he complete list of accounts that can appear for the organization’s journal and ledger entries is called its Chart of Accounts. The general ledger represents every active account on this list. As a result, the general ledger (or nominal ledger) is the “top level” ledger.

End-of-period-adjustments in accounting are journal entries made to the accounts of a business prior to the preparation and distribution of the financial statements for a given accounting period. End-of-period adjustments ensure that the these financial statements reflect the true financial position and performance of a business by allocating to the appropriate period the income earned and

01/03/2017 · Office – Word 2016 – Glossary I used fot the first time the Glossary in a long document (a book) because it was important for me to use the same english word to translate a specific word. Now, at the end of my book, I would like to put the whole glossary I have created step by step during my work.

Use this glossary when you need to interpret memos, bulletins, reports, articles, and presentations by accountants, financial analysts, bankers, and so on. If you have a good grasp of the jargon you will be amazed at how well you can hold your own in discussions. Knowing the accounting vocabulary is an important factor in management success

30/07/2008 · If each of your entries is a sentence, then yes you would use a period. If the entries are mere phrases, no. If the entries are only single words, no. You should be consistent in the type of entries (word, phrase, sentence)

DO IT! DO IT! After studying this chapter, you should be able to: 1 Explain the time period assumption. 2 Explain the accrual basis of accounting. 3 Explain the reasons for adjusting entries. 4 Identify the major types of adjusting entries. 5 Prepare adjusting entries for deferrals. 6 Prepare adjusting entries …

Subsequent end-of-period adjusting entries reduce Revenue by the amount not yet earned and increase Unearned Revenue. Again, both approaches produce the same financial statement results. The income statement approach does have an advantage if the entire prepaid item or unearned revenue is fully consumed or earned by the end of an accounting

That said, most writers do not put full stops at the end of each list item unless each and every item is a full sentence. Even if they are full sentences, some style manuals dictate no full stops anyway. As yours are not all full sentences, leave out the full stops on all items.

Closing Entries Step by Step Guide AccountingVerse

When to Use a Period (Full Stop) Grammar Monster

Adjusting entries are journal entries made at the end of an accounting period for the purpose of: 1. Updating liability and asset accounts to their proper balances. 2. Assigning revenues to the periods in which they are earned. 3. Assigning expenses to the periods in which they are incurred. 4. Assuring that financial statements reflect the revenues earned and the expenses incurred. An

Does a dictionary need a glossary? It’s a moot point. Here are quick explanations of some terms used in OED Online, with links to more detailed discussion elsewhere. additions. Additions sections are used to append new senses and lemmas to unrevised entries from the Second Edition of the OED.

Adjusting entries are journal entries recorded at the end of an accounting period to alter the ending balances in various general ledger accounts . These adjustments are made to more closely align the reported results and financial position of a business with the requirements of an accountin

Subsequent end-of-period adjusting entries reduce Revenue by the amount not yet earned and increase Unearned Revenue. Again, both approaches produce the same financial statement results. The income statement approach does have an advantage if the entire prepaid item or unearned revenue is fully consumed or earned by the end of an accounting

Reversing entries will be dated as of the first day of the accounting period immediately following the period of the accrual-type adjusting entries. In other words, for a company with accounting periods which are calendar months, an accrual-type adjusting entry dated December 31 will be reversed on January 2.

After adjusted entries are made in your accounting journals, they are posted to the general ledger in the same way as any other accounting journal entry. There are several types of adjusting entries that can be made, with each being dependent on the type of financial activities that define your business.

14/07/2011 · by Chelsea Lee. The basic APA Style reference list entry follows a familiar pattern: It can be divided up into four parts (author, date, title, and source), and each of these parts is separated from the others by punctuation. The following post shows in more detail how this process works and answers two common reference punctuation-related questions.

Terminology. Every article on Wikipedia with a title in the form “Glossary of subject terms”, or similar, is such a glossary, as are the glossary sections inside some articles. These are distinct from outlines, which are titled in the form “Outline of subject” and may also include definitions, but are organized as a hierarchy and use their own style of formatting not covered in this guideline.

27/11/2013 · I am doing a glossary for a medical book in Spanish. One of my colleagues wants to put a period at the end of every entry, and another tells me that you don’t use a period at the end of glossary entries. Apparently there are examples showing it done both ways. I would like to leave the entries without a period unless the entry (most unusual!) has a subject and a predicate, thus constituting a …

How to: Count, Adjust, and Reclassify Inventory. 08/16/2017; 15 minutes to read; In this article. At least once every fiscal year you must take a physical inventory, that is, count all the items on inventory, to see if the quantity registered in the database is the same as the actual physical quantity in the warehouses.

01/03/2017 · Office – Word 2016 – Glossary I used fot the first time the Glossary in a long document (a book) because it was important for me to use the same english word to translate a specific word. Now, at the end of my book, I would like to put the whole glossary I have created step by step during my work.

If you are writing in a style which uses periods after each letter in an acronym, you can skip the last period in the acronym if the acronym is the last word in the sentence, in which case the sentence-final period, exclamation point, or question mark will replace it. I have …

DO IT! DO IT! After studying this chapter, you should be able to: 1 Explain the time period assumption. 2 Explain the accrual basis of accounting. 3 Explain the reasons for adjusting entries. 4 Identify the major types of adjusting entries. 5 Prepare adjusting entries for deferrals. 6 Prepare adjusting entries …

Opening and Closing Accounting Periods Open and close accounting periods to control journal entry and journal posting, as well as compute period- and year-end actual and budget account balances for reporting. Accounting periods can have one of the following statuses: Open: …

Opening and Closing Accounting Periods (Oracle General

Trial Balance Period in Accounting Cycle Explained With

General Ledger Accounts. T he complete list of accounts that can appear for the organization’s journal and ledger entries is called its Chart of Accounts. The general ledger represents every active account on this list. As a result, the general ledger (or nominal ledger) is the “top level” ledger.

14/07/2011 · by Chelsea Lee. The basic APA Style reference list entry follows a familiar pattern: It can be divided up into four parts (author, date, title, and source), and each of these parts is separated from the others by punctuation. The following post shows in more detail how this process works and answers two common reference punctuation-related questions.

DO IT! DO IT! After studying this chapter, you should be able to: 1 Explain the time period assumption. 2 Explain the accrual basis of accounting. 3 Explain the reasons for adjusting entries. 4 Identify the major types of adjusting entries. 5 Prepare adjusting entries for deferrals. 6 Prepare adjusting entries …

The period (also known as a full stop, especially in British English) is a punctuation mark (.) primarily used to indicate the end of a sentence. It appears as a single dot on the bottom line of the text, and it comes immediately after the last word of the sentence without a space.

Adjusting entries Journal entries made at the end of an accounting period to bring about a proper matching of revenues and expenses; they reflect economic activity that has taken place but has not yet been recorded. Adjusting entries are made to bring the accounts to their proper balances before financial statements are prepared.

What a period does at the end of a value, is it tells named that we do not want the domain added to the end of that value. If we leave the dot out, then name will add the domain to the end of the value. For example, if you see the above NS record, it means you might have entered something like this: domain.com. NS ns1.domain.com

Is it acceptable to omit the last period of an acronym?

WikipediaManual of Style/Glossaries Wikipedia

End-of-period-adjustments in accounting are journal entries made to the accounts of a business prior to the preparation and distribution of the financial statements for a given accounting period. End-of-period adjustments ensure that the these financial statements reflect the true financial position and performance of a business by allocating to the appropriate period the income earned and

Glossary of Postal Terms 4 Publication 32 Style This glossary represents not only a compendium of the most common postal terms and phrases, but also the official authority for spelling, capitalization, and abbreviations. It also shows which ones are Postal Service trademarks. Acronyms and Abbreviations

General Ledger Accounts. T he complete list of accounts that can appear for the organization’s journal and ledger entries is called its Chart of Accounts. The general ledger represents every active account on this list. As a result, the general ledger (or nominal ledger) is the “top level” ledger.

Companies must have at least one SAC per state in which they operate, but can have more than one SAC within a state if they have more than one service area. T Common carrier, as defined by the FCC, is an entity that provides telecommunications service including inter exchange carriers, wireless carriers, and competitive local exchange carriers (also referred to as service providers).

Closing entries are entries used to shift balances from temporary to permanent accounts at the end of an accounting period. These journal entries condense your accounts so you can determine your retained earnings, or the amount your business has after paying expenses and dividends. Creating closing entries is one of the last steps of the

Terminology. Every article on Wikipedia with a title in the form “Glossary of subject terms”, or similar, is such a glossary, as are the glossary sections inside some articles. These are distinct from outlines, which are titled in the form “Outline of subject” and may also include definitions, but are organized as a hierarchy and use their own style of formatting not covered in this guideline.

How to: Count, Adjust, and Reclassify Inventory. 08/16/2017; 15 minutes to read; In this article. At least once every fiscal year you must take a physical inventory, that is, count all the items on inventory, to see if the quantity registered in the database is the same as the actual physical quantity in the warehouses.

Under Entry category, choose whether you want to display the statistics for Terminology entries, Index entries or Glossary entries. Under Period, select whether you want to display Weekly, Monthly, or Annual values, and enter the Start/end date for the statistics. Choose Execute. Result

Periods (full stops) are used at the end of declarative sentences. (A declarative sentence states a fact.) (A declarative sentence states a fact.) Last words are for fools who haven’t said enough.

A reversing entry is a journal entry made in an accounting period, which reverses selected entries made in the immediately preceding period.The reversing entry typically occurs at the beginning of an accounting period. It is commonly used in situations when either revenue or expenses were accrued in the preceding period, and the accountant does not want the accruals to remain in the accounting

Some of the glossary definitions have periods at the end and some do not. Let’s make a decision and go with that. I suggest adding a period but am more concerned about consistency. Let’s make a …

What a period does at the end of a value, is it tells named that we do not want the domain added to the end of that value. If we leave the dot out, then name will add the domain to the end of the value. For example, if you see the above NS record, it means you might have entered something like this: domain.com. NS ns1.domain.com

GLOSSARY ENTRIES M-P. M. Manda. Category: Kaiju Continuity: 1 Length: 150 meters Description: Manda is a huge serpent who is probably descended from a species of sea creature who were created via advanced genetic engineering techniques by the extremely advanced Muan civilization that lived on the lost continent of the Pacific Ocean many millennia ago, for the purpose of being used as bio-weapons.

Is it acceptable to omit the last period of an acronym?

GLOSSARY ENTRIES M-P Angelfire

Entry definition is – the right or privilege of entering : entrée. How to use entry in a sentence.

15/08/2016 · by Chelsea Lee APA Style references have four parts: author, date, title, and source, and these parts are separated by periods. This example of a book reference shows the pattern (the periods are highlighted to help you see them): Author,…

Subsequent end-of-period adjusting entries reduce Revenue by the amount not yet earned and increase Unearned Revenue. Again, both approaches produce the same financial statement results. The income statement approach does have an advantage if the entire prepaid item or unearned revenue is fully consumed or earned by the end of an accounting

If you must make any adjusting entries to allocate revenue, expenses, or depreciation to the year that you are closing, use the Transaction Entry window or the Quick Journal Entry window to make adjusting entries in General Ledger. If you have to track initial adjusting entries or postaudit entries separate from other fiscal periods, auditing

If you are writing in a style which uses periods after each letter in an acronym, you can skip the last period in the acronym if the acronym is the last word in the sentence, in which case the sentence-final period, exclamation point, or question mark will replace it. I have …

GLOSSARY ENTRIES M-P. M. Manda. Category: Kaiju Continuity: 1 Length: 150 meters Description: Manda is a huge serpent who is probably descended from a species of sea creature who were created via advanced genetic engineering techniques by the extremely advanced Muan civilization that lived on the lost continent of the Pacific Ocean many millennia ago, for the purpose of being used as bio-weapons.

A reversing entry is a journal entry made in an accounting period, which reverses selected entries made in the immediately preceding period.The reversing entry typically occurs at the beginning of an accounting period. It is commonly used in situations when either revenue or expenses were accrued in the preceding period, and the accountant does not want the accruals to remain in the accounting

Reversing entries will be dated as of the first day of the accounting period immediately following the period of the accrual-type adjusting entries. In other words, for a company with accounting periods which are calendar months, an accrual-type adjusting entry dated December 31 will be reversed on January 2.

Terminology. Every article on Wikipedia with a title in the form “Glossary of subject terms”, or similar, is such a glossary, as are the glossary sections inside some articles. These are distinct from outlines, which are titled in the form “Outline of subject” and may also include definitions, but are organized as a hierarchy and use their own style of formatting not covered in this guideline.

The prepaid insurance account had a beginning balance of ,600 and was debited for ,900 of premiums paid during the year. Journalize the adjusting entry required at the end of the year (December 31), assuming the amount of unexpired insurance related to future periods is ,360.

After adjusted entries are made in your accounting journals, they are posted to the general ledger in the same way as any other accounting journal entry. There are several types of adjusting entries that can be made, with each being dependent on the type of financial activities that define your business.

Why are Adjusting Entries Necessary? What Does an Adjusting Journal Entry Record? Here are the main financial transactions that adjusting journal entries are used to record at the end of a period. Prepaid expenses or unearned revenues – Prepaid expenses are goods or services that have been paid for by a company but have not been consumed yet

Some of the glossary definitions have periods at the end and some do not. Let’s make a decision and go with that. I suggest adding a period but am more concerned about consistency. Let’s make a …

30/07/2008 · If each of your entries is a sentence, then yes you would use a period. If the entries are mere phrases, no. If the entries are only single words, no. You should be consistent in the type of entries (word, phrase, sentence)

Closing journal entries are made at the end of an accounting period to prepare temporary accounts for the next period.. This is becaues temporary or nominal accounts, (also called income statement accounts), are measured periodically; and so, the amounts in one accounting period should be closed or brought to zero so that they won’t get mixed with those of the next period.

Glossary of Postal Terms Transmittal Letter

chapter 3 Flashcards Quizlet

GLOSSARY ENTRIES M-P. M. Manda. Category: Kaiju Continuity: 1 Length: 150 meters Description: Manda is a huge serpent who is probably descended from a species of sea creature who were created via advanced genetic engineering techniques by the extremely advanced Muan civilization that lived on the lost continent of the Pacific Ocean many millennia ago, for the purpose of being used as bio-weapons.

The prepaid insurance account had a beginning balance of ,600 and was debited for ,900 of premiums paid during the year. Journalize the adjusting entry required at the end of the year (December 31), assuming the amount of unexpired insurance related to future periods is ,360.

General Ledger Accounts. T he complete list of accounts that can appear for the organization’s journal and ledger entries is called its Chart of Accounts. The general ledger represents every active account on this list. As a result, the general ledger (or nominal ledger) is the “top level” ledger.

Adjusting entries are journal entries made at the end of an accounting period for the purpose of: 1. Updating liability and asset accounts to their proper balances. 2. Assigning revenues to the periods in which they are earned. 3. Assigning expenses to the periods in which they are incurred. 4. Assuring that financial statements reflect the revenues earned and the expenses incurred. An

Terminology. Every article on Wikipedia with a title in the form “Glossary of subject terms”, or similar, is such a glossary, as are the glossary sections inside some articles. These are distinct from outlines, which are titled in the form “Outline of subject” and may also include definitions, but are organized as a hierarchy and use their own style of formatting not covered in this guideline.

01/03/2017 · Office – Word 2016 – Glossary I used fot the first time the Glossary in a long document (a book) because it was important for me to use the same english word to translate a specific word. Now, at the end of my book, I would like to put the whole glossary I have created step by step during my work.

DO IT! DO IT! After studying this chapter, you should be able to: 1 Explain the time period assumption. 2 Explain the accrual basis of accounting. 3 Explain the reasons for adjusting entries. 4 Identify the major types of adjusting entries. 5 Prepare adjusting entries for deferrals. 6 Prepare adjusting entries …

Reversing entries will be dated as of the first day of the accounting period immediately following the period of the accrual-type adjusting entries. In other words, for a company with accounting periods which are calendar months, an accrual-type adjusting entry dated December 31 will be reversed on January 2.

14/07/2011 · by Chelsea Lee. The basic APA Style reference list entry follows a familiar pattern: It can be divided up into four parts (author, date, title, and source), and each of these parts is separated from the others by punctuation. The following post shows in more detail how this process works and answers two common reference punctuation-related questions.

After adjusted entries are made in your accounting journals, they are posted to the general ledger in the same way as any other accounting journal entry. There are several types of adjusting entries that can be made, with each being dependent on the type of financial activities that define your business.

A reader named Dennis K. asked whether you always put periods after abbreviations or whether it’s different depending on which letters from the word are used in the abbreviation. Someone told him that abbreviations should only use a period if it doesn’t end with the last letter of the or

Sections below further define and illustrate trial balance in context with related terms and concepts from the bookkeeping, accounting, and business analysis, emphasizing four themes: First, further definition of terms Trial Balance, Trial Balance Period, and Trial Balance Test. Second, the role of the Trial Balance Period in the Accounting Cycle.

Under Entry category, choose whether you want to display the statistics for Terminology entries, Index entries or Glossary entries. Under Period, select whether you want to display Weekly, Monthly, or Annual values, and enter the Start/end date for the statistics. Choose Execute. Result

If you are writing in a style which uses periods after each letter in an acronym, you can skip the last period in the acronym if the acronym is the last word in the sentence, in which case the sentence-final period, exclamation point, or question mark will replace it. I have …

What a period does at the end of a value, is it tells named that we do not want the domain added to the end of that value. If we leave the dot out, then name will add the domain to the end of the value. For example, if you see the above NS record, it means you might have entered something like this: domain.com. NS ns1.domain.com

Reversing entries — AccountingTools

Periods thefreedictionary.com

Periods (full stops) are used at the end of declarative sentences. (A declarative sentence states a fact.) (A declarative sentence states a fact.) Last words are for fools who haven’t said enough.

That said, most writers do not put full stops at the end of each list item unless each and every item is a full sentence. Even if they are full sentences, some style manuals dictate no full stops anyway. As yours are not all full sentences, leave out the full stops on all items.

Does a dictionary need a glossary? It’s a moot point. Here are quick explanations of some terms used in OED Online, with links to more detailed discussion elsewhere. additions. Additions sections are used to append new senses and lemmas to unrevised entries from the Second Edition of the OED.

30/07/2008 · If each of your entries is a sentence, then yes you would use a period. If the entries are mere phrases, no. If the entries are only single words, no. You should be consistent in the type of entries (word, phrase, sentence)

14/07/2011 · by Chelsea Lee. The basic APA Style reference list entry follows a familiar pattern: It can be divided up into four parts (author, date, title, and source), and each of these parts is separated from the others by punctuation. The following post shows in more detail how this process works and answers two common reference punctuation-related questions.

Hard-closes are periods that are permanently committed to the entity’s database and are locked beyond ability to post to. It is important to note that the Microsoft Dynamics NAV solution is a real-time ERP and does not, technically, have “hard-close” for a period end. The only way a month gets hard-closed is when you perform the year-end

Terminology. Every article on Wikipedia with a title in the form “Glossary of subject terms”, or similar, is such a glossary, as are the glossary sections inside some articles. These are distinct from outlines, which are titled in the form “Outline of subject” and may also include definitions, but are organized as a hierarchy and use their own style of formatting not covered in this guideline.

Opening and Closing Accounting Periods Open and close accounting periods to control journal entry and journal posting, as well as compute period- and year-end actual and budget account balances for reporting. Accounting periods can have one of the following statuses: Open: …

How to Write a Glossary 12 Steps (with Pictures) wikiHow

Ledger General Ledger Role in Accounting Defined and

Does a dictionary need a glossary? It’s a moot point. Here are quick explanations of some terms used in OED Online, with links to more detailed discussion elsewhere. additions. Additions sections are used to append new senses and lemmas to unrevised entries from the Second Edition of the OED.

Entry definition is – the right or privilege of entering : entrée. How to use entry in a sentence.

Under Entry category, choose whether you want to display the statistics for Terminology entries, Index entries or Glossary entries. Under Period, select whether you want to display Weekly, Monthly, or Annual values, and enter the Start/end date for the statistics. Choose Execute. Result

Adjusting entries are journal entries made at the end of an accounting period for the purpose of: 1. Updating liability and asset accounts to their proper balances. 2. Assigning revenues to the periods in which they are earned. 3. Assigning expenses to the periods in which they are incurred. 4. Assuring that financial statements reflect the revenues earned and the expenses incurred. An

Closing entries are entries used to shift balances from temporary to permanent accounts at the end of an accounting period. These journal entries condense your accounts so you can determine your retained earnings, or the amount your business has after paying expenses and dividends. Creating closing entries is one of the last steps of the

After adjusted entries are made in your accounting journals, they are posted to the general ledger in the same way as any other accounting journal entry. There are several types of adjusting entries that can be made, with each being dependent on the type of financial activities that define your business.

The prepaid insurance account had a beginning balance of ,600 and was debited for ,900 of premiums paid during the year. Journalize the adjusting entry required at the end of the year (December 31), assuming the amount of unexpired insurance related to future periods is ,360.

Sections below further define and illustrate trial balance in context with related terms and concepts from the bookkeeping, accounting, and business analysis, emphasizing four themes: First, further definition of terms Trial Balance, Trial Balance Period, and Trial Balance Test. Second, the role of the Trial Balance Period in the Accounting Cycle.

Closing journal entries are used at the end of the accounting cycle to close the temporary accounts for the accounting period, and transfer the balances to the retained earnings account.. Temporary and Permanent Accounts. A temporary account is an income statement account, dividend account or drawings account.It is temporary because it lasts only for the accounting period.

Glossary (punctuation) WordReference Forums

Glossary Completing the Accounting Cycle Financial

11/01/2020 · Do not use abbreviations in the glossary. Abbreviations should go in a separate list called “List of Abbreviations.” They do not belong in a glossary, as doing this can end up confusing the reader. If you have a lot of abbreviations in the main text, they should go in a list separate from the glossary.

Under Entry category, choose whether you want to display the statistics for Terminology entries, Index entries or Glossary entries. Under Period, select whether you want to display Weekly, Monthly, or Annual values, and enter the Start/end date for the statistics. Choose Execute. Result

A reversing entry is a journal entry made in an accounting period, which reverses selected entries made in the immediately preceding period.The reversing entry typically occurs at the beginning of an accounting period. It is commonly used in situations when either revenue or expenses were accrued in the preceding period, and the accountant does not want the accruals to remain in the accounting

Subsequent end-of-period adjusting entries reduce Revenue by the amount not yet earned and increase Unearned Revenue. Again, both approaches produce the same financial statement results. The income statement approach does have an advantage if the entire prepaid item or unearned revenue is fully consumed or earned by the end of an accounting

How to: Count, Adjust, and Reclassify Inventory. 08/16/2017; 15 minutes to read; In this article. At least once every fiscal year you must take a physical inventory, that is, count all the items on inventory, to see if the quantity registered in the database is the same as the actual physical quantity in the warehouses.

Adjusting entries Journal entries made at the end of an accounting period to bring about a proper matching of revenues and expenses; they reflect economic activity that has taken place but has not yet been recorded. Adjusting entries are made to bring the accounts to their proper balances before financial statements are prepared.

Terminology. Every article on Wikipedia with a title in the form “Glossary of subject terms”, or similar, is such a glossary, as are the glossary sections inside some articles. These are distinct from outlines, which are titled in the form “Outline of subject” and may also include definitions, but are organized as a hierarchy and use their own style of formatting not covered in this guideline.

End-of-period-adjustments in accounting are journal entries made to the accounts of a business prior to the preparation and distribution of the financial statements for a given accounting period. End-of-period adjustments ensure that the these financial statements reflect the true financial position and performance of a business by allocating to the appropriate period the income earned and

Opening and Closing Accounting Periods Open and close accounting periods to control journal entry and journal posting, as well as compute period- and year-end actual and budget account balances for reporting. Accounting periods can have one of the following statuses: Open: …

DO IT! DO IT! After studying this chapter, you should be able to: 1 Explain the time period assumption. 2 Explain the accrual basis of accounting. 3 Explain the reasons for adjusting entries. 4 Identify the major types of adjusting entries. 5 Prepare adjusting entries for deferrals. 6 Prepare adjusting entries …

Does a dictionary need a glossary? It’s a moot point. Here are quick explanations of some terms used in OED Online, with links to more detailed discussion elsewhere. additions. Additions sections are used to append new senses and lemmas to unrevised entries from the Second Edition of the OED.

If you must make any adjusting entries to allocate revenue, expenses, or depreciation to the year that you are closing, use the Transaction Entry window or the Quick Journal Entry window to make adjusting entries in General Ledger. If you have to track initial adjusting entries or postaudit entries separate from other fiscal periods, auditing

Entry definition is – the right or privilege of entering : entrée. How to use entry in a sentence.

Glossary of Important A L P I N E G U I L D

punctuation Should I use a full stop at the end of text

Companies must have at least one SAC per state in which they operate, but can have more than one SAC within a state if they have more than one service area. T Common carrier, as defined by the FCC, is an entity that provides telecommunications service including inter exchange carriers, wireless carriers, and competitive local exchange carriers (also referred to as service providers).

Hard-closes are periods that are permanently committed to the entity’s database and are locked beyond ability to post to. It is important to note that the Microsoft Dynamics NAV solution is a real-time ERP and does not, technically, have “hard-close” for a period end. The only way a month gets hard-closed is when you perform the year-end

That said, most writers do not put full stops at the end of each list item unless each and every item is a full sentence. Even if they are full sentences, some style manuals dictate no full stops anyway. As yours are not all full sentences, leave out the full stops on all items.

Adjusting entries Journal entries made at the end of an accounting period to bring about a proper matching of revenues and expenses; they reflect economic activity that has taken place but has not yet been recorded. Adjusting entries are made to bring the accounts to their proper balances before financial statements are prepared.

Periods (full stops) are used at the end of declarative sentences. (A declarative sentence states a fact.) (A declarative sentence states a fact.) Last words are for fools who haven’t said enough.

General Ledger Accounts. T he complete list of accounts that can appear for the organization’s journal and ledger entries is called its Chart of Accounts. The general ledger represents every active account on this list. As a result, the general ledger (or nominal ledger) is the “top level” ledger.

Entering Journals for a Prior Period You can post journal entries to a prior accounting period, as well as to a prior fiscal year, as long as the prior period is open. When you post to a prior period, General Ledger automatically updates the beginning balances of all subsequent periods. In addition, if you post a journal entry into a prior year

01/03/2017 · Office – Word 2016 – Glossary I used fot the first time the Glossary in a long document (a book) because it was important for me to use the same english word to translate a specific word. Now, at the end of my book, I would like to put the whole glossary I have created step by step during my work.

What a period does at the end of a value, is it tells named that we do not want the domain added to the end of that value. If we leave the dot out, then name will add the domain to the end of the value. For example, if you see the above NS record, it means you might have entered something like this: domain.com. NS ns1.domain.com

30/07/2008 · If each of your entries is a sentence, then yes you would use a period. If the entries are mere phrases, no. If the entries are only single words, no. You should be consistent in the type of entries (word, phrase, sentence)

11/01/2020 · Do not use abbreviations in the glossary. Abbreviations should go in a separate list called “List of Abbreviations.” They do not belong in a glossary, as doing this can end up confusing the reader. If you have a lot of abbreviations in the main text, they should go in a list separate from the glossary.

27/11/2013 · I am doing a glossary for a medical book in Spanish. One of my colleagues wants to put a period at the end of every entry, and another tells me that you don’t use a period at the end of glossary entries. Apparently there are examples showing it done both ways. I would like to leave the entries without a period unless the entry (most unusual!) has a subject and a predicate, thus constituting a …

KB Year-end closing procedures for General Ledger in

Periods thefreedictionary.com

A reader named Dennis K. asked whether you always put periods after abbreviations or whether it’s different depending on which letters from the word are used in the abbreviation. Someone told him that abbreviations should only use a period if it doesn’t end with the last letter of the or

Hard-closes are periods that are permanently committed to the entity’s database and are locked beyond ability to post to. It is important to note that the Microsoft Dynamics NAV solution is a real-time ERP and does not, technically, have “hard-close” for a period end. The only way a month gets hard-closed is when you perform the year-end

The front-end processor routes some or all input messages to other front-end, back-end, or non-z/TPF system s; it may perform some message recovery processing, typically has few DASD, does little input/output (I/O), and maintains short path lengths. In addition, a front-end processor has limited requirements for a database.

How to: Count, Adjust, and Reclassify Inventory. 08/16/2017; 15 minutes to read; In this article. At least once every fiscal year you must take a physical inventory, that is, count all the items on inventory, to see if the quantity registered in the database is the same as the actual physical quantity in the warehouses.

14/07/2011 · by Chelsea Lee. The basic APA Style reference list entry follows a familiar pattern: It can be divided up into four parts (author, date, title, and source), and each of these parts is separated from the others by punctuation. The following post shows in more detail how this process works and answers two common reference punctuation-related questions.

The period (also known as a full stop, especially in British English) is a punctuation mark (.) primarily used to indicate the end of a sentence. It appears as a single dot on the bottom line of the text, and it comes immediately after the last word of the sentence without a space.

Subsequent end-of-period adjusting entries reduce Revenue by the amount not yet earned and increase Unearned Revenue. Again, both approaches produce the same financial statement results. The income statement approach does have an advantage if the entire prepaid item or unearned revenue is fully consumed or earned by the end of an accounting

Some of the glossary definitions have periods at the end and some do not. Let’s make a decision and go with that. I suggest adding a period but am more concerned about consistency. Let’s make a …

Terminology. Every article on Wikipedia with a title in the form “Glossary of subject terms”, or similar, is such a glossary, as are the glossary sections inside some articles. These are distinct from outlines, which are titled in the form “Outline of subject” and may also include definitions, but are organized as a hierarchy and use their own style of formatting not covered in this guideline.

DO IT! DO IT! After studying this chapter, you should be able to: 1 Explain the time period assumption. 2 Explain the accrual basis of accounting. 3 Explain the reasons for adjusting entries. 4 Identify the major types of adjusting entries. 5 Prepare adjusting entries for deferrals. 6 Prepare adjusting entries …

Sections below further define and illustrate trial balance in context with related terms and concepts from the bookkeeping, accounting, and business analysis, emphasizing four themes: First, further definition of terms Trial Balance, Trial Balance Period, and Trial Balance Test. Second, the role of the Trial Balance Period in the Accounting Cycle.

If you must make any adjusting entries to allocate revenue, expenses, or depreciation to the year that you are closing, use the Transaction Entry window or the Quick Journal Entry window to make adjusting entries in General Ledger. If you have to track initial adjusting entries or postaudit entries separate from other fiscal periods, auditing

Companies must have at least one SAC per state in which they operate, but can have more than one SAC within a state if they have more than one service area. T Common carrier, as defined by the FCC, is an entity that provides telecommunications service including inter exchange carriers, wireless carriers, and competitive local exchange carriers (also referred to as service providers).

Trial Balance Period in Accounting Cycle Explained With

APA Style 6th Edition Blog Periods in Reference List Entries

Does a dictionary need a glossary? It’s a moot point. Here are quick explanations of some terms used in OED Online, with links to more detailed discussion elsewhere. additions. Additions sections are used to append new senses and lemmas to unrevised entries from the Second Edition of the OED.

Periods (full stops) are used at the end of declarative sentences. (A declarative sentence states a fact.) (A declarative sentence states a fact.) Last words are for fools who haven’t said enough.

After adjusted entries are made in your accounting journals, they are posted to the general ledger in the same way as any other accounting journal entry. There are several types of adjusting entries that can be made, with each being dependent on the type of financial activities that define your business.

The prepaid insurance account had a beginning balance of ,600 and was debited for ,900 of premiums paid during the year. Journalize the adjusting entry required at the end of the year (December 31), assuming the amount of unexpired insurance related to future periods is ,360.

The front-end processor routes some or all input messages to other front-end, back-end, or non-z/TPF system s; it may perform some message recovery processing, typically has few DASD, does little input/output (I/O), and maintains short path lengths. In addition, a front-end processor has limited requirements for a database.

Entry definition is – the right or privilege of entering : entrée. How to use entry in a sentence.

11/01/2020 · Do not use abbreviations in the glossary. Abbreviations should go in a separate list called “List of Abbreviations.” They do not belong in a glossary, as doing this can end up confusing the reader. If you have a lot of abbreviations in the main text, they should go in a list separate from the glossary.

Entering Journals for a Prior Period You can post journal entries to a prior accounting period, as well as to a prior fiscal year, as long as the prior period is open. When you post to a prior period, General Ledger automatically updates the beginning balances of all subsequent periods. In addition, if you post a journal entry into a prior year

30/07/2008 · If each of your entries is a sentence, then yes you would use a period. If the entries are mere phrases, no. If the entries are only single words, no. You should be consistent in the type of entries (word, phrase, sentence)

Glossary of Postal Terms 4 Publication 32 Style This glossary represents not only a compendium of the most common postal terms and phrases, but also the official authority for spelling, capitalization, and abbreviations. It also shows which ones are Postal Service trademarks. Acronyms and Abbreviations

Opening and Closing Accounting Periods Open and close accounting periods to control journal entry and journal posting, as well as compute period- and year-end actual and budget account balances for reporting. Accounting periods can have one of the following statuses: Open: …

Subsequent end-of-period adjusting entries reduce Revenue by the amount not yet earned and increase Unearned Revenue. Again, both approaches produce the same financial statement results. The income statement approach does have an advantage if the entire prepaid item or unearned revenue is fully consumed or earned by the end of an accounting

Closing journal entries are used at the end of the accounting cycle to close the temporary accounts for the accounting period, and transfer the balances to the retained earnings account.. Temporary and Permanent Accounts. A temporary account is an income statement account, dividend account or drawings account.It is temporary because it lasts only for the accounting period.

If you are writing in a style which uses periods after each letter in an acronym, you can skip the last period in the acronym if the acronym is the last word in the sentence, in which case the sentence-final period, exclamation point, or question mark will replace it. I have …

Is it acceptable to omit the last period of an acronym?

The Adjusting Process And Related Entries

01/03/2017 · Office – Word 2016 – Glossary I used fot the first time the Glossary in a long document (a book) because it was important for me to use the same english word to translate a specific word. Now, at the end of my book, I would like to put the whole glossary I have created step by step during my work.

Periods (full stops) are used at the end of declarative sentences. (A declarative sentence states a fact.) (A declarative sentence states a fact.) Last words are for fools who haven’t said enough.

If you are writing in a style which uses periods after each letter in an acronym, you can skip the last period in the acronym if the acronym is the last word in the sentence, in which case the sentence-final period, exclamation point, or question mark will replace it. I have …

Terminology. Every article on Wikipedia with a title in the form “Glossary of subject terms”, or similar, is such a glossary, as are the glossary sections inside some articles. These are distinct from outlines, which are titled in the form “Outline of subject” and may also include definitions, but are organized as a hierarchy and use their own style of formatting not covered in this guideline.

Adjusting entries are journal entries made at the end of an accounting period for the purpose of: 1. Updating liability and asset accounts to their proper balances. 2. Assigning revenues to the periods in which they are earned. 3. Assigning expenses to the periods in which they are incurred. 4. Assuring that financial statements reflect the revenues earned and the expenses incurred. An

If you must make any adjusting entries to allocate revenue, expenses, or depreciation to the year that you are closing, use the Transaction Entry window or the Quick Journal Entry window to make adjusting entries in General Ledger. If you have to track initial adjusting entries or postaudit entries separate from other fiscal periods, auditing

Under Entry category, choose whether you want to display the statistics for Terminology entries, Index entries or Glossary entries. Under Period, select whether you want to display Weekly, Monthly, or Annual values, and enter the Start/end date for the statistics. Choose Execute. Result

Bookkeeping Adjusting Entries Reversing Entries

Glossary Completing the Accounting Cycle Financial

The front-end processor routes some or all input messages to other front-end, back-end, or non-z/TPF system s; it may perform some message recovery processing, typically has few DASD, does little input/output (I/O), and maintains short path lengths. In addition, a front-end processor has limited requirements for a database.

Hard-closes are periods that are permanently committed to the entity’s database and are locked beyond ability to post to. It is important to note that the Microsoft Dynamics NAV solution is a real-time ERP and does not, technically, have “hard-close” for a period end. The only way a month gets hard-closed is when you perform the year-end

Adjusting entries are journal entries made at the end of an accounting period for the purpose of: 1. Updating liability and asset accounts to their proper balances. 2. Assigning revenues to the periods in which they are earned. 3. Assigning expenses to the periods in which they are incurred. 4. Assuring that financial statements reflect the revenues earned and the expenses incurred. An

Closing journal entries are used at the end of the accounting cycle to close the temporary accounts for the accounting period, and transfer the balances to the retained earnings account.. Temporary and Permanent Accounts. A temporary account is an income statement account, dividend account or drawings account.It is temporary because it lasts only for the accounting period.

Closing entries are entries used to shift balances from temporary to permanent accounts at the end of an accounting period. These journal entries condense your accounts so you can determine your retained earnings, or the amount your business has after paying expenses and dividends. Creating closing entries is one of the last steps of the

End-of-period-adjustments in accounting are journal entries made to the accounts of a business prior to the preparation and distribution of the financial statements for a given accounting period. End-of-period adjustments ensure that the these financial statements reflect the true financial position and performance of a business by allocating to the appropriate period the income earned and

KB Year-end closing procedures for General Ledger in

WikipediaManual of Style/Glossaries Wikipedia

Companies must have at least one SAC per state in which they operate, but can have more than one SAC within a state if they have more than one service area. T Common carrier, as defined by the FCC, is an entity that provides telecommunications service including inter exchange carriers, wireless carriers, and competitive local exchange carriers (also referred to as service providers).

Closing journal entries are made at the end of an accounting period to prepare temporary accounts for the next period.. This is becaues temporary or nominal accounts, (also called income statement accounts), are measured periodically; and so, the amounts in one accounting period should be closed or brought to zero so that they won’t get mixed with those of the next period.

Closing journal entries are used at the end of the accounting cycle to close the temporary accounts for the accounting period, and transfer the balances to the retained earnings account.. Temporary and Permanent Accounts. A temporary account is an income statement account, dividend account or drawings account.It is temporary because it lasts only for the accounting period.

How to: Count, Adjust, and Reclassify Inventory. 08/16/2017; 15 minutes to read; In this article. At least once every fiscal year you must take a physical inventory, that is, count all the items on inventory, to see if the quantity registered in the database is the same as the actual physical quantity in the warehouses.

Glossary of Postal Terms 4 Publication 32 Style This glossary represents not only a compendium of the most common postal terms and phrases, but also the official authority for spelling, capitalization, and abbreviations. It also shows which ones are Postal Service trademarks. Acronyms and Abbreviations

After adjusted entries are made in your accounting journals, they are posted to the general ledger in the same way as any other accounting journal entry. There are several types of adjusting entries that can be made, with each being dependent on the type of financial activities that define your business.

Use this glossary when you need to interpret memos, bulletins, reports, articles, and presentations by accountants, financial analysts, bankers, and so on. If you have a good grasp of the jargon you will be amazed at how well you can hold your own in discussions. Knowing the accounting vocabulary is an important factor in management success

Subsequent end-of-period adjusting entries reduce Revenue by the amount not yet earned and increase Unearned Revenue. Again, both approaches produce the same financial statement results. The income statement approach does have an advantage if the entire prepaid item or unearned revenue is fully consumed or earned by the end of an accounting

Entry Definition of Entry by Merriam-Webster

Opening and Closing Accounting Periods (Oracle General

Use this glossary when you need to interpret memos, bulletins, reports, articles, and presentations by accountants, financial analysts, bankers, and so on. If you have a good grasp of the jargon you will be amazed at how well you can hold your own in discussions. Knowing the accounting vocabulary is an important factor in management success

01/03/2017 · Office – Word 2016 – Glossary I used fot the first time the Glossary in a long document (a book) because it was important for me to use the same english word to translate a specific word. Now, at the end of my book, I would like to put the whole glossary I have created step by step during my work.

15/08/2016 · by Chelsea Lee APA Style references have four parts: author, date, title, and source, and these parts are separated by periods. This example of a book reference shows the pattern (the periods are highlighted to help you see them): Author,…

Hard-closes are periods that are permanently committed to the entity’s database and are locked beyond ability to post to. It is important to note that the Microsoft Dynamics NAV solution is a real-time ERP and does not, technically, have “hard-close” for a period end. The only way a month gets hard-closed is when you perform the year-end

14/07/2011 · by Chelsea Lee. The basic APA Style reference list entry follows a familiar pattern: It can be divided up into four parts (author, date, title, and source), and each of these parts is separated from the others by punctuation. The following post shows in more detail how this process works and answers two common reference punctuation-related questions.

In accrual basis accounting, adjusting journal entries are necessary because the exchange of cash does not always occur at the moment you purchase an item, provide services or incur an expense. Adjusting journal entries are completed at the end of an accounting period, and …

How to: Count, Adjust, and Reclassify Inventory. 08/16/2017; 15 minutes to read; In this article. At least once every fiscal year you must take a physical inventory, that is, count all the items on inventory, to see if the quantity registered in the database is the same as the actual physical quantity in the warehouses.

A reversing entry is a journal entry made in an accounting period, which reverses selected entries made in the immediately preceding period.The reversing entry typically occurs at the beginning of an accounting period. It is commonly used in situations when either revenue or expenses were accrued in the preceding period, and the accountant does not want the accruals to remain in the accounting

The period (also known as a full stop, especially in British English) is a punctuation mark (.) primarily used to indicate the end of a sentence. It appears as a single dot on the bottom line of the text, and it comes immediately after the last word of the sentence without a space.

Glossary of Postal Terms 4 Publication 32 Style This glossary represents not only a compendium of the most common postal terms and phrases, but also the official authority for spelling, capitalization, and abbreviations. It also shows which ones are Postal Service trademarks. Acronyms and Abbreviations

Closing journal entries are made at the end of an accounting period to prepare temporary accounts for the next period.. This is becaues temporary or nominal accounts, (also called income statement accounts), are measured periodically; and so, the amounts in one accounting period should be closed or brought to zero so that they won’t get mixed with those of the next period.

APA Style 6th Edition Blog Periods in Reference List Entries

F – glossary entries IBM

11/01/2020 · Do not use abbreviations in the glossary. Abbreviations should go in a separate list called “List of Abbreviations.” They do not belong in a glossary, as doing this can end up confusing the reader. If you have a lot of abbreviations in the main text, they should go in a list separate from the glossary.

Entry definition is – the right or privilege of entering : entrée. How to use entry in a sentence.

Entering Journals for a Prior Period You can post journal entries to a prior accounting period, as well as to a prior fiscal year, as long as the prior period is open. When you post to a prior period, General Ledger automatically updates the beginning balances of all subsequent periods. In addition, if you post a journal entry into a prior year

DO IT! DO IT! After studying this chapter, you should be able to: 1 Explain the time period assumption. 2 Explain the accrual basis of accounting. 3 Explain the reasons for adjusting entries. 4 Identify the major types of adjusting entries. 5 Prepare adjusting entries for deferrals. 6 Prepare adjusting entries …

General Ledger Accounts. T he complete list of accounts that can appear for the organization’s journal and ledger entries is called its Chart of Accounts. The general ledger represents every active account on this list. As a result, the general ledger (or nominal ledger) is the “top level” ledger.

Opening and Closing Accounting Periods Open and close accounting periods to control journal entry and journal posting, as well as compute period- and year-end actual and budget account balances for reporting. Accounting periods can have one of the following statuses: Open: …

Closing journal entries are made at the end of an accounting period to prepare temporary accounts for the next period.. This is becaues temporary or nominal accounts, (also called income statement accounts), are measured periodically; and so, the amounts in one accounting period should be closed or brought to zero so that they won’t get mixed with those of the next period.

Periods (full stops) are used at the end of declarative sentences. (A declarative sentence states a fact.) (A declarative sentence states a fact.) Last words are for fools who haven’t said enough.

The period (also known as a full stop, especially in British English) is a punctuation mark (.) primarily used to indicate the end of a sentence. It appears as a single dot on the bottom line of the text, and it comes immediately after the last word of the sentence without a space.

01/03/2017 · Office – Word 2016 – Glossary I used fot the first time the Glossary in a long document (a book) because it was important for me to use the same english word to translate a specific word. Now, at the end of my book, I would like to put the whole glossary I have created step by step during my work.

Adjusting entries are journal entries made at the end of an accounting period for the purpose of: 1. Updating liability and asset accounts to their proper balances. 2. Assigning revenues to the periods in which they are earned. 3. Assigning expenses to the periods in which they are incurred. 4. Assuring that financial statements reflect the revenues earned and the expenses incurred. An

Entering Journals for a Prior Period (Oracle General

Using Closing Entries to Wrap up Your Accounting Period

27/11/2013 · I am doing a glossary for a medical book in Spanish. One of my colleagues wants to put a period at the end of every entry, and another tells me that you don’t use a period at the end of glossary entries. Apparently there are examples showing it done both ways. I would like to leave the entries without a period unless the entry (most unusual!) has a subject and a predicate, thus constituting a …

Why are Adjusting Entries Necessary? What Does an Adjusting Journal Entry Record? Here are the main financial transactions that adjusting journal entries are used to record at the end of a period. Prepaid expenses or unearned revenues – Prepaid expenses are goods or services that have been paid for by a company but have not been consumed yet

Hard-closes are periods that are permanently committed to the entity’s database and are locked beyond ability to post to. It is important to note that the Microsoft Dynamics NAV solution is a real-time ERP and does not, technically, have “hard-close” for a period end. The only way a month gets hard-closed is when you perform the year-end

A reader named Dennis K. asked whether you always put periods after abbreviations or whether it’s different depending on which letters from the word are used in the abbreviation. Someone told him that abbreviations should only use a period if it doesn’t end with the last letter of the or

Adjusting entries are journal entries recorded at the end of an accounting period to alter the ending balances in various general ledger accounts . These adjustments are made to more closely align the reported results and financial position of a business with the requirements of an accountin

Closing journal entries are made at the end of an accounting period to prepare temporary accounts for the next period.. This is becaues temporary or nominal accounts, (also called income statement accounts), are measured periodically; and so, the amounts in one accounting period should be closed or brought to zero so that they won’t get mixed with those of the next period.

Adjusting entries are journal entries made at the end of an accounting period for the purpose of: 1. Updating liability and asset accounts to their proper balances. 2. Assigning revenues to the periods in which they are earned. 3. Assigning expenses to the periods in which they are incurred. 4. Assuring that financial statements reflect the revenues earned and the expenses incurred. An

30/07/2008 · If each of your entries is a sentence, then yes you would use a period. If the entries are mere phrases, no. If the entries are only single words, no. You should be consistent in the type of entries (word, phrase, sentence)